Arrived 1031 Exchange

When you sell an investment property, capital gains taxes can take a big bite out of your profits. A 1031 Exchange allows you to defer those taxes indefinitely if you reinvest in other properties, preserving your capital to build long-term wealth.

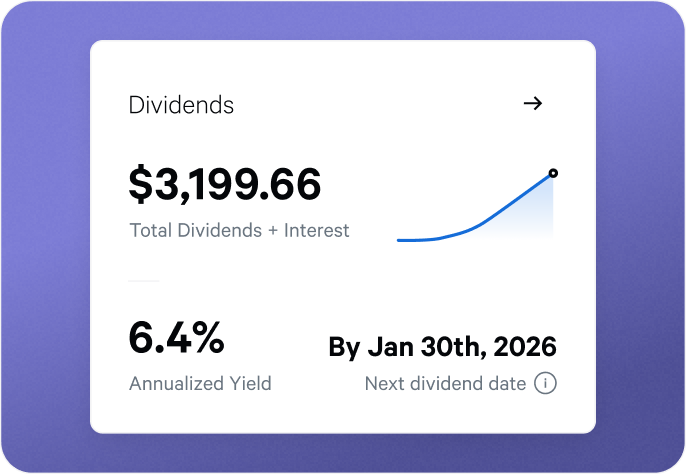

Step away from hands-on property management and enjoy the freedom of passive ownership.

Sell your existing rental property without paying massive capital gains taxes.

Generate higher returns on your equity by utilizing Arrived's team of experts and economies of scale.

Exchange into markets that match your investment goals and risk tolerance. Diversify by owning properties beyond your local area.

1031 Exchanges come with strict IRS deadlines. The Arrived team helps you efficiently source and acquire replacement properties to keep your exchange on track.

Arrived can work with your tax and estate advisors to help ensure your heirs receive a step-up in basis, supporting a more tax-efficient transfer of wealth.

How it Works

We handle the entire process so you don't have to. From property identification to acquisition and ongoing management, our team ensures your property purchase is smooth and built for long-term success.

Step 1

Schedule a call with our team, so we can learn about your goals.

Step 2

We'll prepare your property for sale and list it on the market.

Step 3

We work with you and a Qualified Intermediary (QI) to identify and acquire a new property in compliance with IRS deadlines.

Step 4

Arrived manages the new property on your behalf while you receive monthly distributions and enjoy the benefits of rental ownership—minus the day-to-day responsibilities.