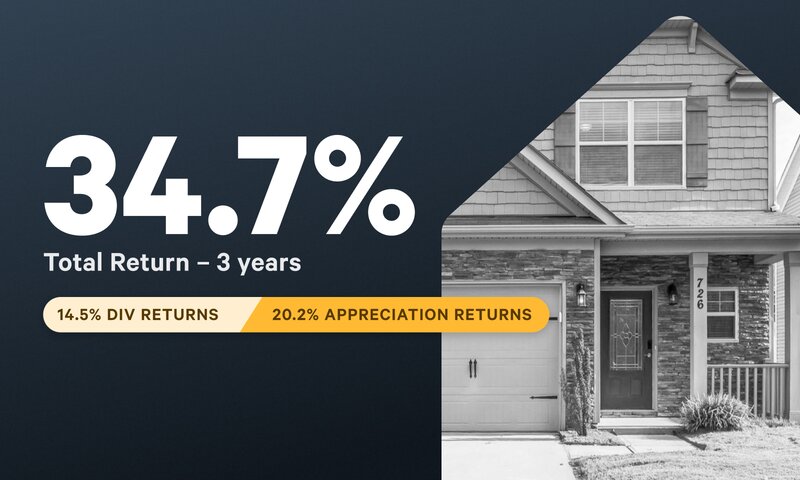

In October 2024, Arrived sold The Centennial. This sale presents an opportunity to highlight the dual benefits of dividend income and property appreciation in real estate equity investments and show how Arrived’s acquisition, management, and property sales strategies helped achieve a total return of 34.7% (11.2% average annual returns) for investors.

Key Stats:

- Total Return: 34.7% (11.2% average annual returns)

- Total Appreciation: 20.2% (6.5% per year)

- Total Dividends: 14.5% (4.7% per year)

Acquisition Strategy: Why Charlotte and Why The Centennial

Our Investments team chose this home for several reasons, including its open floor plan and favorable location near Charlotte, NC. We have invested in multiple properties in this market due to its growing population, affordable cost of living, and strong demand for both housing and rentals. Charlotte is a thriving city with robust economic growth driven by major companies such as Bank of America, Honeywell, and Lowe’s. The property’s open floor plan and large backyard enhance its appeal to tenants, thereby boosting its rental potential and overall market value.

The Centennial IPO was launched in September 2021, with 154 investors funding the total purchase price of $285,000, which was offset by 66.7% in property leverage. Before offering The Centennial to investors, Arrived secured a resident with a 2-year lease, ensuring immediate rental income from the property’s IPO.

Operational Efficiency: Securing Consistent Income and High Tenant Retention

From its October 2021 IPO to its August 2024 listing for sale, The Centennial was leased throughout, providing investors with consistent monthly dividends from rental income. This long-term occupancy was achieved through proactive resident sourcing and lease negotiations. Arrived even increased rental income by 9% in the second year through a lease renegotiation, adding to the property’s return potential.

Arrived’s property management team handled every step of The Centennial’s upkeep, allowing investors to sit back and enjoy the income from their investment. Beyond ensuring steady rental income, the team proactively managed minor repairs to protect the property’s value without burdening investors. For example, when a washing machine leak required drywall repair in May 2022, Arrived took care of everything—demonstrating our commitment to a seamless, hands-off experience for investors.

The Sale of The Centennial: Maximizing Value Through Strategic Timing

The typical hold time for single family residential properties is five to seven years. However, Arrived's Investments Team strategically timed the sale of The Centennial to align with the end of a lease cycle, optimizing market conditions and maximizing return potential. During the sales process, Arrived made two counteroffers and engaged in negotiations over inspection findings, ultimately securing a final sale price of $351,000.

Final Results

- Sale Price: $351,000

- Total Appreciation Return: 20.2% (6.5% annually)

- Dividend Return: 14.5% (4.7% annually) – providing 42% of total returns

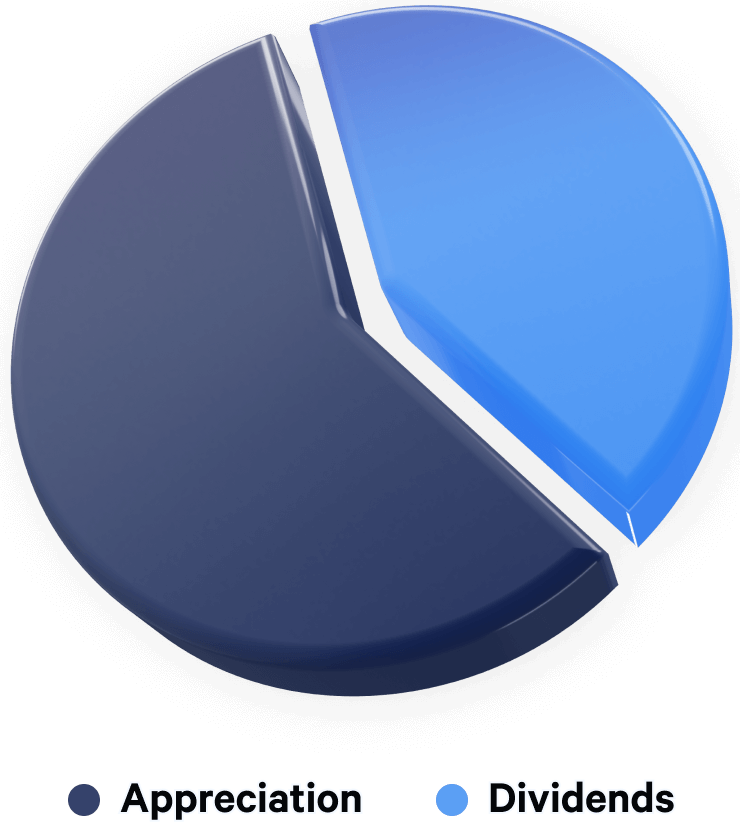

20.2% Appreciation Returns

58% of total return

Positively impacted by our Investments Team's selection of the Charlotte market in 2021, which has since experienced strong growth.

14.5% Dividend Returns

42% of total return

Positively influenced by factors such as timely rent payments, low vacancy rates, and no need for major repairs.

Key Takeaways: What The Centennial’s Success Means for Future Investors

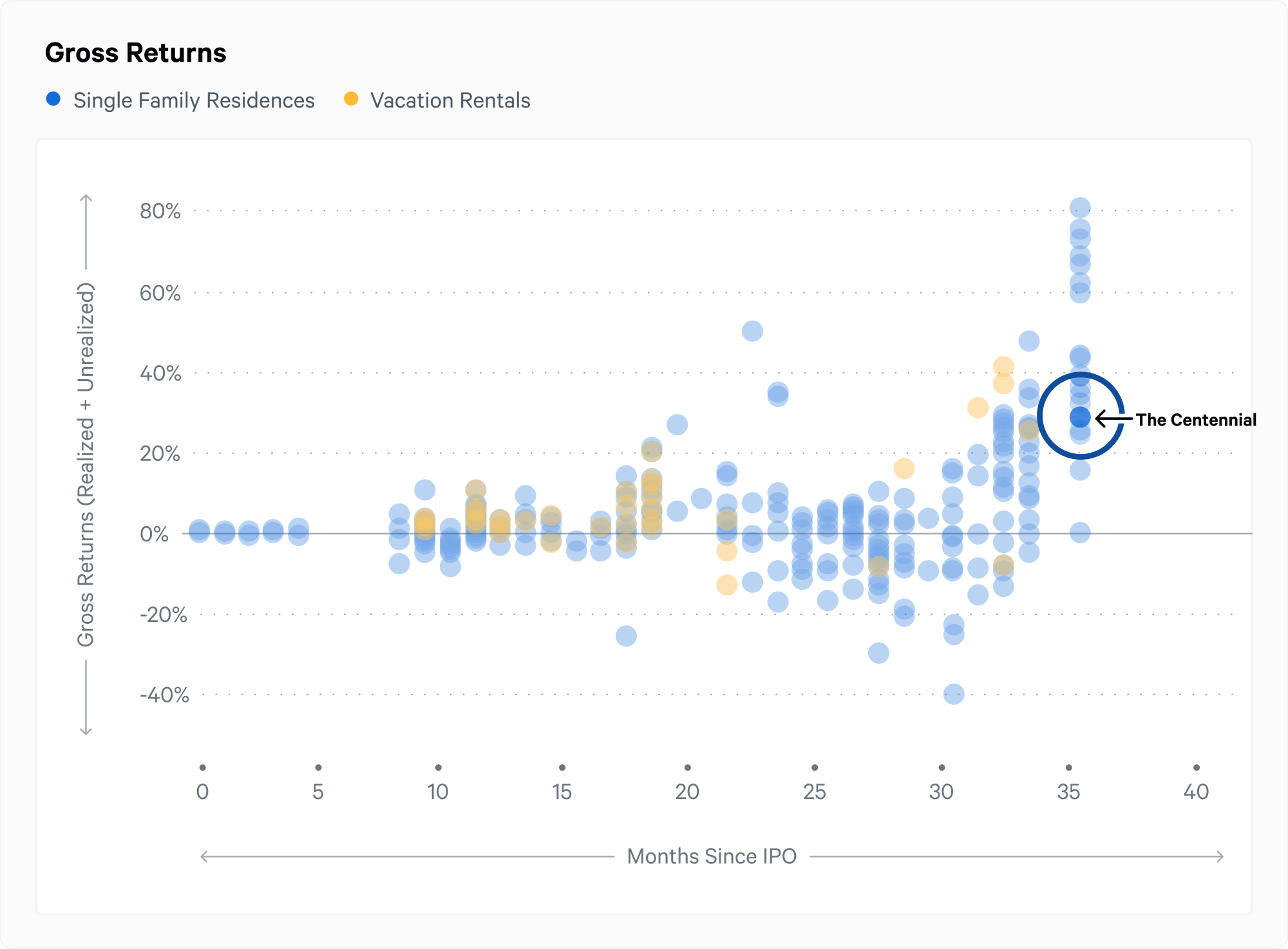

The Centennial is an example of the power of Arrived’s strategy in action—a carefully selected property in a growing market consistently managed to generate reliable returns. While this property experienced significant appreciation, it is not an exception; instead, it falls comfortably within the mid-range of properties available for investment in 2021. We believe the success of The Centennial is repeatable across properties.

For investors, Centennial’s story illustrates how property appreciation and dividends combine to generate robust returns. Arrived aims to continue delivering similar value across our portfolio through careful market selection, attentive property management, and thoughtful timing in sales.

Conclusion: A Proven Path to Investment Success

Arrived’s sale of The Centennial has set a promising example for investors looking to benefit from dividend income and long-term appreciation. By leveraging local market insights and maintaining a high standard in property management, we are committed to offering investment opportunities that align with growth trends and deliver returns that exceed expectations.