When evaluating investment opportunities, headline return figures often steal the spotlight. But savvy investors know that what truly matters is the post-tax yield—how much of the return you keep after accounting for taxes.

Tax efficiency can significantly enhance returns for real estate and private credit investments, making these asset classes more compelling than options like high-yield savings accounts or taxable fixed-income investments.

Here’s a closer look at how investors can understand and evaluate post-tax yields in the context of these tax-advantaged opportunities.

Why post-tax yields matter

The returns you see advertised for various investments often represent pre-tax figures. While these numbers are helpful for initial comparisons, they don’t always tell the whole story. Different asset classes are subject to different tax treatments, so two investments with identical pre-tax returns can lead to significantly different net profits.

The tax advantages of REITs

Arrived’s investment offerings, including the Private Credit Fund, individual single family property offerings, and the Single Family Residential Fund, are all structured as Real Estate Investment Trusts (REITs). This structure unlocks tax benefits that enhance post-tax yields.

Some benefits that come from investing in REIT-qualified offerings include:

Passthrough income

REITs allow income to pass directly to investors without incurring corporate income tax, avoiding the double taxation associated with traditional corporations.

199A QBI Deduction

Investors in REITs like Arrived’s funds can qualify for the 20% Qualified Business Income (QBI) deduction, reducing taxable income from REIT distributions.

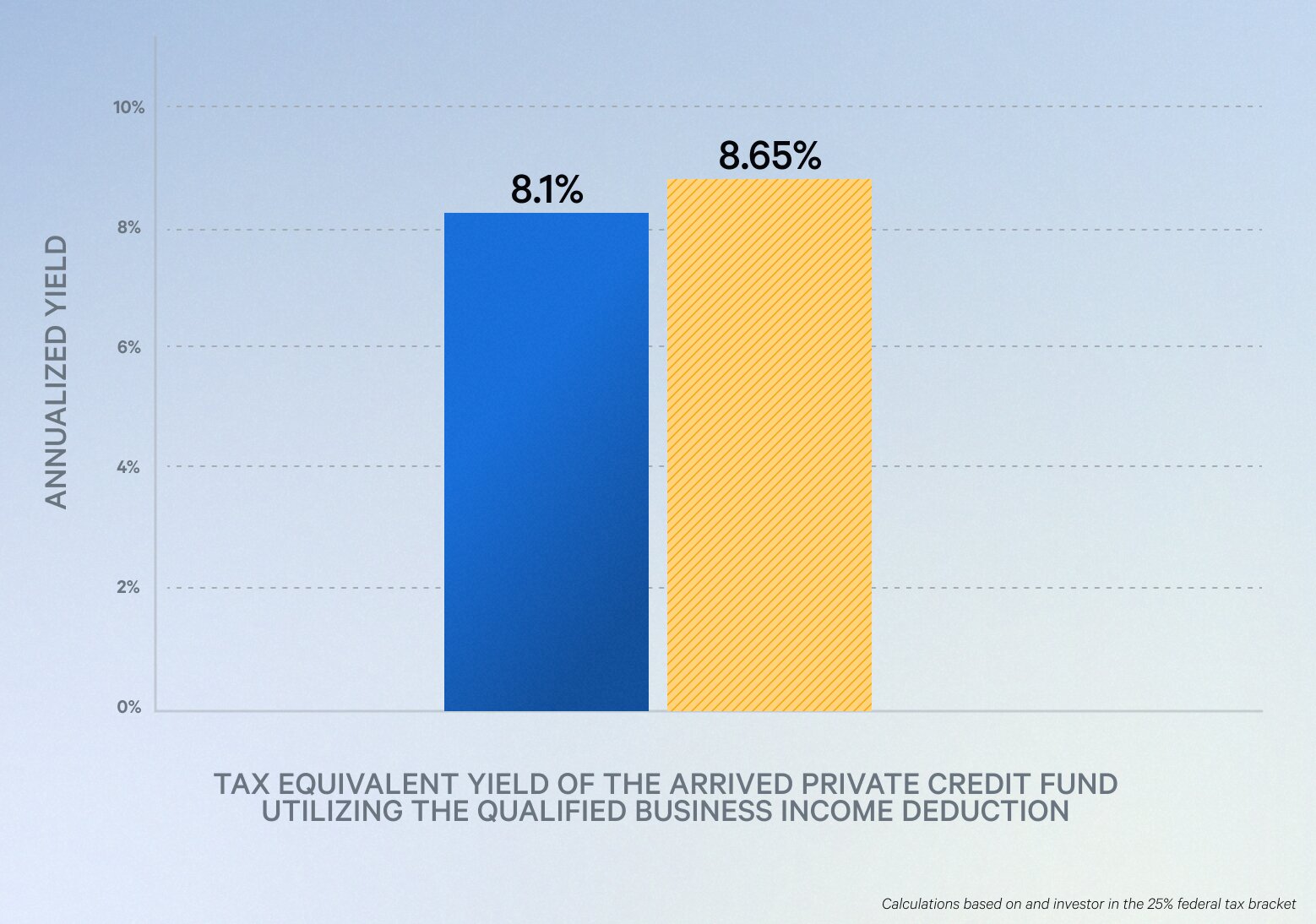

For example, an investor in the 25% federal tax bracket could see an advertised yield of 8.1%¹ effectively increase to a tax-equivalent yield of approximately 8.65% when factoring in the Qualified Business Income (QBI) deduction.

Depreciation benefits

Real estate investments also allow for depreciation deductions, reducing taxable income even as properties generate cash flow. This tax deferral can significantly enhance cash-on-cash returns and improve long-term performance.

Comparing post-tax yields to other investments

High-yield savings accounts

Fully taxable at ordinary income rates, these accounts yield far less after taxes. For an investor in the 25% federal tax bracket, a 4.75% yield becomes just 3.56% post-tax.

Private credit funds

Investments in Arrived’s Private Credit Fund with an advertised 8.1% historic annualized yield¹ and the 199A deduction result in a post-tax yield of 6.48%. That’s nearly double the post-tax yield of a high-yield savings account, offering a compelling case for these tax-efficient investments.

Why timing matters

The 199A deduction expires in 2025

The 20% tax deduction on REIT and private credit income will expire in 2025 unless Congress extends it. While many expect this deduction to continue, the timeline incentivizes acting while the benefit remains.

Tax season is here

As investors plan for the new year, January is the perfect time to evaluate tax-efficient strategies. Highlighting tax benefits now can help you optimize your investment portfolio and prepare for the coming tax season.

Market comparisons are favorable

When considering tax implications, private credit and real estate investments offer advantages compared to other investments. While traditional savings options are fully taxable, investments in private credit and real estate structured as REITs can benefit from favorable tax treatment that can impact the bottom line. These potential tax efficiencies and competitive yields can make them an attractive option for certain investors. As with any investment, individual circumstances vary, and investors should consult a tax or financial advisor to evaluate the best options for their goals.