If you’re looking for a simple and easy way to start investing in real estate without a huge cash investment, a Real Estate Investment Trust or REIT may be the answer. According to the National Association of Real Estate Investment Trusts (NAREIT), in October 2020, approximately 145 million Americans lived in households invested in REITs either through their 401(k) or through IRAs, pension plans, and other investment funds.

What is a REIT? Simply put, a REIT is a company that operates or finances income-producing real estate. Like mutual funds, REITs give you the opportunity to gain from the profits of real estate without having to buy individual properties yourself. Let’s talk about REITs, the different categories of REITs, and whether it’s right for you to invest in one.

What is a REIT?

A REIT, or a Real Estate Investment Trust, is a type of company that is designed to own, operate or finance real estate. REITs are an easy way for investors to get started in real estate without a large cash outlay, and they provide diversification and historically high returns.

REITs were created in 1960 to make it easier for investors to get real estate exposure in their portfolios. They are modeled after mutual funds, which means that REITs pool capital from multiple investors and makes it possible for those investors to earn dividends from their real estate investments.

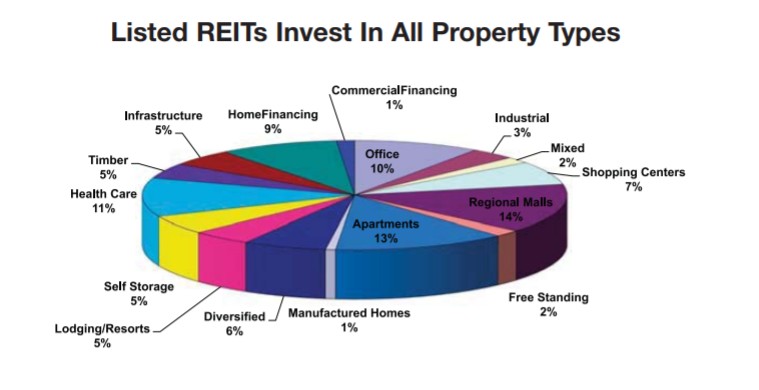

Today it’s estimated that REITs own $3 trillion in gross assets. REITs can invest in any kind of real estate, such as apartments, office buildings, hotels, or malls. REITs might focus on one strategy or type of real estate or multiple.

There are strict rules to qualify as a REIT. They are required to pay out 90% of their taxable income back to their investors as dividends. There are also limitations on how much of their assets and income can come from non-real estate activities, and there are requirements for a minimum number of shareholders.

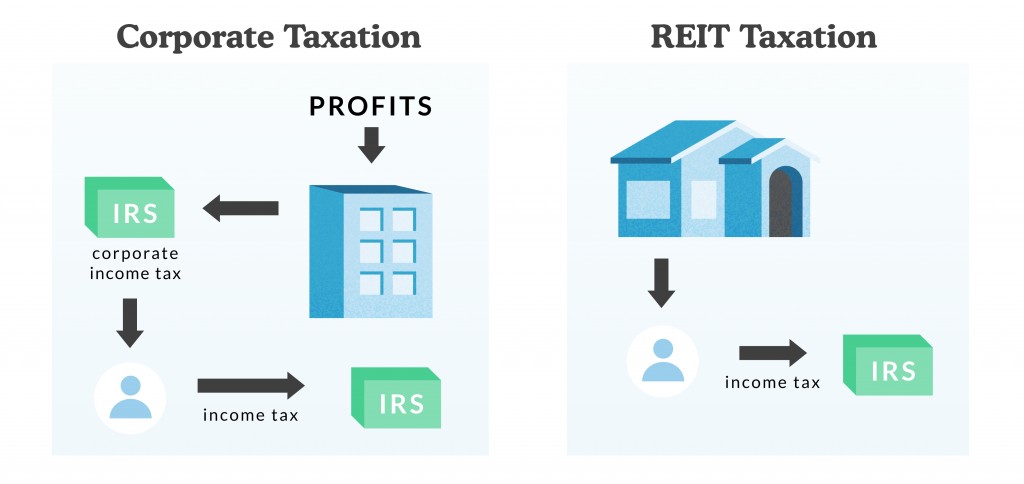

So why do REITs put up with all these rules? Because there are massive tax benefits for investors if the REIT complies with all the requirements.

For example, companies that qualify as REITs don’t pay corporate income tax. They pass their earnings on to their shareholders, who pay income tax on the earnings. This is single taxation, compared to double taxation with stock dividends.

On top of that, because REITs are pass-through entities, the income investors receive qualifies for the Qualified Business Income deduction. This deduction, which was new in 2018, allows REIT investors to reduce the taxable income from their investment by up to 20%.

REITs come in all sorts of shapes and sizes. They can be public, private, or public but not traded. They can invest in equity, debt, or a combination. And there are a dozen different tests they need to meet to continue to qualify as a REIT.

The three main categories of REIT

There are three main categories of REITs you can invest in. These include:

Publicly traded REITs

These REITs trade on major stock exchanges such as the NYSE and the Nasdaq Exchange and can be bought and sold by individual investors. They are regulated by the U.S. Securities and Exchange Commission (SEC) and must provide audited financial reports. Anyone with a brokerage account can invest in a publicly traded REIT.

Private non-traded REITs

Private non-traded REITs are, as the name suggests, not open to the public. They’re frequently only open to institutional investors or high-net-worth individuals. Private REITs are exempt from SEC registration and don’t trade on national securities exchanges.

Public non-traded REITs

These REITs are also open to all investors, and while they’re required to register with the SEC and provide audited financial information, they do not trade on national securities exchanges. Investors typically purchase public non-traded REITs through a financial advisor or real estate crowdfunding platforms. While they are less liquid than public REITs, they tend to have less volatility because they’re not subject to market fluctuations.

Long-term rental properties on Arrived are structured as public non-traded REITs (note: vacation rentals are considered ‘active’ income and, therefore, not REIT eligible. Please see your tax advisor for specific investment advice). Anyone can invest and get access to higher cash returns than they might find on the public market. There are no limitations on who can invest in Arrived’s homes, and you can invest between $100 and $15,000 per property. Like a public REIT, our information is all audited and publicly available for anyone interested in learning more.

Public REITPrivate REITPublic Non-Traded REIT (Arrived)LiquidityHighLowLowDividend YieldLowHighHighMinimum InvestmentLowHighLowAccessibility/Who can investHigh/AnyoneLow/Accredited investors onlyHigh/AnyoneSEC OversightHighLowHighTax BenefitsHighHighHighCorrelation with Stock MarketMediumLowLow

Types of REITs

Within the three categories of REITs above, there are many types of investment opportunities within REITs. Let’s look at the types of REITs, first by asset type and then by sector or property type.

The different classes of REITs by asset type are:

- Equity REITs: Most REITs are equity REITs that own and operate income-producing real estate. The revenue from this type of REIT is generated primarily through rental income and not reselling properties.

- Mortgage REITs: Mortgage REITs, also sometimes referred to as mREITs, generate income through financing for real estate. These investments purchase or originate mortgages and mortgage-backed securities. Their earnings are generated primarily by the net interest margin, that is, the spread between the interest they earn on mortgage loans and the cost of funding the loans.

- Hybrid REITs: Hybrid REITs use the investment strategies of both equity and mortgage REITs and invest in a combination of income-producing real estate and real estate-backed loans.

The different classes of REITs by sector or property type include:

Office REITs: Office REITs own and manage office real estate and rent space in those properties. These properties can be commercial real estate such as skyscrapers or office parks.

Office REITs generally focus on a specific region, say San Francisco or the East Coast, as well as specific types of markets, like central business districts or suburban areas. They can also focus on a specific class of tenants (technology companies, biotech firms, government agencies) and receive rental income in the form of long-term leases.

Industrial REITs: Industrial REITs own and manage large-scale industrial facilities such as warehouses and distribution centers. Some focus on specific regions or industrial property types, such as those for light manufacturing or cold storage.

Retail REITs: Retail REITs own and manage real estate in the retail sector, including REITs that focus on commercial properties such as regional malls, shopping centers, grocery-anchored shopping centers, or free-standing retail properties such as convenience stores and pharmacies. Retail REITs account for 24% of all REIT investments made in the US.

Hospitality REITs: Hospitality REITs, also known as lodging REITs, own and manage hotels and resorts and rent space in these properties to guests. They’re typically managed by a third-party hotel brand and own different classes of hotels based on both location and the hotel’s level of service and amenities.

Residential REITs: Residential REITs own and manage residential real estate, which includes apartment buildings, single-family homes, student housing, and manufactured homes. They often focus on specific property types and geographic markets. The biggest residential REITs tend to focus on large urban centers, such as New York or Los Angeles, where they can have higher capital gains and charge higher rents.

Timberland REITs: Timberland REITs own and manage timberland real estate, that is, they specialize in harvesting and selling timber. Some timberland REITs also own wood products manufacturing facilities.

Healthcare REITs: Healthcare REITs own and manage healthcare-related real estate. This includes senior living facilities or retirement homes, hospitals, medical office buildings, and skilled nursing facilities.

Self-storage REITs: Self-storage REITs own and manage storage facilities that rent space to both individuals and businesses.

Infrastructure REITs: Infrastructure REITs own and manage infrastructures such as fiber cables, wireless infrastructure, telecommunications towers, and energy pipelines. They lease this infrastructure, often to energy companies and mobile carriers.

Data center REITs: Data center REITs own and manage data storage facilities. They lease space in these facilities to technology companies for servers and other equipment. Data storage facilities are very specific types of properties in that they need to provide uninterruptible power supply, regulated temperatures, and physical security.

Diversified REITs: Diversified REITs own and manage a diversified portfolio of income-producing real estate, that is, a mix of property types, making them ideal for investors looking for a variety of real estate asset classes. For example, a diversified REIT may include some industrial properties as well as data centers or a mix of residential and commercial buildings.

Specialty REITs: Specialty REITs own and manage unique and specialized properties, such as movie theaters, casinos, farmland, outdoor advertising, or ground leases. These REITs usually have a mix of property types that don’t clearly fit into other sectors.

Tax benefits of REITs

REITs have two huge tax benefits that make all of the complications worth it. Both tax breaks benefit you, the investor. After all, by buying shares in a REIT, you are becoming an owner of that rental property, and these tax benefits help you keep more of your hard-earned money.

Single taxation

REITs are what’s known as a “pass-through entity.” They pass the income they earn directly to their shareholders. The rental property earns income, which flows through to the owners (you) and is then taxed as ordinary income.

Normally, this is not how large corporations work. If you own stock in a corporation, your dividends are actually taxed twice. Corporations earn income from their operations. Then the corporation files its tax return and has to pay income taxes to the government.

Then the company takes their leftover earnings and gives some back to shareholders as dividends. The shareholders have to report the dividends, and they pay personal income taxes on it.

So the company pays taxes, and then the individual pays taxes again – on the same earnings!

REITs are specifically exempted from double taxation. As long as they abide by the requirements and qualify as a REIT, they don’t pay the corporate income tax. That means they pass more of the earnings on to the shareholders.

For a more in-depth explanation and an example of how this works, see our article on Single Taxation.

Qualified Business Income deduction

For nearly 60 years, the only tax benefit of REITs was avoiding double taxation. However, starting in 2018, a new rule really helps REIT investors.

The 2017 Tax Cuts and Jobs Act shook up a lot of the existing tax code. Among the changes was the creation of the Qualified Business Income deduction. Right now, it’s set to last until 2025, but Congress may extend it in the future.

This deduction is only available to owners of a pass-through business. Fortunately, businesses like Arrived are all purposefully structured as a pass-through entity for select properties (again, Vacation rentals are considered ‘active’ income and, therefore, not REIT eligible).

This new rule allows investors to deduct up to 20% of their taxable income from REITs. For example, if you earned $100 in dividends from Arrived, you would be taxed as if you only earned $80. You essentially get to keep 20% of your qualified Arrived dividends income-tax-free.

That has the effect of lowering each of the tax brackets by 20%. Here’s how the marginal tax brackets change.

If you fall in the tax bracket on the left, your dividends from Arrived are taxed at the marginal rate on the right for the federal income tax.

For a more in-depth explanation and an example of how this works, see our article on The QBI Deduction.

REIT pros and cons

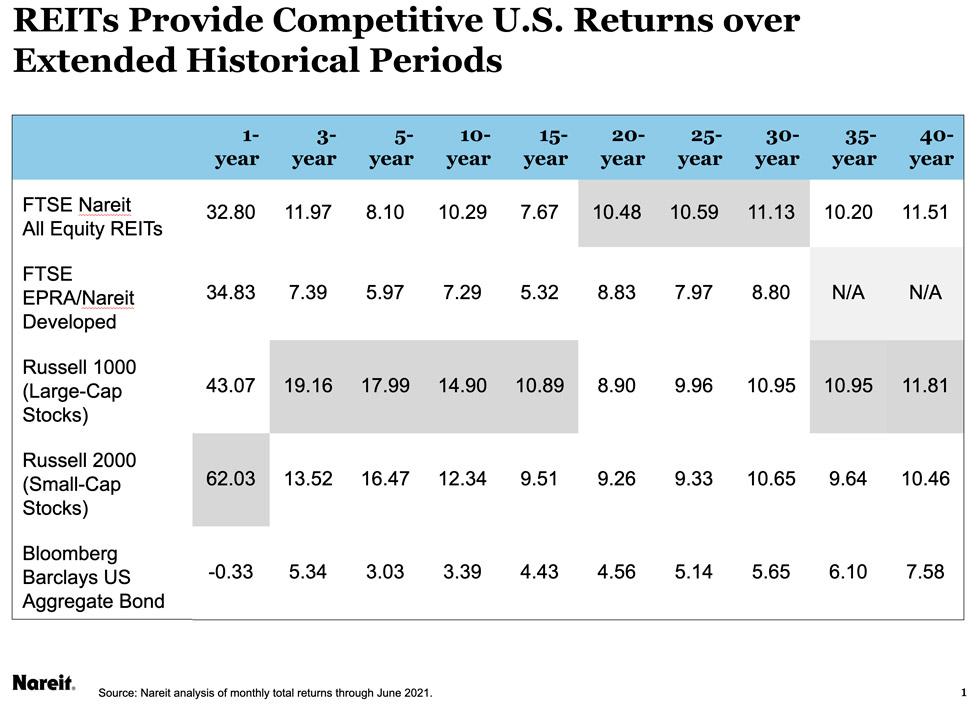

As with all asset types, REITs come with advantages and disadvantages. While REITs can be an important addition to any portfolio, thanks to the stable and dependable annual dividends and cash flow they offer, as well as the long-term capital appreciation, they can also have lower growth and potential for high management and transaction fees.

When deciding on whether REITs work for you as a part of your total assets portfolio, here are some pros and cons to keep in mind:

REIT benefits

Low barrier to entry: One of the best reasons to invest in REITs is the easy access they give you to the real estate market – residential, commercial, retail – without the cost of individual properties and the headaches of being a landlord.

Steady dividends: REIT total return performance for the last 20 years has outperformed the S&P 500 Index, other indices, and the rate of inflation. As of January 2020, REIT dividends paid 3.93% on average, according to research published by NYU’s Stern School of Business, while S&P 500 funds offered dividend yields of around 1.71%. Plus, REITs are required to pay out at least 90% of their taxable income to shareholders, giving you a larger gross income.

Portfolio diversification: Diversification is important in a real estate portfolio to balance out the highs and lows of markets, but if you were to try and buy individual types of real estate in different locations, different markets, in different sectors, it would not only be expensive, but possibly unaffordable. REITs allow you to invest in different property types while keeping your investment highly liquid since much like with the stock market; most REITs can be bought or sold with the click of a button.

High liquidity: Most REITs are publicly traded, like stocks, which makes them highly liquid investments that are easier to buy and sell than actual properties.

Low taxation: Because REITs aren’t required to pay federal corporate income tax, they shield investors from double taxation. REITs are also required to provide audited financial statements, making them highly transparent investments with records of past performance.

REIT disadvantages

Low capital appreciation: While REITs tend to generate a steady income stream for investors through high dividends, they’re not known for offering much in the way of capital appreciation. Since 90% of the income from REITs is given out to shareholders, only 10% can be reinvested to buy new holdings. REITs are also sensitive to interest rates; that is, when interest rates rise, REIT prices tend to fall.

High management and transaction fees: Non-traded REITs can require an initial investment of $25,000 or more and may be limited to accredited investors. They can also come with high management and transaction fees.

Taxed as income: While REITs qualify for the 20% pass-through deduction and aren’t required to pay federal corporate tax, thus shielding investors from double taxation, they don’t meet the IRS definition of “qualified dividends,” and are therefore taxed at a higher rate than any other form of dividends.

Easily invest in rental homes

REITs have been a powerful investment vehicle for 60 years. Across the different types of REITs and investment strategies, they all have access to great tax breaks if they stick to the requirements.

Arrived, structured as a public non-traded REIT, gets to reap the benefits of a public and private REIT structure for certain properties. With Arrived, investors have access to the returns of a private REIT with the low investment minimums and public transparency of a public REIT.

And because of this structure, investors get to keep more of their cash dividends. Arrived investors benefit from single taxation and the Qualified Business Income deduction to keep more of their investment returns. Ready to start capitalizing on all the benefits of REITs? Take a look at our properties here and start building your real estate portfolio today.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The views reflected in the commentary are subject to change at any time without notice. View Arrived’s disclaimers.