With interest rates reaching 10-year highs, Arrived is leveraging the opportunity to open up another avenue for real estate investment — private credit.

The Arrived Private Credit Fund invests in short-term financing for professional real estate projects, providing the potential for high yields and secured by residential housing.

With an annualized yield of 8.1% since launch, quarterly liquidity options, and regular monthly dividends, we believe this product can potentially deliver some of the most attractive risk-adjusted yields of the last few years.

How the Arrived Private Credit Fund works

The Arrived Private Credit Fund offers investors a straightforward avenue to real estate-backed debt investments. Operating on a simple premise, the fund strategically allocates capital into short-term loans that finance various real estate projects, including renovations, rehabs, and new home constructions. These projects are managed by experienced professionals in the real estate industry, ensuring a level of expertise and oversight.

Investors in the fund can expect their capital to be deployed into a diverse portfolio of loans, each ranging from six to 36 months in duration on average and typically ranging in size from $100k to $500k. This diversified approach helps mitigate risks and maximize returns by spreading investments across different projects and markets. The fund generates returns primarily through interest payments collected on the loans, which are distributed to investors every month. With a focus on steady income and capital preservation, the Arrived Private Credit Fund offers a transparent and accessible opportunity for investors to participate in the real estate market without the complexities of property ownership.

Arrived Private Credit Fund highlights

The Arrived Private Credit Fund simplifies and removes barriers to real estate debt investments.

The key highlights:

- Historic Yield: 8.1% annualized dividend paid

- Liquidity: Expected quarterly liquidity options offer flexibility.

- Diversified Portfolio: The fund invests in a diverse pool of real estate-backed loans, mitigating risks and enhancing stability.

- Monthly Dividend Payouts: Investors enjoy regular monthly dividend payouts, enhancing cash flow.

Types of investments

The Arrived Private Credit Fund will typically focus on these loan areas:

New construction

This type of financing involves providing funding for constructing entirely new residential properties. New construction financing typically covers the costs of land acquisition, permits, materials, labor, and other expenses related to building a new structure.

Bridge loan

Bridge financing is a short-term loan bridging the gap between purchasing a new property and selling an existing one. It provides borrowers with immediate access to capital while they wait for longer-term financing or the sale of their property. Bridge loans often finance the purchase or renovation of a property to refinance or sell it within a relatively short time frame.

Renovation

Renovation financing involves funding the renovation or rehabilitation of existing residential properties. This type of financing supports the refurbishment, repair, or improvement of properties to enhance their value or appeal. Renovation projects may include upgrading outdated features, repairing structural issues, or modernizing amenities.

Learn more about the types of real estate debt in Introduction to Real Estate Debt Investing.

Selection criteria

The cornerstone of Arrived Private Credit Fund lies in meticulous selection criteria. Here's a look into how we evaluate loans:

Borrower’s experience and creditworthiness

In addition to evaluating the financial metrics of potential loans, we strongly emphasize the quality and track record of the borrowers. Our strategy involves partnering with experienced professionals with a proven history of successfully executing real estate projects and meeting their financial obligations.

Why is this important?

The expertise and reliability of the borrower can significantly influence the success of a real estate project and, consequently, the performance of the loan. By collaborating with reputable and experienced borrowers, we help mitigate the risk of project delays, cost overruns, or other unforeseen challenges that could jeopardize the loan's repayment.

Loan to after-repair value

When assessing potential loans for inclusion in the Arrived Private Credit Fund, we emphasize the loan-to-after repair value (LTARV). This ratio represents the proportion of the loan amount in relation to the appraised value of the underlying property. Our preference leans towards loans with a conservative LTARV ratio, typically below 70%.

Why is this important?

A low LTARV ratio signifies a substantial cushion between the loan amount and the property's actual value. Practically, this means that even if property values decline, a significant buffer remains to cover the outstanding loan amount. As a result, the risk of default can be minimized.By prioritizing loans with a conservative LTV ratio, we uphold our commitment to robust risk management, ensuring that the Fund's portfolio is resilient even in challenging market conditions.

Loan position

In real estate-backed lending, the loan position plays a critical role in determining the priority of repayment in the event of default or foreclosure. The Arrived Private Credit Fund exclusively acquires loans secured by residential properties in the first loan position.

Why is this important?

Securing loans in the first loan position affords investors enhanced security and priority in the event of default. In practical terms, this means that in the unfortunate event of foreclosure, investors in the Fund are first in line to recoup their investment and any outstanding loan amounts.

Property location

In real estate, location always matters. Arrived uses a combination of data science and decades of hands-on real estate experience to evaluate the potential real estate project and the surrounding real estate market to determine what projects have the most potential. The Arrived Credit Fund also includes projects from markets nationwide to help provide a better-balanced portfolio.

Why is this important?

Local market dynamics can significantly influence exit liquidity — whether via sale or refinancing — and the value of a property post-completion, with lower-risk projects typically situated in robust real estate markets.

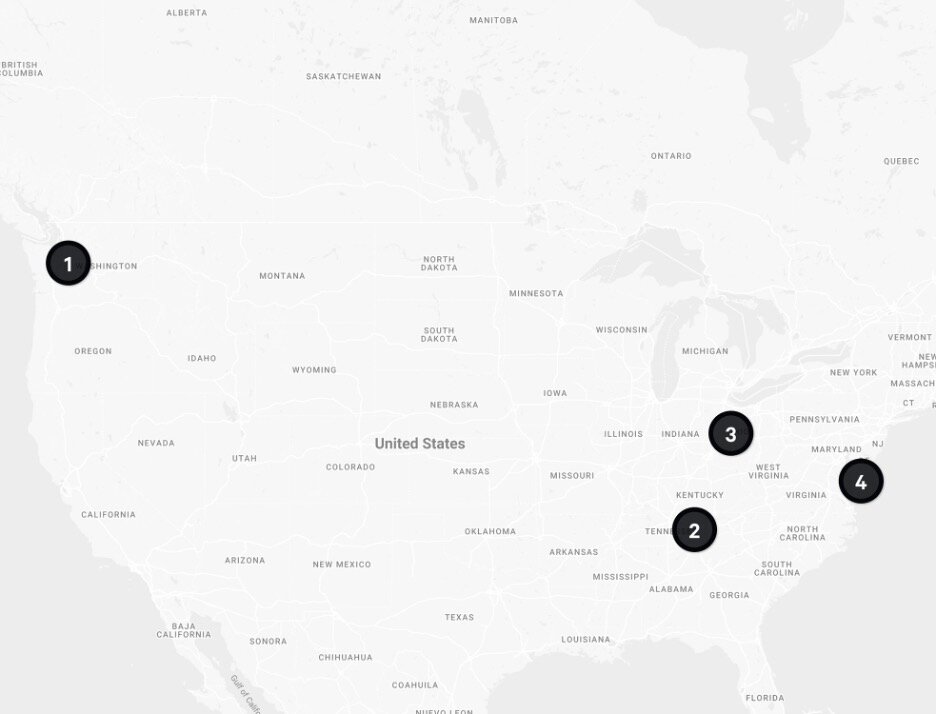

Inaugural Arrived Private Credit Fund loans

Here are a few examples of the types of loans chosen for the Arrived Private Credit Fund.

1. Seattle, Washington

- Loan Total: $978,750

- Developer Projects in the Last 3 Years: 2

- Loan to After-Repair Value: 56.7%

- Loan Type: Rehab + ADU

- Loan Position: 1st

2. Knoxville, Tennessee

- Loan Total: $206,250

- Developer Projects in the Last 3 Years: 1

- Loan to As-Is Value: 65.5%

- Loan Type: Bridge

- Loan Position: 1st

3. Columbus, Ohio

- Loan Total: $209,250

- Developer Projects in the Last 3 Years: 20

- Loan to After-Repair Value: 70%

- Loan Type: Rehab

- Loan Position: 1st

4. Marion Station, Maryland

- Loan Total: $144,500

- Developer Projects in the Last 3 Years: 29

- Loan to After-Repair Value: 53.5%

- Loan Type: Rehab

- Loan Position: 1st

Managing risk

Real estate debt investments offer enticing prospects for returns but also carry inherent risks. The Arrived Private Credit Fund recognizes the importance of diligent risk management to safeguard investor capital and optimize long-term performance. Here's how the fund addresses various risks:

Renovation risk

One of the primary risks associated with real estate projects is the uncertainty surrounding renovations or rehabilitation phases. The Arrived Private Credit Fund tackles this risk head-on by implementing rigorous due diligence processes for each project. Before extending financing, the fund evaluates the viability and feasibility of renovation plans, scrutinizing factors such as project scope, budgeting, and the track record of the project team.

Additionally, the fund may incorporate contingency plans and performance milestones to ensure projects stay on track and mitigate the risk of delays or cost overruns. By adopting these measures, the fund aims to minimize renovation-related risks and enhance the likelihood of successful project completion.

Market risk

Real estate markets are inherently dynamic and susceptible to economic, social, and geopolitical fluctuations. The Arrived Private Credit Fund maintains a vigilant stance on market trends and indicators to navigate potential market volatility. The fund remains attuned to supply and demand dynamic shifts, interest rate movements, and macroeconomic conditions through continuous monitoring and analysis. Armed with this insight, the fund can proactively adjust its investment strategies and allocation decisions to capitalize on emerging opportunities or mitigate risks posed by adverse market conditions.

Borrower risk

Partnering with experienced and creditworthy borrowers is crucial to mitigating borrower-related risks in real estate debt investments. The Arrived Private Credit Fund prioritizes collaboration with reputable borrowers with a proven track record of successful projects and timely loan repayments. By conducting thorough borrower due diligence and assessing factors such as financial stability, past performance, and industry reputation, the fund seeks to minimize the risk of default or non-performance. The fund diversifies its loan portfolios across various borrowers, projects, and geographic regions to reduce exposure to borrower-specific risks.

Learn more about how loans are evaluated and repaid in What Is the Capital Stack?

Watch the Arrived Private Credit Fund webinar

Investing in both debt and equity can be beneficial for a well-balanced portfolio. If you’re looking to diversify your real estate investments, the Arrived Private Credit Fund is an easy way to access real-estate-backed debt. We’ve removed barriers to this investment vehicle at a time when high interest rates provide investors with an attractive yield secured by quality real estate.

For additional educational resources on investing in real estate-backed debt:

FAQ

Who can invest?

How much can I invest?

What type of products are available on Arrived?

Will I have any responsibilities for managing properties I invest in? If not, who is responsible?

What type of returns can I obtain?