Homeownership offers many benefits. Not only is it a sound investment strategy, but it also comes with many tax benefits.

Here’s a quick look at the tax deductions available for homeowners, with a few bonus deductions available to real estate investors. Use it as a guide when you file your tax return.

What are tax deductions?

According to the Internal Revenue Service (IRS), tax deductions “can reduce the amount of your income before you calculate the tax you owe."

Tax deductions lower your adjusted gross income (AGI), reducing your tax liability. It’s a simple formula. Subtract the tax deductions from your income and lower your tax bill.

Tax deductions vs. tax credits

Both tax deductions and tax credits lower your tax liability, but they’re very different—tax deductions lower taxable income. Tax credits directly reduce the amount of taxes a taxpayer owes.

Here’s a closer look at them.

Let’s say you’re a single filer with an adjustable gross income is $75,000. Your federal tax rate is 22%. Therefore, your tax liability is $15,225.

But you qualify for a $3,000 tax deduction. The tax deduction reduces your AGI to $72,000, so you now pay taxes on that $72,000. With this AGI, your federal tax rate remains 22%, but your federal income tax liability drops to $14,336. Not bad.

However, you also qualify for a $1,500 tax credit. This tax credit is deducted directly from your tax liability. As a result, your income tax drops to $12,836.

Types of tax deductions

There are two ways, or categories, of tax deductions. They are taking the standard deduction the IRS offers or itemizing your deductions. You can only choose one when you file your taxes. So, here’s a quick look at the differences between standard and itemized deductions.

Standard deductions

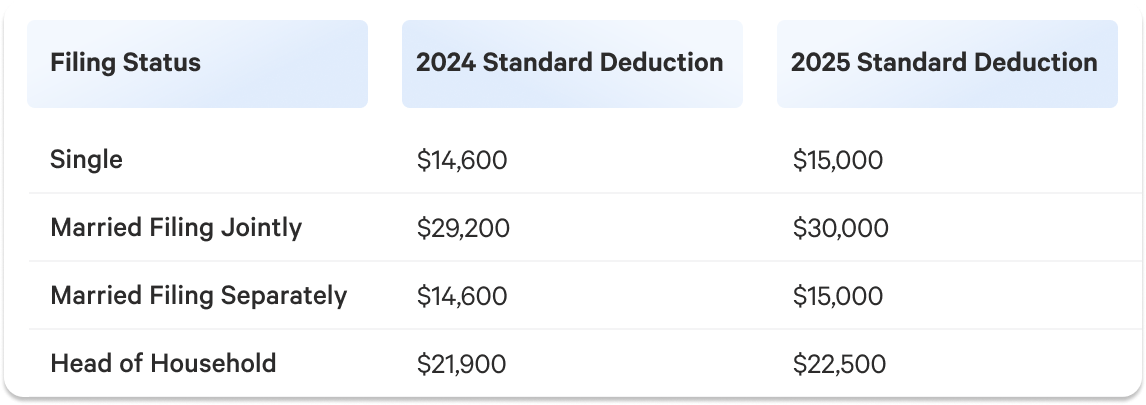

Standard deductions are published by the IRS every tax year. They’re available to all tax filers and determined by your filing status.

Below is a table with the standard deductions for the 2024 and 2025 tax years:

Itemized deductions

Itemizing your deductions is another way for taxpayers to reduce their adjusted gross income. Unlike standard deductions, the deduction amount for itemized deductions is not set by the IRS and varies from the taxpayer to taxpayer.

When you itemize deductions, you add up all applicable deductions, including tax breaks for homeowners. Then, you subtract that number from your taxable income.

8 tax breaks for homeowners

The IRS has very specific rules and requirements regarding tax deductions for homeowners. We recommend speaking with a tax professional familiar with tax law before itemizing your taxes. Below is a list of some of the tax breaks available to homeowners. Use it as a guide when reviewing your financial situation.

1. Mortgage interest

That’s right! If you have a mortgage on your home, you can deduct the amount of money you’ve paid in mortgage interest from your taxable income.

The Tax Cuts and Jobs Act limits the mortgage interest deduction to $750,000 for a single filer or married couples filing jointly. Married couples filing separately have a mortgage interest deduction limit of $375,000.

2. Private mortgage insurance payments

If you purchased your home with a down payment of less than 20%, you likely have private mortgage insurance (PMI). PMI protects the lender if the homeowner doesn’t make monthly mortgage payments.

PMI payments are another expense homeowners can deduct to reduce their tax liability.

3. Home equity loan interest

A home equity loan, or home equity line of credit (HELOC), enables homeowners to tap into the equity they’ve built without selling their homes. HELOCs are essentially second mortgages.

Homeowners who’ve used their home equity loan to fund home improvements can qualify to deduct their HELOC interest payments from their taxable income.

Taxpayers can claim this deduction throughout the life of the loan as long as they’re paying interest.

4. Home improvements

Not all home improvements are tax deductions. Upgrading your kitchen or bathroom or installing a pool are not tax-deductible expenses.

Only necessary home improvements may be tax deductible. What are essential home improvements? Well, that depends. An example might be if the home needed to be made wheelchair accessible because of illness or injury to the homeowner. However, sometimes, these may be considered medical expenses.

Talk to a tax professional to see if your home improvements qualify as a deduction.

5. Mortgage points

Mortgage points, or discount points, are fees paid to a lender to obtain a reduced interest rate on a home loan. They are typically calculated as a percentage of the total loan amount rather than the home’s purchase price. Mortgage points are often included in the closing costs of a home sale.

You could deduct the cost from your taxable income if you purchased mortgage points while financing your home.

6. Property taxes

Homeowners typically pay local and state property taxes. The local government sets local taxes. The state government sets state taxes. Homeowners can deduct these property taxes from their taxable income.

Property taxes may be deducted from your principal residence, second home, and any other property you own.

The property tax deduction for married couples filing jointly is $10,000. It’s $5,000 for single filers or married couples filing separately.

7. Home office expenses

If you are self-employed, you may qualify for a home office deduction.

The home office deduction is available for taxpayers who use a home office for regular and exclusive business use.

The IRS sets a standard rate of $5 per square foot with a maximum of 300 square feet.

Here’s how it works.

Let’s say you’re self-employed, and your home office is 200 square feet. You’d multiply 200 by $5 to get your home office deduction. In this example, your deduction would be $1,000.

8. Capital gains

In real estate, capital gains are the profits made by a homeowner or real estate investor after selling a property. Capital gains taxes, therefore, are the taxes they pay on those profits.

To qualify for the capital gains tax break, the home sold must have been the taxpayer’s primary residence for two out of the last five years.

The capital gains tax break allows married couples filing jointly to keep up to $500,000 in capital gains. Single filers and married couples filing separately can keep up to $250,000 without paying capital gains tax.

3 additional tax benefits for real estate investors

Properties, like a rental home, may qualify for other tax deductions in an income-producing capacity. Below are some of them.

1. Depreciation

The IRS defines depreciation as “the recovery of the cost of the property over a number of years.” Property owners and real estate investors can deduct part of a property’s depreciation yearly until they fully recover its cost.

This tax benefit is only available for properties used in an income-producing activity. It is not available for principal residences.

Taxpayers can depreciate property that meets all of the following requirements:

- It must be property owned by the taxpayer.

- It must be used in a business or income-producing activity.

- It must have a determinable useful life.

- It must be expected to last more than one year.

- It must not be expected property.

Talk to a tax professional to learn more about this deduction.

2. Homeowners association fees

Taxpayers cannot deduct homeowners association (HOA) fees from their taxable income if paid for their primary residence. However, they can deduct them for rental properties.

3. Utilities

That’s right! Utilities paid for a primary residence are typically not tax-deductible, but they are for rental properties.

Non-deductible home expenses

If you decide to itemize your home expenses, you must know that several expenses are not tax deductible. They include:

- Homeowner’s insurance premiums. While you can deduct PMI payments, you cannot deduct your regular homeowner’s insurance premiums.

- Mortgage payments. It’s true. Mortgage interest payments and mortgage points used in a home purchase are deductible. Regular monthly mortgage payments that go towards your mortgage debt are not deductible.

- Down payment. That’s right. While you may deduct mortgage points, you cannot deduct the down payment.

- Sales tax. If you’re purchasing a primary home, you cannot deduct any sales tax paid because they’re usually lumped in with other deductible items.

Is itemizing for tax breaks right for you?

It depends. Some people don’t like the hassle of itemizing their taxes. Some people don’t mind.

Before deciding, we recommend taking a few minutes to add up the value of your available itemized deductions. Then, compare that to the standard deduction provided by the IRS. Which saves you the most money? That’s usually the best option.

The bottom line

Homeownership comes with many tax benefits you don’t get if you live in a rental. Homeowners and real estate investors should consider these benefits when filing their taxes. A certified tax professional can help ensure you get the most deductions while following tax laws.

Want to invest in real estate easily?

We can help. Arrived lets you buy shares of rental properties without dealing with a home mortgage or real estate taxes. We also handle all the property management, so you get the benefits of property ownership without the hassle. Browse our available properties to start investing in real estate today.