Why you should add more real estate to your portfolio

Wealth is created by owning income producing assets. Real estate and stocks are two of the best in terms of delivery strong returns over time. The main difference is that stocks have traditionally been easy to invest in, while real estate has been mostly reserved for people who are already wealthy. At Arrived, our goal is to level the playing field by making it possible for anyone to invest in real estate, starting with just $100.

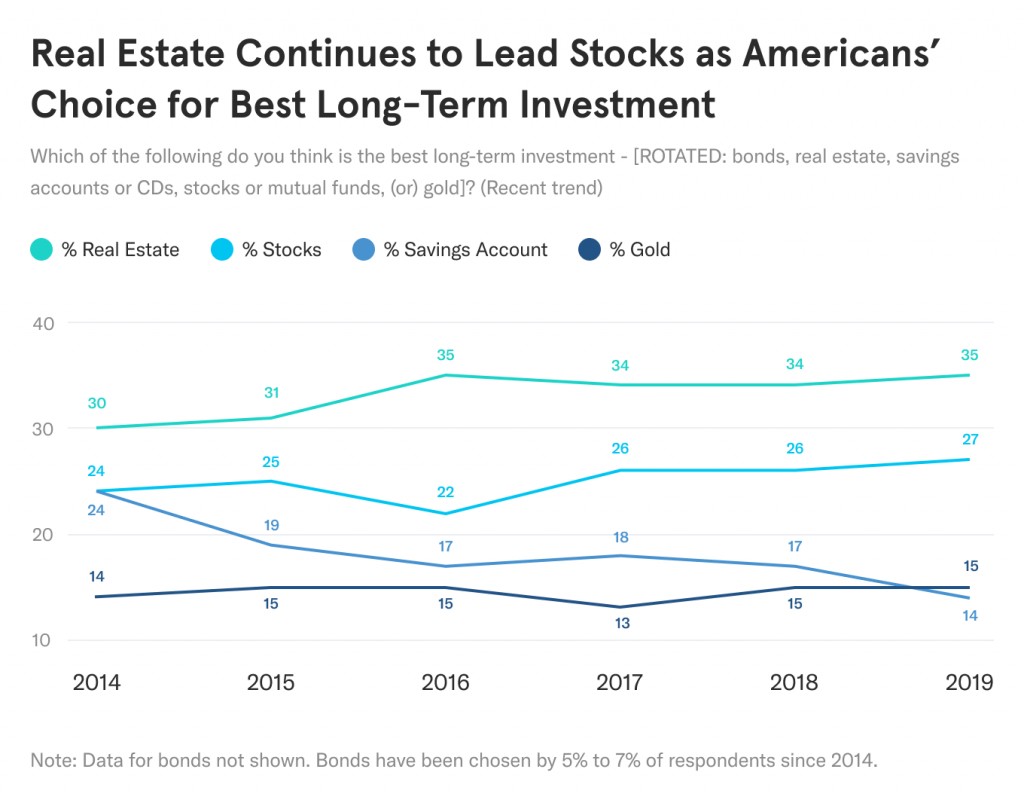

People know that real estate is a great investment. In fact, real estate beats stocks as the top choice for long term investments. Below we can see a Gallup poll that shows that 34% of people see real estate as the best long term investment, beating out the 27% who believe that stocks are the best long term investment.

However, most investors only own stocks. An Arrived survey of 1,000 people showed that 55% of people invested in stocks but only 7% have real estate investments outside of their primary residence. We believe the reason for this is that Real estate investing has been difficult to get into, precisely because it requires a lot of money, time, and expertise. Now Arrived is breaking down these barriers to entry.

Every person’s situation is different, but common suggestions are to have between 5-30% of your investment portfolio in real estate. The exact amount will depend on your age, net worth, and risk tolerance.

Here are some of the main reasons why investors should complement their stock investments with more real estate.

High Returns

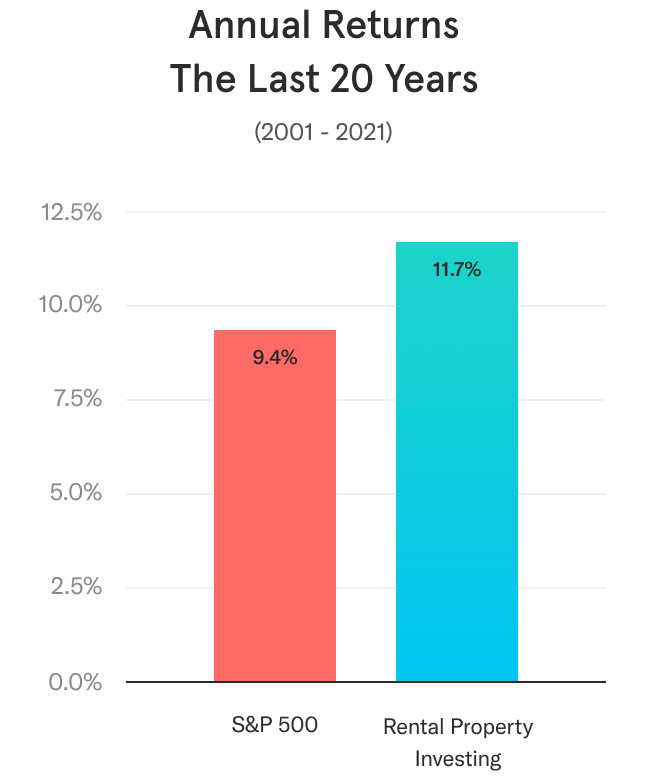

At Arrived, we put together an in-depth study on the historical returns for single family rental properties. Our findings showed that investing in single family rental homes over the past 20 years would have resulted in a 11.7% annual return on investment. The annualized return for the S&P 500 was 9.43% over the last 20 years (ending 10/31/21). As you can see, while the S&P 500 has delivered very strong investment returns across 20 years, the rental property asset class has actually outperformed the S&P 500.

Low Volatility

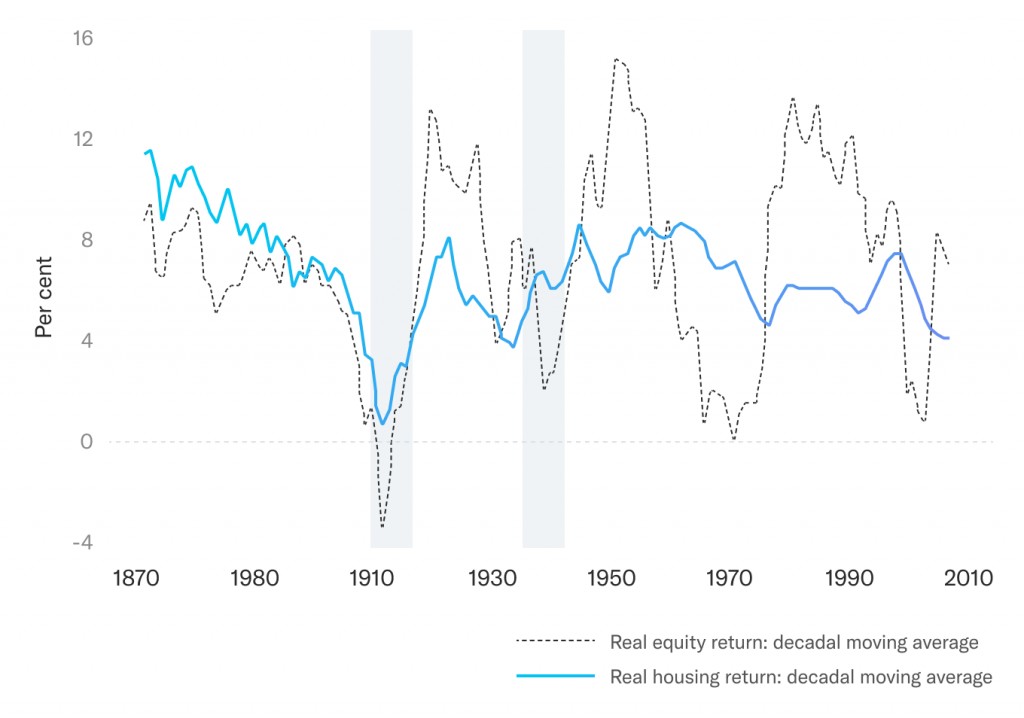

The goal of investing is to achieve high returns while managing the amount of risk. A landmark study came out in 2019 that compared the returns and risk of different investments in various countries from 1870 to 2015.

The study, The Return of Everything, showed that residential real estate and stocks had virtually the same rate of return. Both returned about 7% per year after adjusting for inflation. However, residential real estate was half as volatile as stocks!1 One reason is that since housing is a necessity and not a luxury expense (people always will need a place to live), while there are changes in overall demand for housing, those fluctuations are much less pronounced.

Volatility is important because it measures the risk of an investment. Real estate increased steadily, whereas stocks bounced up and down more dramatically and more frequently. Watching your investments ride the roller coaster can be emotionally exhausting and make it hard to invest for the long-run.

From the Return of Everything:

“The low covariance of equity and housing returns reveals that there could be significant aggregate diversification gains (i.e., for a representative agent) from holding the two asset classes.”

Translated: Stocks and real estate don’t go up and down together. That makes your investments less risky.

Stocks are a great investment. Real estate is a great investment. But investing in a combination of both can earn investors higher returns with less risk.

In the below chart you can see the annual returns for stocks (equities) compared to housing. While stocks have wild swings and long periods where the returns are low (1966-1982), you can see that housing returns are steady over time.

Better Cash Returns

Real estate is best known for its ability to generate strong cash returns. A rental property collects rents, pays its expenses, and has cash leftover at the end of the month (“cash flow”).

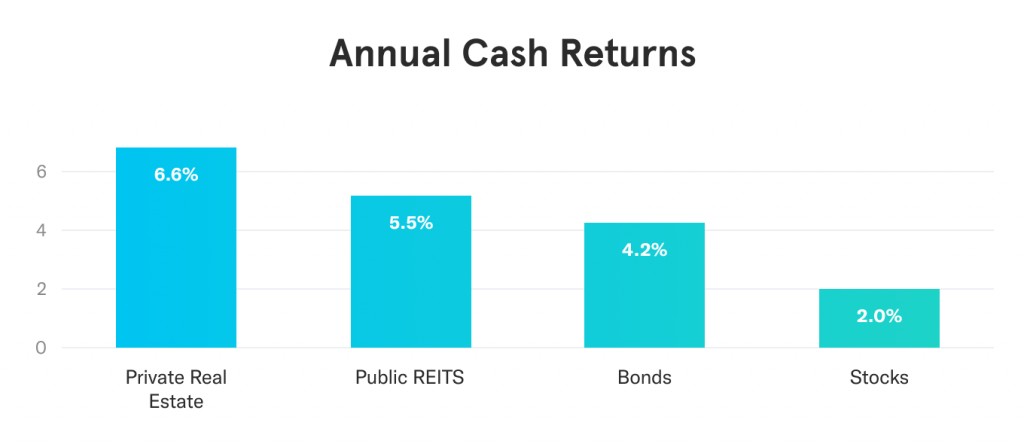

There are two types of stocks, some that pay a dividend and some that don’t:

- Not all companies pay a dividend. Companies like Amazon, hoard shareholder cash and focus on reinvesting for growth. Stocks that don’t pay a dividend can only make money through appreciation. The investor gets no cash back until they sell the stock.

- The stocks that do pay a dividend typically have worse yields than real estate. Over the last 3 years, the average dividend yield of the S&P 500 has been between 1.7% and 2.0%.2 Private real estate deals have yields around 6.6%.3

Investors looking for a balanced return profile love the cash returns that real estate can offer. Cash returns are great because investors can do whatever they want with the money.

Stocks and real estate are both ways for investors to earn passive income. Stocks rely more on appreciation and offer lower cash returns. Real estate is the opposite, offering strong cash returns while still achieving appreciation of the property.

Cheap Debt to Increase Returns

Using debt (aka “leverage”) can be a powerful way to increase the returns of an investment. Leverage amplifies the results of an investment. If an investment does well, leverage will make it great. If an investment does poorly, leverage could make it disastrous. One of the greatest benefits to investing in real estate is that homeowners and investors are able to use a very low cost bank loan to help finance their purchase and lock in that low rate for a long time.

While it is possible to use debt to invest in stocks, it’s not common. For retail equity investors, it can be confusing and often dangerous. The danger is due to the fact that stocks can be very volatile. If prices go down, you could be forced to sell in order to pay back the loan. Real estate doesn’t have the extreme volatility that stocks do. As a result leverage on real estate can be seen as safer than leverage on stocks.

Ability to Find Undervalued Assets

The stock market is very efficient. A stock’s price is determined by supply and demand for that stock on the particular marketplace. First off, there is a high volume of buyers and sellers, so stocks tend to be very liquid and the price reflects the expected value accurately. Second, everyone has the same public information on each company and each share of a stock is exactly the same (my share of Apple is the exact same as your share of Apple). Last, stocks can only change hands in one marketplace at one price at any given time.

This makes it very difficult to find a truly undervalued stock. Stocks with high potential upside usually have high risk of going down too. Real estate, on the other hand, has opportunities to find great properties at reduced prices.

- Real estate is local: Buyers are usually local because they can’t move the property to somewhere else. Someone in Nashville looking to buy a rental property would look in the Nashville area. They wouldn’t submit an offer for a property in Jacksonville. Lower competition makes it easier to negotiate with a seller.

- Each piece of real estate is unique. Every home has a different floorplan and sits on a different piece of land. Determining a fair value can be hard because every single property for sale is different. This opens the door for smart investors to find deals that others wouldn’t.

- Unlisted Opportunities: Sometimes real estate is sold before it even gets put on the public market place. These “pocket listings” are properties for sale that don’t have any public marketing. Investors can purchase undervalued properties by buying them before any competitors even know they’re for sale. This can’t happen on the stock market – a share for sale is available to everyone all at once.

The stock market has millions of people competing for the same assets with the same information, making it difficult to find an undervalued asset. Real estate has few competing buyers and sometimes not everyone even knows a property is for sale. Smart real estate investors are able to find good deals in ways that aren’t possible in the stock market.

Forced Appreciation

Once you own a stock, there isn’t anything you can do to help your investment appreciate. You could buy the company’s product but that revenue is miniscule for a large public company. Investing in stocks means buying the asset and hoping the value increases.

Rental properties don’t rely on hope. By performing repairs and improvements with high ROI’s (return on investment), owners can increase the value of the property. For example, adding new appliances can allow owners to increase rents. This also increases the monthly cash flow and lifts the property value.

Real estate gives investors opportunities to force appreciation through smart improvements. Stock investors are stuck hoping the company’s management team does a good job.

Tax Advantages

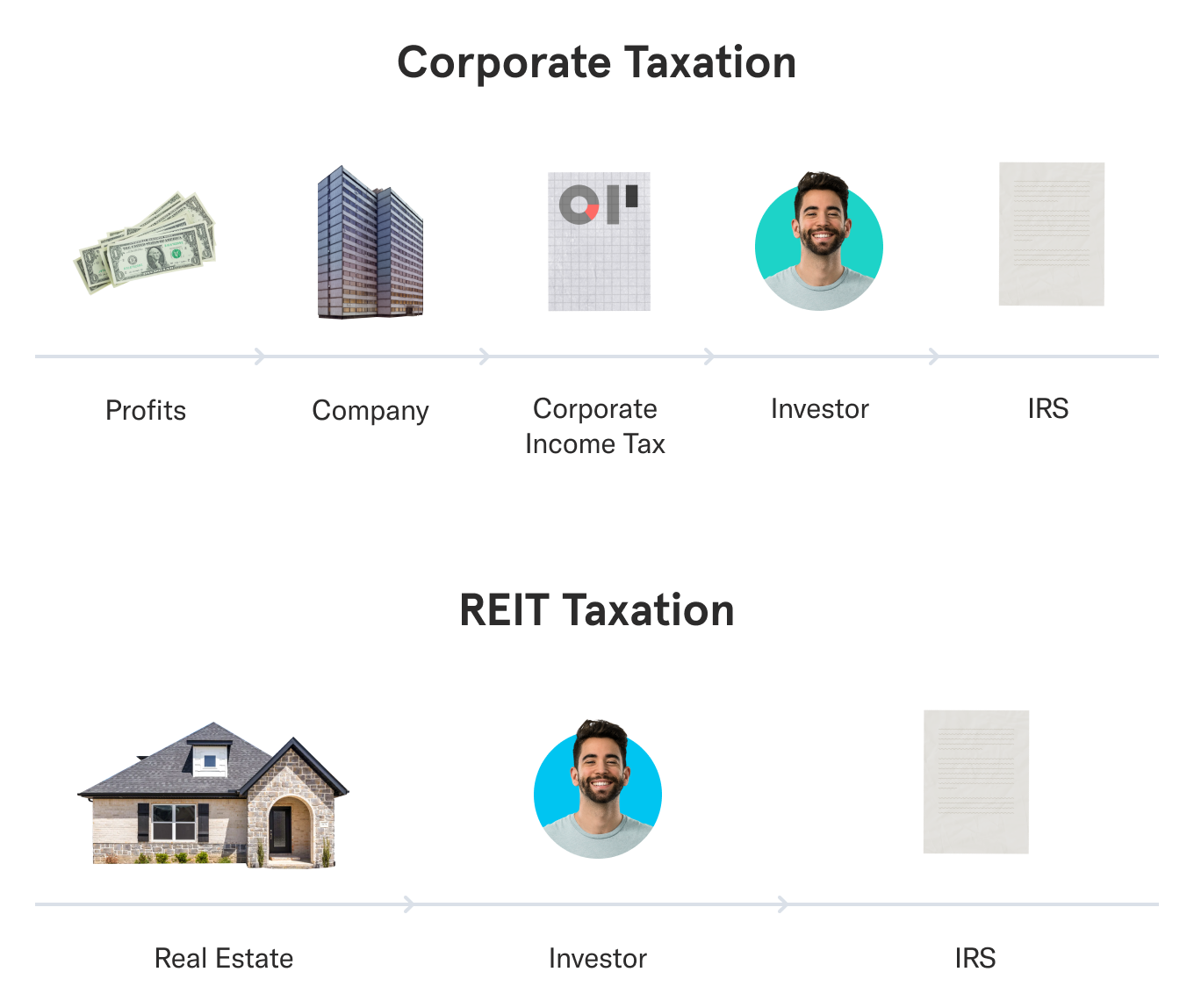

Dividends from publicly traded companies are subject to double-taxation. The company earns money and pays the corporate income tax on that income. Then they distribute earnings to investors in dividends, and investors pay income tax on those dividends. The same earnings are taxed twice!

Many real estate investments like Arrived Homes are structured as a Real Estate Investment Trust (REIT). REITs have a very different tax structure. They pay no tax at the corporate level, and investors are taxed once when they receive dividends. REIT investors are also allowed to use a special piece of the 2017 Tax Cuts and Jobs Act. Section 199A allows REIT dividends to have a flat 20% deduction. This means if you earned $100 of dividends, you’d be taxed as if you only earned $80!

Investors in real estate have clear advantages over stocks because earnings are only taxed once, and only taxed on 80% of what they actually earned.

Hedge Against Inflation

Real estate and more specifically rental properties are not only natural hedge against inflation, but they can even benefit from inflation. When there is rising inflation, the rental prices and home valuations have historically increased along with inflation. This is because having a home is a necessity and not a luxury expense that can be easily avoided. As a result, when it comes to real estate, inflation is not eating at your investment value as is the case with most other assets.

Actually, given the highly leveraged nature of most real estate investments, inflation can actually accelerate the returns. As inflation causes home values to increase, the leverage accelerates the rate of growth of the owner’s equity in the property relative to the debt. Let’s use an extreme and say for example you invest in a home with 20% down and there was a 20% inflation, that means you just doubled your down payment and doubled the equity you own in the home. Additionally, as inflation raises the rent payments while the interest payments stay locked at the same low rates, the cash flow from the property increases with inflation.

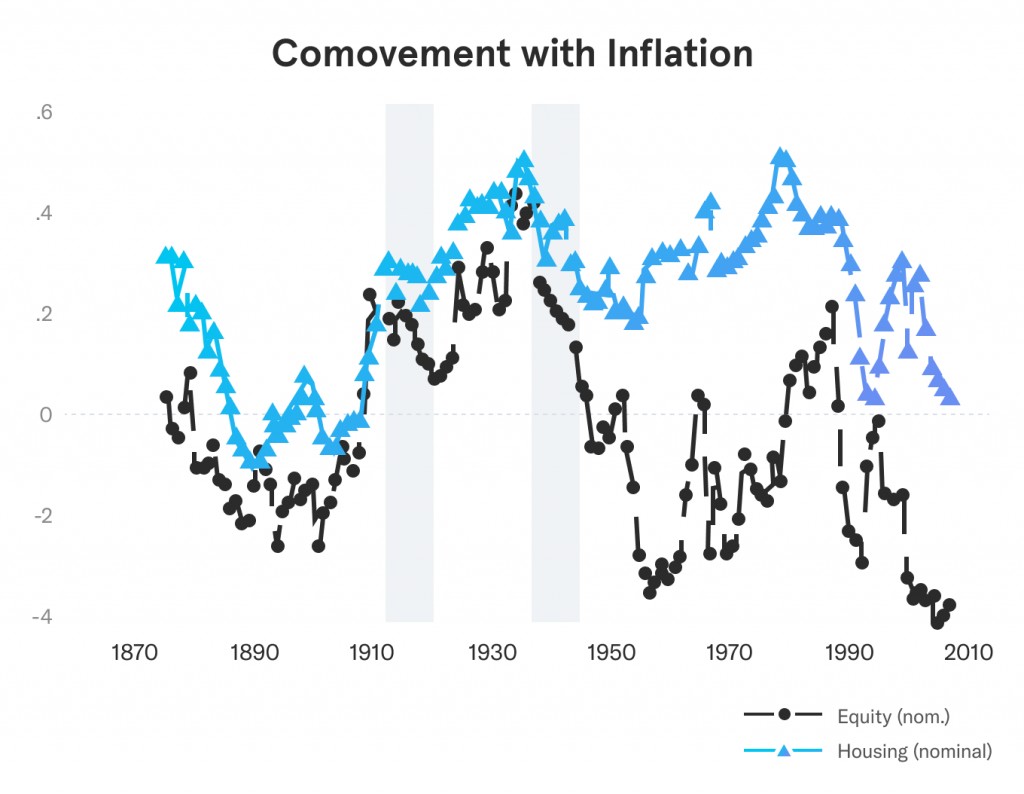

In this graph below we can see how during the 1900s housing prices have provided a very robust hedge against inflation and higher consumer prices. Equities have been the opposite and co-moved negatively with inflation prices.

In Summary

As you can see from this article, there are many differences between investing in stock and real estate. Below you can find a table comparing stocks, traditional real estate, and Arrived on the key dimensions.

Do You Need to Invest in More Real Estate?

Stocks and real estate both belong in your portfolio. Stocks are a great investment that will continue to be great investments over long periods of time. Real estate offers strong returns with low volatility, as well as the ability to find undervalued deals and special tax advantages.

Most people don’t own enough real estate investments, and should take some time to assess if they need to add more to their portfolio. Luckily, Arrived is bringing the same ease of trading stocks to investing in real estate. Sign up below to browse our properties and start adding real estate to your portfolio.

- https://academic.oup.com/qje/article/134/3/1225/5435538

- https://ycharts.com/indicators/sp_500_dividend_yield#:~:text=S%26P%20500%20Dividend%20Yield%20is,long%20term%20average%20of%201.87%25.

- http://www.ipa.com/wp-content/uploads/2018/11/Black-Creek_Market-Insights-Private-vs-Public-RE_08-2018_FINAL.pdf