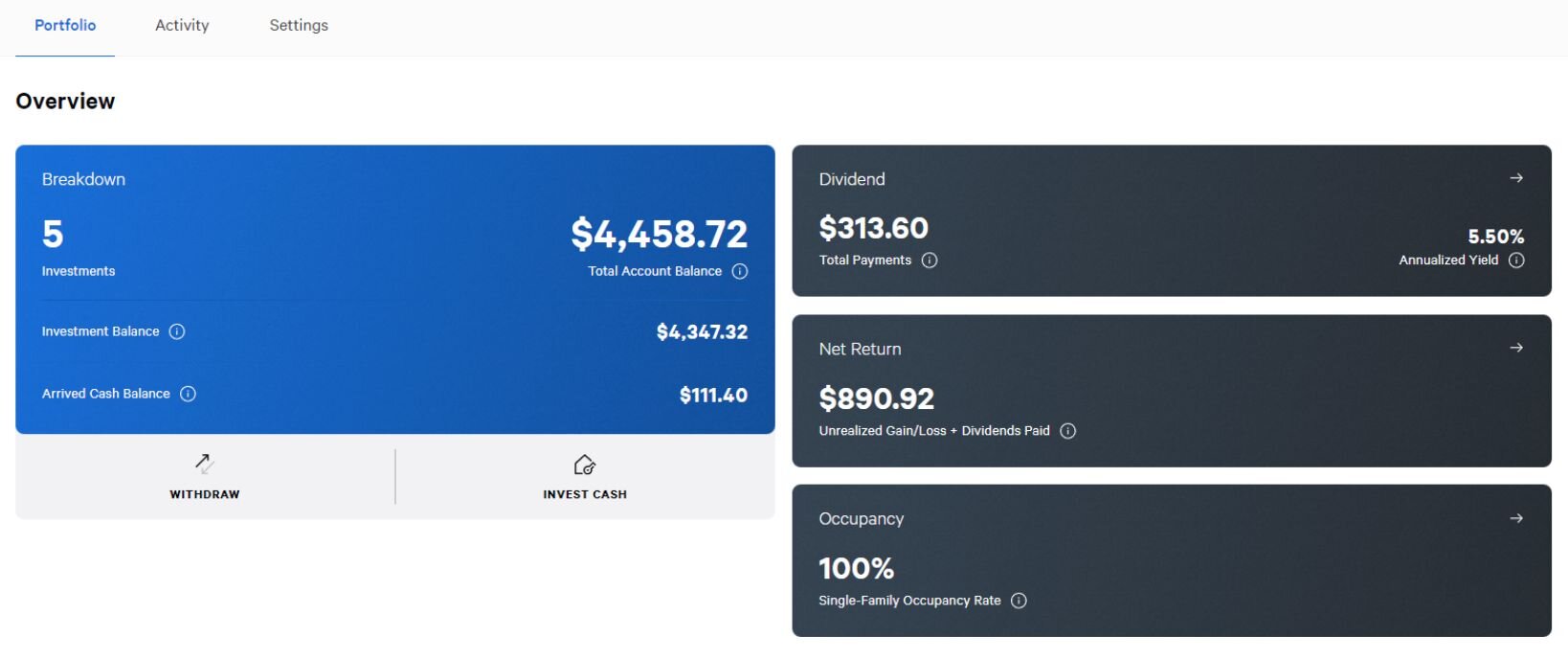

We built the Cash Balance to pay dividends directly to an investor’s Arrived account. With the launch of this new feature, we’ve unlocked our ability to pay dividends monthly instead of quarterly. As an Arrived investor, you’ll also have easy access to Cash Balance to reinvest in new offerings (potentially creating more compound returns over time) or withdraw your dividends into your personal account at any time. It is up to you.

And did we mention it is fee-free? Win, win, win.

What Is Cash Balance?

Cash Balance is specifically crafted for investors' Arrived funds. This feature allows investors to seamlessly receive dividends, redemptions, and proceeds from the sale of assets directly into their Cash Balance.

Key Features:

Withdraw Funds: Investors have the freedom to withdraw funds at their convenience.

More Frequent Payouts: Enables monthly dividends — so you get your funds faster.

Balance Visibility: Provides a clear overview of your financial status with Arrived:

- Available Balance: Funds ready for purchases or withdrawal.

- Pending Balance: Funds that are transitioning into your Wallet, such as withdrawals or purchases.

Buy Shares with Flexibility: Investors can buy shares using a combination of funds from their external bank account or Cash Balance.

How it Works

As an Arrived investor, you automatically have access to Cash Balance. All disbursements — including dividends and redemptions – will be conveniently delivered to your Cash Balance. All you need to do is log in to your account to view your total balance, available balance, and in-process funds.

When funds are available, you can opt to invest in new offerings like Arrived’s suite of Individual Property Offerings or the Arrived Single Family Residential Fund. You can use a combination of available funds in your Cash Balance and funds from your bank account. Or, you can opt to transfer your dividends into your linked bank account. Withdrawals are processed through standard ACH payments. On average, funds will reach your bank account within 3-5 business days.

You’ll never pay a fee to use or move funds in your Cash Balance.

Is Cash Balance Safe?

We manage the behind-the-scenes action of Cash Balance while keeping your funds secure so you can focus on your dividends.

Cash Balance funds are securely held in a Wells Fargo FBO — or “For the Benefit Of” — account. An FBO account, also known as a "beneficiary account" or "fiduciary account," is held by one party (the custodian or fiduciary) for the benefit of another party (the beneficiary). The custodian manages the assets in the account on behalf of the beneficiary.

We’ve also taken steps to ensure our investors have peace of mind when it comes to using Cash Balance. Your total funds are FDIC-insured up to $250,000. FDIC insurance, or Federal Deposit Insurance Corporation insurance, is a government-backed program that protects depositors' funds in banks and savings associations. FDIC insurance ensures that depositors receive their insured funds should an issue arise.

Cash Balance offers a fully automated, secure experience so you can focus on what matters most — your financial future.