Investing in real estate used to be complicated.

At Arrived, our mission is to empower everyone to build wealth through modern real estate investing. We created an investor experience simplifying the complex decision-making traditionally associated with real estate — and lowered the barriers to entry — so anyone can do it.

A better experience for investors

Investing in rental properties can be complex and time-consuming, even for those with experience. It requires significant time and resources to realize return potential.

We simplify the process, making it easy and accessible for everyone.

The old way to invest in rental properties

- Start a property search

- Find a lender and get approved for a loan

- Determine investment value

- Make an offer and see if you get accepted

- Pay a hefty down payment

- Close on home

- Get homeowner's insurance

- Make needed renovations

- List home for rent

- Show home to renters

- Screen potential tenants

- Sign a lease

- Safely store security deposits

- Manage property maintenance (yes, toilets too)

- Manage accounting

- Organize taxes every year

Rental property investors are responsible for everything from assessing the value of potential investments to securing financing, managing tenants, and maintaining the property. In short, it takes a lot of steps.

The Arrived way to invest in real estate

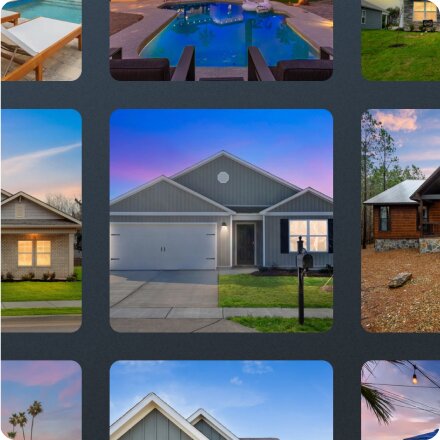

With Arrived, investors can easily browse pre-vetted rental properties, choose their investment amount, and build a tailored portfolio of hand-selected homes in minutes.

In addition to individual properties, Arrived offers a range of fully managed real estate funds to suit different strategies:

- Single Family Residential Fund: One-click diversification into high-quality rental homes, with always-available opportunities and built-in liquidity.

- City Funds: Targeted exposure to rental homes in specific U.S. cities, allowing investors to bet on regional growth and build a location-based strategy.

- Private Credit Fund: Invest in short-term real estate debt secured by residential properties, offering the potential for high yields.

Whether you want to build a custom portfolio of individual properties or invest through our curated funds, Arrived makes real estate investing simple and flexible.

Step 1 - Browse and choose investments

Begin your investment journey with Arrived by exploring a curated selection of diverse investment opportunities.

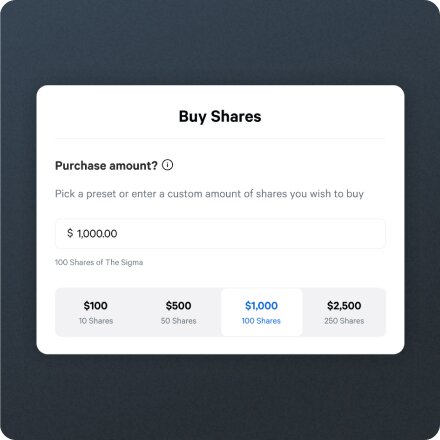

Step 2 - Buy shares

Take the next step towards ownership without the hassle. Decide on an investment amount that fits your budget and buy shares.

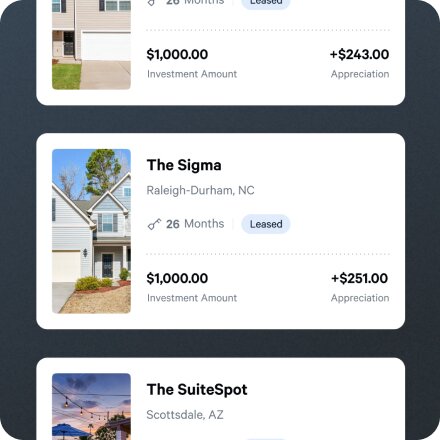

Step 3 - Earn passive income and participate in any potential appreciation

Arrived manages the properties on your behalf, so you can access the potential financial benefits of real estate ownership—without the operational burden of managing tenants or maintenance.

Unlock passive income and the potential for property appreciation

Investing on Arrived can deliver returns in two ways:

- Monthly dividends for investors in both individual properties and Funds.

- Potential appreciation when a property is sold after the investment hold period, if its value has increased.

Diversify across asset classes

Diversify your real estate portfolio in minutes with Arrived's main asset types, tailored to enhance a well-rounded investment strategy.

- Return Type: Income + appreciation

- Total Historical Returns: 6 - 10% annual*

- Income Portion: 3 - 5% annual*

- Appreciation: Included

- Minimum Investment Hold: Individual properties have a target hold period of 5-7 years. Single Family Residential Fund and City Fund investors may request redemptions 6 months after their initial investment.

Coming in Summer 2025, the Arrived Secondary Market will provide quarterly opportunities for investors to buy and sell shares of individual properties.

- Diversification: Diversifying across at least five properties can help reduce risk and stabilize returns by spreading exposure and balancing income and appreciation potential.

- Return Type: Income

- Total Historical Returns: 7 - 9% annual*

- Income Portion: 7 - 9% annual*

- Appreciation: Not Included

- Minimum Investment Hold: Investors may request redemptions 6 months after their initial investment.

- Diversification: Funds offer diversification by including a portfolio of homes, balancing risk and returns across various properties.

Leave property management to the pros

Investing in real estate shouldn’t feel like a second job. Arrived handles every aspect of property management, so you can sit back and leave the work to us.

Our property management partners have mission-critical responsibilities ranging from assisting in the property search to managing remodels and finding tenants. Every partner we select has passed our strict evaluation criteria.

Choose your investment level

Arrived believes everyone should be able to invest in real estate. That’s why we offer flexible investment amounts ranging from $100 to over $1M.

Investors also have easy access to their Cash Balance, which they can use to reinvest in new offerings or withdraw dividends at any time.

Handpicked investments by seasoned professionals

We leverage decades of experience and data science to maximize return potential across our property offerings and funds. Our team has previously managed a $11B+ portfolio of 57K+ rental homes, giving us deep expertise in identifying high-performing properties. By integrating market insights with sophisticated analytical tools, we deliver investment opportunities that are strategically selected for their growth and profitability.

- Use data science to analyze hundreds of markets

- Identify markets with the strongest cash flow and appreciation potential

- Pick the best neighborhoods and home attributes

- Create a property and financial analysis

- Present to our investment committee for review

Regulation-backed investment options

All Arrived offerings are open to accredited and non-accredited investors. We adhere to SEC standards for transparency and provide regular audited financial reports so you know exactly what you're investing in and how your assets are performing. You can access our public SEC filings here.

FAQ

Who can invest?

How much can I invest?

What type of products are available on Arrived?

Will I have any responsibilities for managing properties I invest in? If not, who is responsible?

What type of returns can I obtain?