Arrived built a platform empowering everyone to build wealth through rental income and appreciation. With our individual property offerings, we simplified the process of investing in rental homes and reduced the barriers to entry that have made it difficult for the average person to invest in real estate. In just three years since launch, Arrived investors have acquired over 340 rental properties, over $121M of property value.

Now, with the Arrived Single Family Residential Fund, you can invest in the same high-quality properties while enjoying an always-available investment experience, one-click diversification, and access to liquidity.

What it is

While our individual property offerings allow you to invest selectively, the Arrived Fund provides investors with an even more streamlined and passive investment experience with multiple benefits to complement our individual property offerings. Investors in the fund will be diversified across several properties in multiple real estate markets, and they will see that diversification grow over time as the fund grows.

Benefits

Instant DiversificationThe Arrived Single Family Residential Fund will contain multiple properties and markets, with investments spread over time. Through this process, the fund has diversification built in and is an excellent option for investors who want an even more passive way to build a diverse real estate portfolio.

Investment LiquidityWhile real estate investments are considered best for long-term holding, The Fund provides investors access to liquidity options six months after the initial investment and quarterly thereafter, subject to SEC-mandated redemption caps and the manager’s approval.

Always-Available InvestingIndividual property offerings follow a “drop” model, which requires investors to be active when new properties are released to maximize their choices. The Fund will always be available for investment and not limited by the inventory of individual properties.

Higher Maximum Investment ThresholdsThe maximum individual REIT investment rules will still apply to the Fund, just as they do with our individual properties. However, due to the size of the Fund compared to our fixed individual offerings, customers can invest more significant amounts all at once. This simplifies the process of allocating capital.

Lower Business Operations CostConsolidating multiple properties under one fund structure allows us to share costs like LCC fees, auditing, and tax preparation across more properties, improving the unit economics for investors.

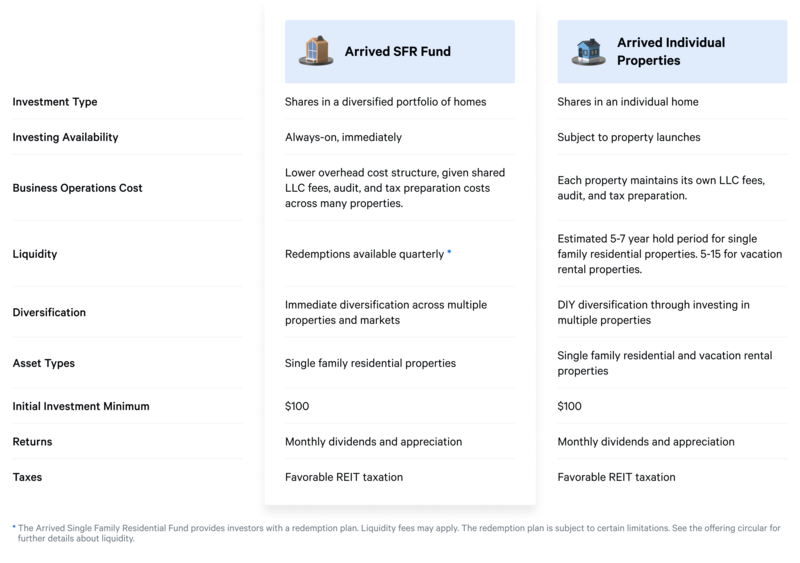

How does the Arrived Single Family Residential Fund compare with Arrived’s individual property offerings?

Arrived individual property offerings and the Arrived Single Family Residential Fund give investors an opportunity to invest in pre-vetted single family residential properties based on their appreciation and income potential.