Arrived’s investment offerings are conducted under Regulation A and are qualified by the U.S. Securities and Exchange Commission (SEC). This qualification process is a regulatory requirement that allows us to publicly offer these investments to both accredited and non-accredited investors. It helps ensure compliance with federal securities laws and reflects our commitment to transparency and investor accessibility in real estate investing.

What is the SEC?

As the Great Depression wreaked havoc on Americans’ confidence in the U.S. markets, Congress passed the Securities Act of 1933, also known as the “Truth in Securities” law, which had two primary objectives:

- Require that investors receive financial and other significant information concerning securities being offered for public sale

- Prohibit deceit, misrepresentations, and other fraud in the sale of securities

The following year, Congress passed the Securities Exchange Act of 1934, which created the U.S. Securities and Exchange Commission, or “SEC” for short. The SEC has a three-part mission:

- Protect investors

- Maintain fair, orderly, and efficient markets

- Facilitate capital formation

Why Does Arrived Qualify its Offerings with the SEC?

There were two primary reasons behind Arrived’s decision to go through the process of qualifying its offerings with the SEC:

- Anyone can invest: By qualifying its offerings with the SEC, Arrived can allow anyone over 18, accredited or non-accredited, to participate in its offerings.

- Investor protection: Qualifying offerings with the SEC means filling out long-form document disclosures for each property, filing financial statements semi-annually, and auditing those statements annually. All of this provides disclosure to investors so that they understand what they’re investing in and the performance of each asset.

What are securities?

What is a security? Investopedia explains it perfectly with the following definition:

The term “security” refers to a fungible, negotiable financial instrument that holds some type of monetary value. A security can represent ownership in a corporation in the form of stock, a creditor relationship with a governmental body or a corporation represented by owning that entity’s bond; or rights to ownership as represented by an option.

Simply put, a security is a secure, tradable financial asset. And, this may go without saying, but, securities are regulated by the SEC.

All Arrived Offerings are securities.

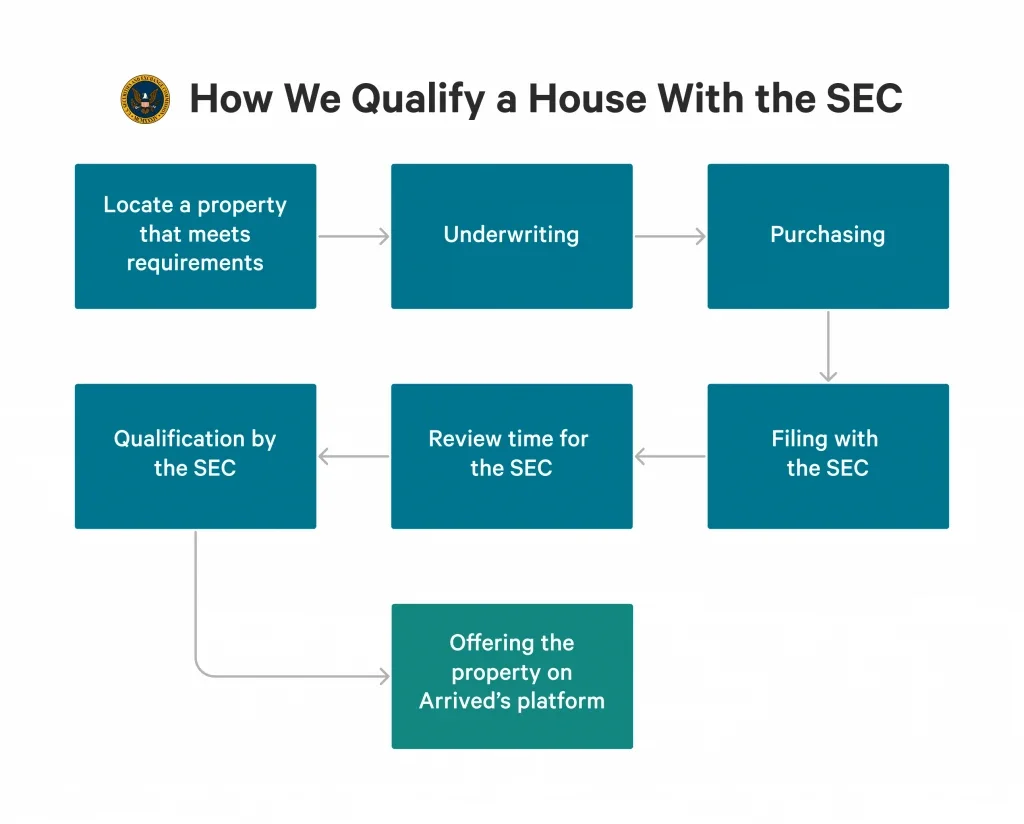

How Arrived’s Process Works

So, how does our process of buying homes and qualifying them with the SEC work? Here’s a general overview:

Downsides to SEC-Qualification

While the positives far outweigh the negatives, there are, in fact, some challenges when it comes to registering and qualifying properties with the SEC.

- Time: The most notable downside of working with the SEC is the time required to complete the necessary filings for a property to be fully registered and qualified. Due to the nature of qualification, we often can’t pinpoint the exact date and time an offering will be available to investors to fund.

- Resources: To complete the filings above and respond to any SEC inquiries, Arrived has to maintain a finance and legal team dedicated to supporting the process.

Access Arrived’s SEC Filings Here

Arrived property financials are prepared in compliance with generally accepted accounting principles (GAAP) for regulatory purposes. Arrived holds its team accountable for the accuracy and integrity of information. If you would like to access our SEC filings, you can click here.

What is Regulation A?

When you pull up an SEC filing from Arrived, you will see a couple mentions of Regulation A, such as, “Each Offering is being conducted (i) under Tier II of Regulation A of the Securities Act of 1933…

”So, what is it? Here’s a full breakdown of Regulation A from the SEC:

Regulation A is an exemption from registration for public offerings. Regulation A has two offering tiers: Tier 1, for offerings of up to $20 million in a 12-month period; and Tier 2, for offerings of up to $75 million in a 12-month period. For offerings of up to $20 million, companies can elect to proceed under the requirements for either Tier 1 or Tier 2.

There are certain basic requirements applicable to both Tier 1 and Tier 2 offerings, including company eligibility requirements, bad actor disqualification provisions, disclosure, and other matters. Additional requirements apply to Tier 2 offerings, including limitations on the amount of money a non-accredited investor may invest in a Tier 2 offering, requirements for audited financial statements and the filing of ongoing reports. Issuers in Tier 2 offerings are not required to register or qualify their offerings with state securities regulators.

U.S. Securities and Exchange Commission: Regulation A

Arrived Offerings fall under Tier 2, and our operations fully support the requirements laid out by the SEC. It’s also worth noting that the limitation on the amount of money a non-accredited investor may invest in a Tier 2 offering is 10% of the total offering, so Arrived sets a maximum investment amount at 10% for all investors on our platform, regardless of accreditation status.