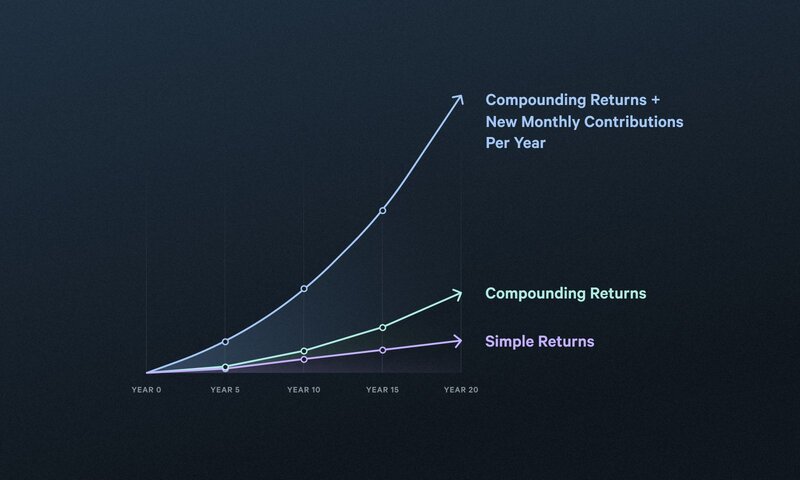

If you want to reach your goals, you need to ensure that the money you’re working so hard for ultimately works for you. Interest is how we earn money on our savings and investments, but how this interest is calculated can be the critical difference between whether your money’s growth is stagnated or exponential.

There are two basic ways that interest is calculated: Simple interest and compound interest.

Let’s focus on compound interest — what it is, why it’s important, and how to reinvest your dividends to maximize your earning potential.

What Is Compound Interest?

There are two ways interest is typically calculated:

- Simple interest

- Compound interest

Simple interest is when a set percentage is applied to the principal amount each year. For instance, if you invest $1,000 at 10% for five years, you’ll receive 10% on the original principal, that is, $100, in interest every year for five years.

Compound interest, on the other hand, is earned when you reinvest your earnings. If you were to take that $100 you earned in interest in the first year and add it to the principal in the second year, the amount of interest would be calculated on $1,100, not the original principal. You’re earning interest on interest, which can add up significantly over the years.

The power of compound interest is in how quickly it can multiply your money. Compounding periods, or the number of times you allow the interest to be compounded, are critical to this accelerated rate. The longer you leave your investment to compound, the higher and faster your money will grow.

How Compound Interest Works

Albert Einstein called compounding the eighth wonder of the world, and Warren Buffett famously amassed his vast fortune on compound interest. Over an extended period, money being compounded can grow exponentially when interest is earned on years of previous interest earnings. There are, however, a number of elements that factor into compound interest:

Initial Principal

The initial amount is where it all begins. 5% interest earned on an investment of $10,000 will look very different from 5% interest earned on a $100,000 investment. That said, while the principal amount matters in how much you earn, start from where you are. You don’t need a large amount of money to benefit from the principles of compound interest.

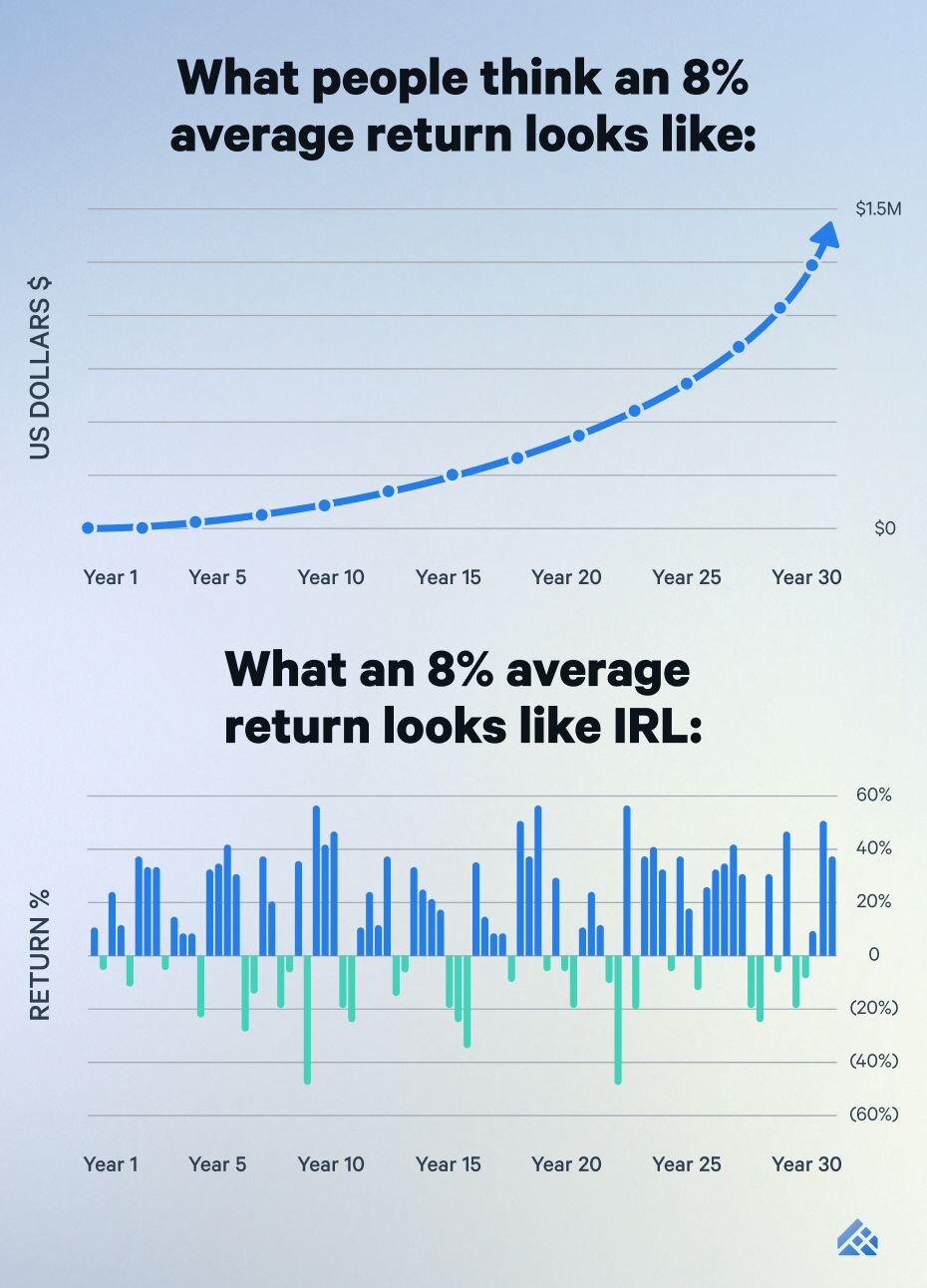

Interest Rate

Your annual interest rate on your money significantly impacts how much it will grow. If you’re earning 1-2% in a savings account, that money will grow far slower than if you were earning 5% or 10%.

Frequency of Compounding

Interest is compounded on a given frequency schedule. For some investments, compounding frequency is daily. For others, it can be monthly or annually. Frequent compounding will allow more opportunities for your money to grow.

Compounding Periods

How long are you planning on keeping your money invested? The answer to this question will determine how much your money can grow. If you withdraw your money after five years of compounding, it will have much less opportunity for growth than if you were to leave it for ten years or more.

The Power of Reinvesting Your Dividends

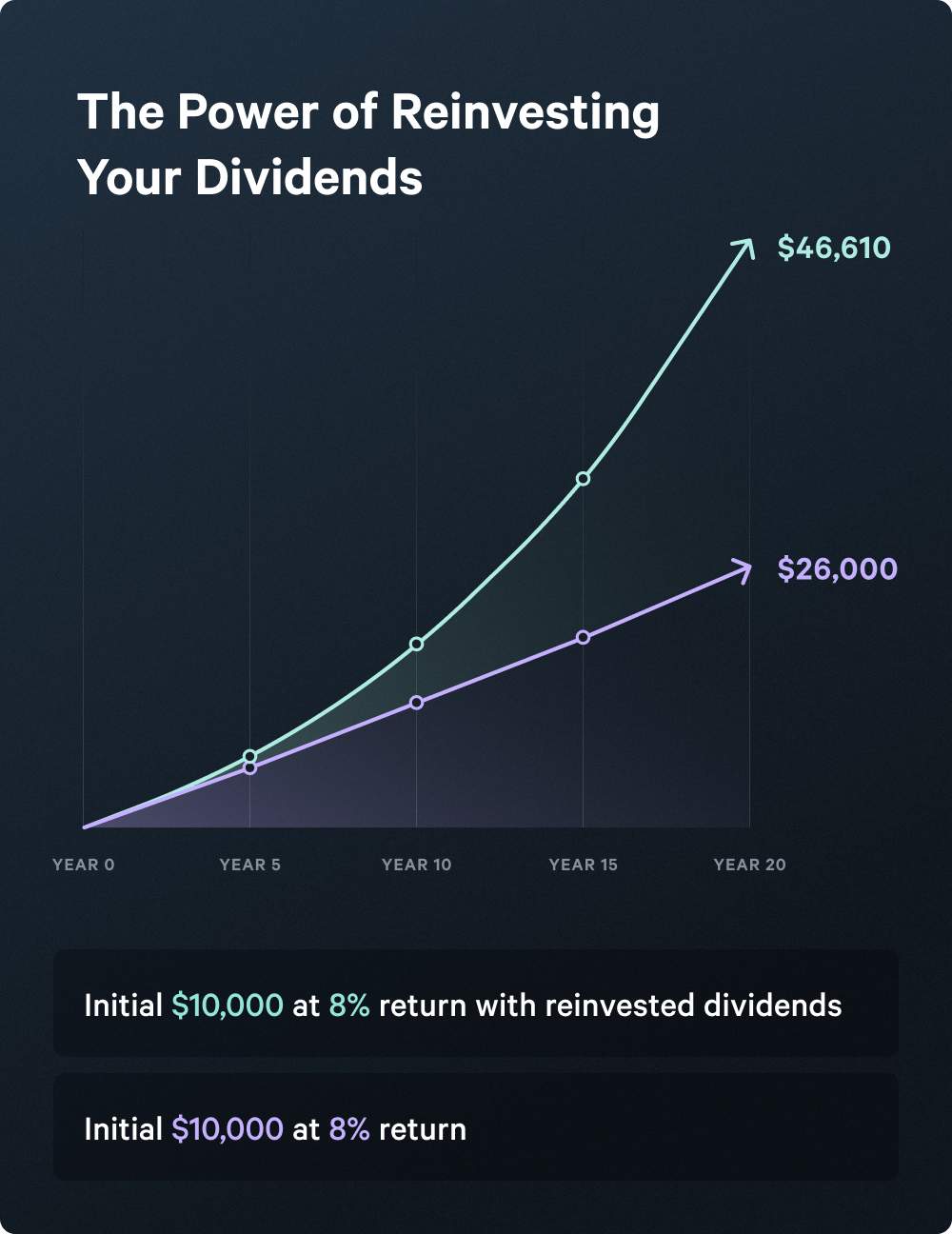

Reinvesting dividends can be a powerful strategy for maximizing wealth growth over the long term.

For example, if you invested $10,000 at 8% interest, you’ll likely walk away with more money than you started. Not too shabby.

But you could amplify that strategy even further by reinvesting the dividends you receive from your initial investment. When you reinvest your dividends, you're essentially putting the money you receive back into your investment. This means that not only does your original investment grow over time, but the earnings from your dividends also start generating their own returns. These new earnings then get added to your investment, allowing it to grow even faster.

It's like a snowball effect – the more you reinvest, the more your investment grows, thanks to the power of compounding. So, by reinvesting dividends, you're not just earning interest on your initial investment; you're earning interest on the interest.

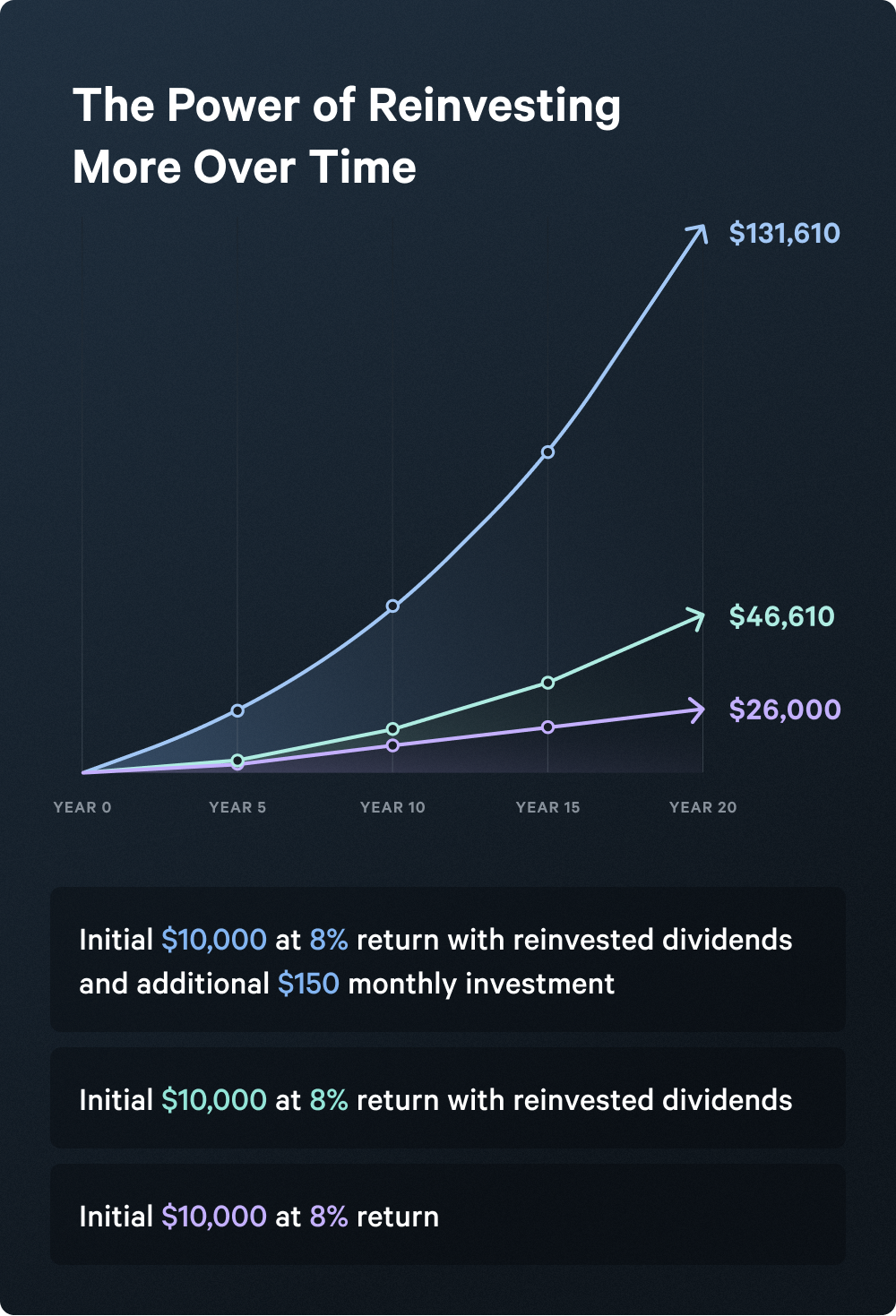

If you want to accelerate your earning potential even further, you could make additional investments. With each monthly contribution, you inject more money into your investment, potentially allowing it to grow faster.

These additional funds further enhance the compounding effect when combined with reinvested dividends. Not only are you earning returns on your original investment and reinvested dividends, but you're also earning returns on the new monthly contributions.

Check out the chart below to see how even a $150 monthly additional investment can factor into your compound interest growth.

Understanding compound interest and the power of reinvesting dividends is essential for anyone looking to build long-term wealth. While simple interest offers straightforward growth, compound interest has the potential to multiply your money exponentially over time. By reinvesting dividends, you're not only earning interest on your initial investment but also on the earnings generated from those dividends, leading to accelerated growth.

Remember, the key to maximizing the benefits of compound interest is time. The longer you allow your investments to compound, the greater the potential for wealth accumulation. So start early, stay consistent, and harness the power of compound interest and reinvested dividends to secure your financial future.

At Arrived, our mission is to provide financial freedom for everybody, and we do this by allowing you to purchase shares in rental properties. Through our platform, you can purchase shares of rental properties and start building a portfolio today.