As a first-time homebuyer, you may have saved for years for a down payment, put together the money for fees and insurance, and swallowed the moving costs. You may not have a lot of spare cash lying around in the weeks after your move to your new home.

So what happens if a major appliance, such as the washing machine, malfunctions two days after you move in? Or the electrical or plumbing system suddenly breaks down? It’s situations like this where a home warranty can come in handy.

What is a home warranty?

A home warranty is a type of contract covering the service, repair, or replacement of major household appliances and home systems, including electrical, plumbing, heating, and air conditioning.

In addition to helping cover some of the cost of significant out-of-pocket expenses, a home warranty company can connect you with contractors who can fix your appliance or system.

Home warranty plans can be customized to meet individual needs, and you can add coverage for items such as well pumps, septic tanks, pools, or spas. A home warranty is typically taken out for one year, after which you can renew. The fee is paid either monthly or annually.

How a home warranty works

When purchasing a home warranty, you’ll usually be given premium or optional home warranty coverage to provide the protection you need. You can add on systems and appliances not already covered in the contract, such as a second refrigerator, a freezer, or an outdoor pool.

After you purchase a warranty, any claims can be filed online or over the phone, depending on the provider. Once your claim is received, you’ll be connected to approved service providers through the home warranty company, who will schedule a time to assess and fix your appliance or system. Most home warranty contracts include trade or service call fees, a small fee the company charges to have a service provider do a house call to diagnose the problem.

According to Forbes, a home warranty costs around $600 per year.

Some real estate agents will also advise home sellers to purchase a home warranty to make the deal more attractive to prospective buyers. Your real estate agent can provide the information if a property has a transferable home warranty.

What does a home warranty cover?

A home warranty will cover items specifically mentioned in your contract. A standard home warranty contract covers:

- Electrical systems

- Plumbing systems

- Heating systems

- Air conditioning systems (HVAC systems)

- Water heaters

- Well pumps

- Permanently-installed sump pumps

- Ductwork

- Kitchen appliances, such as dishwashers and built-in microwaves

- Garbage disposals

- Ceiling fans and bathroom exhaust fans

- Clothes washers and dryers

- Ovens, stoves, and cooktops

- Refrigerators, freezers, and ice makers

- Garage door openers

- Trash compactors

You can also get additional coverage for the following:

- Swimming pools

- Spas

- Septic pumps

- Septic tanks

- Guesthouses

It’s important to note that what will be covered will explicitly be stated in your contract and specific situations in which an item mentioned in your contract may not be covered. For example, a standard limitation in many home warranty contracts is the voiding of service if you attempt to perform repairs yourself or through an unapproved service technician. Similarly, roof leak coverage is a common add-on to many home warranty contracts. It may only include the home’s main structure, not the garage, patio, or deck.

Home warranties will not cover structural elements such as walls, windows, and foundations. Other exclusions are cosmetic damage, light fixtures, appliance accessories, and pest damage.

You can purchase home warranty plans covering only appliances, systems, or both.

Pros and cons of home warranties

Before purchasing a home warranty plan, consider the pros and cons of these contracts.

Pros:

- You save on out-of-pocket costs: If any of your appliances or systems break down, especially right after you’ve purchased or moved into a home, a home warranty plan can help save on repairs and replacements.

- Covers older appliances: While most manufacturers’ warranties will run out after a certain number of years, a home warranty will cover both old and new appliances, giving you peace of mind should an item need replacing.

- Saves you the hassle of finding service providers: When an appliance or system breaks down, having a home warranty protects you from having to find and assess service providers to diagnose and fix the problem.

Cons:

- Trade call fees: Many home warranty companies will charge trade call fees when they send someone out for a home inspection to assess the problem or damage. Since these home service fees are in addition to your monthly payment, they can be expensive for smaller claims.

- Doesn’t cover pre-existing conditions: If you’re buying a home with pre-existing problems, especially in the central systems, your home warranty may not cover it.

- No outside contractors: While it’s nice to save on the hassle of finding contractors to fix problems in your home, it also means that you can’t work with your own choice of contractor or service provider.

- Denial of claims: Claims can be denied by a home warranty company if you’ve not maintained an item correctly.

Home warranties vs. home insurance

While both home warranties and homeowners insurance deal with damages and cost coverage, they differ. Here are a few key differences:

- While home warranties are designed to cover the cost of repairing home appliances and systems, homeowners insurance covers the home’s structure and contents.

- Home warranties will pay for damages caused because of normal wear and tear, while homeowners insurance covers damages and loss caused by incidents like fire or theft.

- Home warranties are optional, though they are sometimes included by home sellers as part of a real estate transaction to make the purchase more attractive. On the other hand, a home insurance policy is often required by mortgage lenders.

- Home warranties can be transferred to a new owner, while a homeowners insurance policy cannot.

What to look for in a home warranty contract

When shopping for home warranties, you’ll want to look at a few home warranty companies and compare contracts to see what you’re being offered. Some things to keep in mind include the following:

- Know your coverage needs: Will the standard home warranty contract work for you, or will you need to customize the home warranty agreement to be fully covered? You may want to cover appliances under their original manufacturer warranties or add additional areas like swimming pools.

- Compare costs: Compare prices of various home warranty companies to find the best home warranty for your needs. Look at the annual premiums and the trade call and service fees.

- Understand terms that will void the contract or result in denials: Grey areas can often result in claim denials, so read the fine print and understand what is covered by your home warranty agreement, what will void it (for instance, trying to make repairs yourself), and what might lead to denial (for example, a lack of proper maintenance.) Also, many home warranty agreements have a standard waiting period of 30 days before you can use them.

The bottom line

If you’re new to homeownership, a home warranty may give you the peace of mind to ensure you’re not hit with a big expense right after purchasing a new home. But whether a home warranty is right for you will come down to several factors, including whether the home is a new construction and your coverage needs.

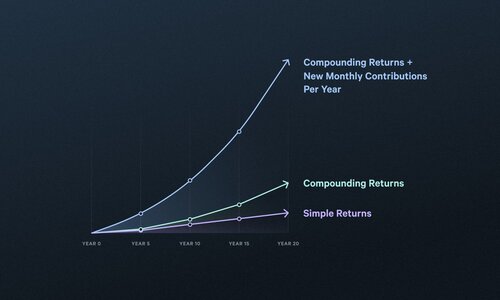

If you’re not yet ready to purchase a home but want to start investing in real estate, look no further. With Arrived, you can purchase shares of rental properties for as little as $100 and start building a portfolio today.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The views reflected in the commentary are subject to change at any time without notice. View Arrived’s disclaimers.