Some of the biggest decisions you’ll make as a real estate investor are your choice of investment types. Should you opt for the promise of fixed income and the safety of debt instruments or the ownership stakes and potential windfalls in equity? While there are advantages to both options, each comes with its own set of features and limitations.

Here’s how to think about debt vs. equity investments and how they impact ownership structures, risk profiles, and overall project dynamics.

What are Debt Investments?

Debt investments refer to financial instruments in which an investor lends money to an individual or entity with the expectation of receiving regular interest payments and the return of the principal amount at a specified maturity date. Unlike equity investments, where investors become full or partial owners, debt investors act as lenders, providing capital and debt financing in exchange for the promise of repayment with interest.

Here’s what you need to know about debt investments:

- Pre-Determined Rate of Return: Debt investments are often considered fixed-income securities because they can provide a predictable income stream through interest payments. The interest rate, also known as the coupon rate, is predetermined. If it's a fixed-rate loan, it will remain fixed for the life of the investment. If it’s a floating-rate loan, interest rates will vary based on a benchmark rate, such as treasuries or interest swaps.

- Principal Repayment: In addition to interest payments, debt investments involve the return of the principal amount at the maturity date. This distinguishes debt from equity, where investors seek capital appreciation through the increase in the value of their ownership stakes.

- Credit Risk: Debt investments carry varying degrees of credit risk, reflecting the likelihood that a borrower defaults on interest or principal payments. Higher-risk borrowers typically offer higher interest rates or compensate investors for the increased risk.

- Market Value Fluctuations: The market value of debt investments can fluctuate based on changes in interest rates and perceived credit risk. However, investors who hold debt securities until maturity generally receive the face value of the investment, regardless of real estate market fluctuations. Some exceptions may exist if an investor pursues a distressed strategy and purchases debt securities at severe discounts.

- Diversity of Debt Instruments: Debt investments encompass a wide range of financial instruments, including government bonds, corporate bonds, municipal bonds, certificates of deposit (CDs), and other fixed-income securities. Each type of debt instrument comes with its own risk and return profile.

Some examples of debt investments are included below:

- Treasury Securities: Debt issued by a country’s treasury department. Due to the government's backing, they are often considered one of the safest forms of debt.

- Municipal Bonds: Issued by state and local governments to finance public projects. They offer tax advantages in some cases.

- Real Estate Debt: This type of debt can take many forms and risk profiles, but the common feature is that it tends to be backed by some hard asset collateral. (Learn more about the types and risk profiles of real estate debt in Introduction to Real Estate Debt Investing)

- Corporate Bonds: Debt issued by corporations to raise funds for various purposes, with varying levels of risk depending on the company’s creditworthiness and whether the loan has collateral (i.e., secured debt) or not (unsecured debt).

- High Yield Debt (Junk Bonds): These bonds are issued by organizations with lower credit ratings, making them riskier than investment-grade bonds. They offer higher yields to compensate for the increased risk of default.

- Distressed Debt: This type of investing involves purchasing the debt of distressed companies at a significant discount to its face value, with the expectation of either restructuring the debt for a higher return or gaining control of the company through debt ownership. While these investments have the potential for higher returns, they often also face much higher risk and volatility. Corporate and municipal bonds can also be considered distressed debt if the loans being purchased are non-performing.

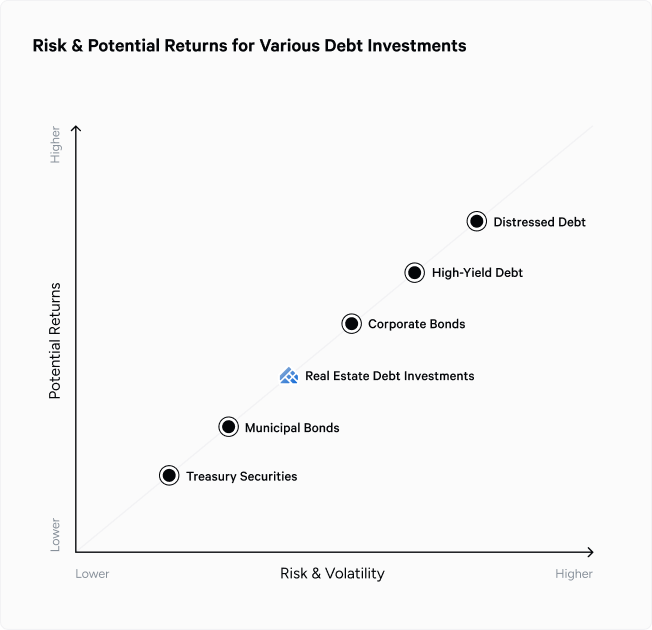

Risk and Potential Returns for Various Debt Investments

Within each debt category, there is a wide range of risk levels depending on the individual loan and where on the capital stack the loan sits. For example, there is senior secured debt within real estate debt, with a higher repayment priority and lower risk profile than unsecured subordinate debt. (Learn more about the capital stack and the repayment priorities in What Is the Capital Stack?)

What are Equity Investments?

Debt investments involve purchasing ownership in a company or an asset, making the investor a shareholder or equity holder. In contrast to debt investments, where investors act as creditors providing loans, equity investors become partial owners.

Equity investments offer the potential for capital appreciation and profit participation but can also involve higher risk and greater volatility than debt instruments.

Here’s what you need to know:

- Ownership Stake: Equity investors acquire shares or ownership interests in a company or asset. The number of shares an investor owns determines their ownership stake, giving them a claim on the company’s assets and earnings.

- Capital Appreciation: The primary goal of equity investments is often capital appreciation. Investors hope that the value of their shares will increase over time, allowing them to realize their investment at a higher price than the purchase price.

- Dividends: Some equity investments, particularly in stocks, may provide dividends. Dividends are periodic payments made by a company to its shareholders, representing a share of its profits.

- Voting Rights: Equity investors may have voting rights depending on the type of equity and the corporate structure. This means they can participate in decisions affecting the company, such as electing board members or approving major corporate actions.

- Risk and Volatility: Equity investments are generally riskier than debt investments. The equity value can fluctuate based on factors such as market conditions, economic trends, and company performance. However, this risk also comes with the potential for a higher rate of return.

Examples of equity investments include:

- Common Stocks: Represent ownership in a publicly traded company, providing investors with voting rights and potential dividends.

- Preferred Stocks: Combine debt and equity characteristics, offering fixed dividends and priority over common stockholders in the distribution of assets in the event of liquidation.

- Real Estate Limited Partnerships (LPs): Limited partnerships involve accredited investors becoming limited partners in a real estate venture, often with a general partner responsible for managing the investment. These partnerships may target specific projects or operate more broadly across the real estate market.

- Venture Capital and Private Equity: Involves investing in private companies in exchange for equity ownership. This type of investment is often associated with startups and companies in their early stages.

- Mutual Funds and Exchange-Traded Funds (ETFs): These investment vehicles pool money from multiple investors to invest in a diversified portfolio of stocks, providing individuals with a convenient way to gain exposure to a broad equity market.

- REITs (Real Estate Investment Trusts): When you invest in a REIT, you are essentially buying shares of a company that owns, operates, or finances income-producing real estate, such as rental property, commercial property, or development projects. REITs are structured to distribute most of their income to shareholders, often as dividends.

- Fractional Real Estate Investing: This involves pooling funds from a large number of investors to invest in specific real estate projects collectively.

Debt vs. Equity Investments — Which Is Right For You?

It’s essential for investors to carefully assess their financial goals, risk tolerance, investment strategy, and time horizon before deciding on the right mix of debt and equity investments for their goals. Many investors choose a balanced approach, incorporating both types of investments to create a diversified portfolio that aligns with their financial objectives.

In real estate development, carefully structuring the capital stack involves assessing the trade-offs between debt and equity financing and determining the optimal blend of financing sources to meet the project's financial needs while balancing risk and return.

Debt Investments

Risk-averse investors prioritizing stability and regular income streams may find debt investments more suitable. You may benefit from debt investments if:

- You’re a conservative investor: Those who prioritize capital preservation and lower risk in their investment portfolios may opt for debt instruments, especially those that sit lower on the capital stack and, therefore, have a priority for repayment of principal and dividends.

- You’re seeking an income: Individuals or retirees looking for a steady income stream may find debt investments, particularly fixed-income securities, attractive. Bonds and other debt instruments that offer regular interest payments can contribute to a reliable income source.

- You’re investing for the short term: Investors with shorter holding periods who cannot afford significant fluctuations in the value of their investments may prefer debt instruments. The fixed nature of interest payments and the return of principal at maturity provide a more predictable outcome.

Equity Investments

Investors seeking long-term growth, the potential for higher returns, and the willingness to accept a higher level of risk may find equity investments more suitable.

You may benefit more from equity investments if:

- You’re a growth-oriented investor: Investors with a long-term horizon and a focus on capital appreciation may opt for equity investments. The potential for higher returns over time aligns with the goals of those seeking growth in their portfolios.

- You’re young: Young investors with a low net worth, long investment horizon, and a higher risk tolerance may choose equities, as they can better withstand market volatility and capitalize on the power of compounding over time.

- You’re a venture capital or private equity investor: Those looking for investment opportunities in emerging businesses and start-ups often engage in venture capital or private equity investments. These forms of equity investing involve taking ownership stakes in companies with high growth potential.

- You have a high risk tolerance: Those comfortable with market fluctuations and having a high risk tolerance may opt for equities. While they come with higher risk, the potential for substantial returns over the long term is also greater.

- You’re looking to diversify your portfolio: Investors seeking a diversified portfolio and willing to accept higher risk in pursuit of potential rewards may allocate some of their investments to equities.

Investing in both debt and equity can be important for a well-balanced portfolio. If you want to diversify your real estate investments, the Arrived Private Credit Fund is an easy way to access real-estate-backed debt. We’ve removed barriers to this investment vehicle at a time when high interest rates provide investors with an attractive yield secured by quality real estate.