The United States housing market is a giant, both in terms of size and importance to the economy. According to the US Census Bureau, there are more than 142 million homes across America. Zillow estimated the total value of private residential real estate was $43.4 trillion in 2021, while the National Association of Realtors (NAR) reports that 5.64 million existing homes were sold in 2020. The real estate industry also plays a significant role in the country’s gross domestic product (GDP). According to Statista, finance, insurance, real estate, rental, and leasing accounted for 21% of the US GDP in 2021.

Real estate has long been considered a reliable investment option, as home values have typically historically increased over time. Moreover, technological advances have made buying and selling properties easier than ever before.

Recently, the pandemic and recent fears of a recession have significantly impacted home sales and housing prices, as buyers and sellers alike have become more cautious about entering into deals due to economic uncertainty and Fed rate hikes. But the housing market remains a significant force in the national economy, with its size and importance only continuing to grow.

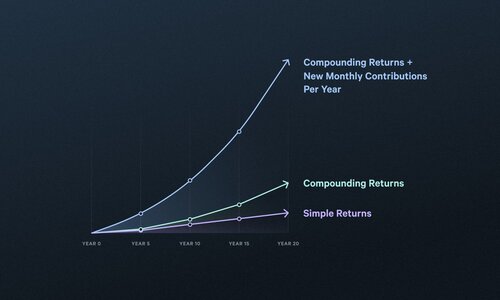

Despite challenges posed by economic uncertainty, there are plenty of opportunities for investors who purchase property to hold for the long term while strategically balancing risk with potential reward. With greater knowledge about the economy, housing markets, and recessions, individuals can capitalize on the current economic climate and potentially benefit from real estate investments for years.

Housing recession overview

A housing recession is a state of economic downturn in the real estate and housing market, which typically occurs when home prices drop for an extended period. Factors that can affect home prices during a recession include:

- Job layoffs

- Falling incomes

- Affordability issues with borrowers

- Rising debt levels

- Overbuilding of new homes coupled with reduced demand

- Speculative activity by home builders resulting in a housing bubble

Additionally, a housing recession can impact mortgage rates and homebuyers. The Federal Reserve raising interest rates may result in a lack of investors and lenders needing more confidence in the market, while fewer buyers can make home purchases due to affordability, financing issues, and the need for a bigger down payment.

Historic housing recessions in the U.S.

The U.S. has seen several historic housing recessions since its inception. The earliest event was the Long Depression of 1873-1879, where over 600 banks closed due to a large stock market crash leading to credit becoming scarce and prices drastically dropping across all sectors. More recent events included The Great Depression from 1929-33 and The Great Recession from 2007-09, both caused by financial exuberance before recessionary times leading to illiquidity in consumer assets and government-backed contracts.

Overall, how the housing market has performed during past recessions is mixed, according to the S&P/Case-Shiller U.S. National Home Price Index. For example, some periods show that prices increase before or after their respective recessions, whereas other periods show steady declines during those same periods. However, it is important to note that with more current data sets, rental housing seems more resilient in economic downturns.

Long-term impacts of a recession

Recessions can have long-term economic impacts, even after the downturn has ended. Historically, recessions have had effects that lasted for years or even decades.

For example, the Great Recession caused a prolonged economic slump. It took over five years from its onset before economic growth returned to pre-recession levels. Moreover, this recession is linked to declines in productivity growth and labor force participation rates that continue to this day.

The 2007–2009 financial crisis also impacted global economies in different ways, including increased inequality and reduced access to credit by small businesses and households. The International Monetary Fund (IMF) found that countries with high levels of public debt were more likely to experience slower economic growth over the decade following the crisis.

Another long-term effect of recessions is a shift in economic power. The Great Recession saw large corporations gain market share while small and mid-sized businesses suffered. Even after the recession ended, these companies continued to hold an outsize influence on market dynamics.

Recessions can also cause lasting damage to people’s finances and credit health. According to Experian, Americans’ credit scores dropped significantly during the Great Recession and remain below pre-recession levels to this day. Many households still feel the effects as they struggle with high consumer debt and difficulty securing loans.

Overall, recessions have far-reaching consequences that can linger long after a downturn has formally ended.

How do recessions impact housing markets?

Housing market recessions historically vary in duration and severity. This can vary depending on the state of the economy before and after the recession, as well as factors such as government stimulus and overall confidence in the housing market.

The 2008 Global Financial Crisis is a prime example of how a recession can have long-term impacts on homebuyers, homeowners, and participants in the real estate industry. The housing market experienced an extended period of decline due to increasing mortgage defaults, decreased demand for homes, and rising home prices that outpaced incomes.

During a housing market recession, there is often an imbalance between supply and demand.

When the demand for housing decreases, home prices usually go down, and fewer homes are purchased. This often leads to an abundance of unsold homes in the market, which drives down prices further as sellers compete to attract buyers.

As a result, homeowners may find themselves with negative equity – meaning they owe more on their mortgage than their home is currently worth. Meanwhile, buyers may benefit from lower prices and less competition with other buyers, but they may have difficulty obtaining financing from banks that are more cautious about lending during recessionary times.

The best advice for buyers and sellers is to consult with a real estate professional who can provide guidance when navigating the market during such challenging times. Additionally, understanding local trends and staying up-to-date on changing laws and regulations can help buyers and sellers make informed decisions.

Pros and cons of investing in housing during a recession

Investing in housing during a recession can offer the opportunity for the buy-and-hold investor. However, while it may present some opportunities to gain a high return on investment (ROI), there are also pitfalls to watch out for.

Pros

- Lower prices: During recessions, property values can decrease, allowing investors to purchase properties at lower costs than they would in other economic climates.

- Inelastic demand: Housing has an inelastic demand meaning that people will still need places to live regardless of economic circumstances making it easier for investors to find tenants or buyers who won’t be deterred by high prices.

- Less competition: During a recession, there is typically less competition among investors, providing an opportunity to acquire properties at more favorable terms.

- Improved bargaining power: Investors are in a stronger position during downturns and may be able to negotiate better deals on the purchase or sale of real estate.

- Improving market conditions: Economic recessions tend to be short-lived, so investing during a recession can provide an opportunity to capitalize on improving market conditions as the economy rebounds.

Cons

- Unstable investments: Investing in housing during a recession can potentially be unstable in the short term because property values can drop further and remain low while the economy attempts to recover.

- Repayment of loans: During recessions, lenders may be less likely to provide mortgages or refinancing options. This could make it more difficult for private investors to obtain financing.

- Lower returns: The lower cost of housing during a recession also means that the potential for return on investment is lower than usual if the property is held for the short term.

- Risk of foreclosure: During tough economic times, renters or buyers may default on payments, which can put investors at risk of foreclosure if they cannot cover the costs themselves.

Closing thoughts

A housing market recession is when the real estate market experiences significant drops in property values. Housing recessions usually last several years, and a variety of factors, including job losses, economic downturns, or over-investment in specific markets, can cause them.

During a housing recession, investors should look for opportunities to buy low, while homebuyers should consider whether it’s best to wait out the recession or take advantage of current market conditions. Regardless of your decision, it’s important to understand what you’re getting into so that you can protect your interests.

With the right approach and knowledge of the market conditions during a recession, investors can make sound decisions that will help them reap benefits in uncertain times. By paying attention to the details and being patient and diligent with due diligence and research, investors can protect their investments and secure a sound investment in the long run.

Arrived offers a platform for exploring single-family residential homes and vacation rental investment opportunities. While investing during a recession may present challenges, Arrived provides tools and resources to help you navigate the process.

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The views reflected in the commentary are subject to change at any time without notice. View Arrived’s disclaimers.