Gen Z wants to be homeowners.

According to our survey*, an overwhelming majority of Gen Z — 87% — feel that homeownership is key to building wealth, while 65% said owning their own home is personally important to them.

Gen Z views homeownership as a path toward financial stability. Of those who felt homeownership was important, 65.5% cited financial security and stability as their driving reason, compared to 20.7% who thought it was a status symbol.

Despite wanting to own a home — and having solid financial reasons for doing so — most of the generation find homeownership hard to reach. As of 2023, only 25.2% of adults under 25 years old are homeowners, according to data from the U.S. Census Bureau.

So, what’s going on?

High Cost of Entry

Rising costs are keeping many younger Americans from reaching their goals. When asked why they hadn’t taken the plunge, nearly 80% of Gen Z said high home prices are their biggest barrier to entering the housing market.

And that makes sense. The oldest members of Gen Z reached adulthood in 2014. Home prices have increased 58.7% between then and now, according to the Federal Reserve Bank of St. Louis.

Housing prices skyrocketed during the pandemic, pushing many Americans out of the market. Between 2020 and 2021, median home sales increased by $52,667, according to data compiled by Bloomberg. That outpaces median workers’ earnings of $50,000. In some markets, prices rose more than 50% between 2020 and 2022.

As pandemic pressures like increased demand and building supply shortages have started to resolve, housing markets have begun to cool off. However, home prices are still a difficult target for many younger would-be buyers. As of Q2 2023, the median price sales price of a home sold in the U.S. was $416,100, according to FRED.

Lowering the Barriers to Real Estate Investment

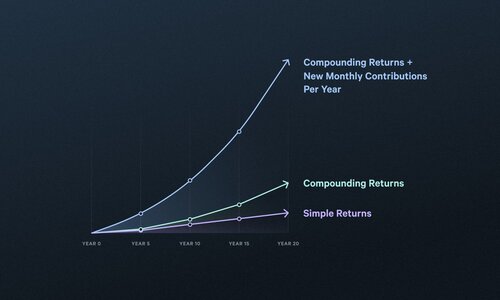

Between large down payments, closing costs, and other expenses like moving costs, buying their first home may feel out of reach for much of Gen Z, but fractional real estate ownership may offer opportunities to build wealth at a lower entry point.

“Coming of age amid skyrocketing home prices and pandemic-era economic turbulence has given some of Gen Z financial whiplash, particularly when it comes to owning a home,” said Cameron Wu, VP of Investments at Arrived. “There’s this common perception that owning a home is just not something that young people can do. This is one of the key reasons we launched Arrived, to create ways for people to invest in real estate at any price point. And it’s working — 58% of Arrived users born after the year 2000 get started with an investment of just $100, helping them grow their wealth and invest in real estate without having to scrimp and save for a down payment that gets more expensive with every passing year.”

Platforms like Arrived allow investors to purchase shares of single-family residential homes and vacation properties while earning dividends and participating in home price appreciation when the property is sold.

In Q2 2023, Arrived generated $790k in dividends for investors.

You can view the dividends for each property on our Historical Returns page.

*For this survey, we asked 1,129 people ages 20-80 about their attitudes toward homeownership using Survey Monkey’s online panel. The survey was conducted on June 1, 2023. For the purpose of this survey, we defined Gen Z as survey respondents born in 1997 or later.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The views reflected in the commentary are subject to change at any time without notice. View Arrived’s disclaimers.