Here at Arrived, we made it easy to invest in real estate. With our platform, anyone can invest in our individual property offerings, enjoy the simplicity of instant diversification through the Arrived Single Family Residential Fund, or invest in real estate debt with the Arrived Private Credit Fund. We handle all the operational work so investors can focus on their portfolios — not the headaches.

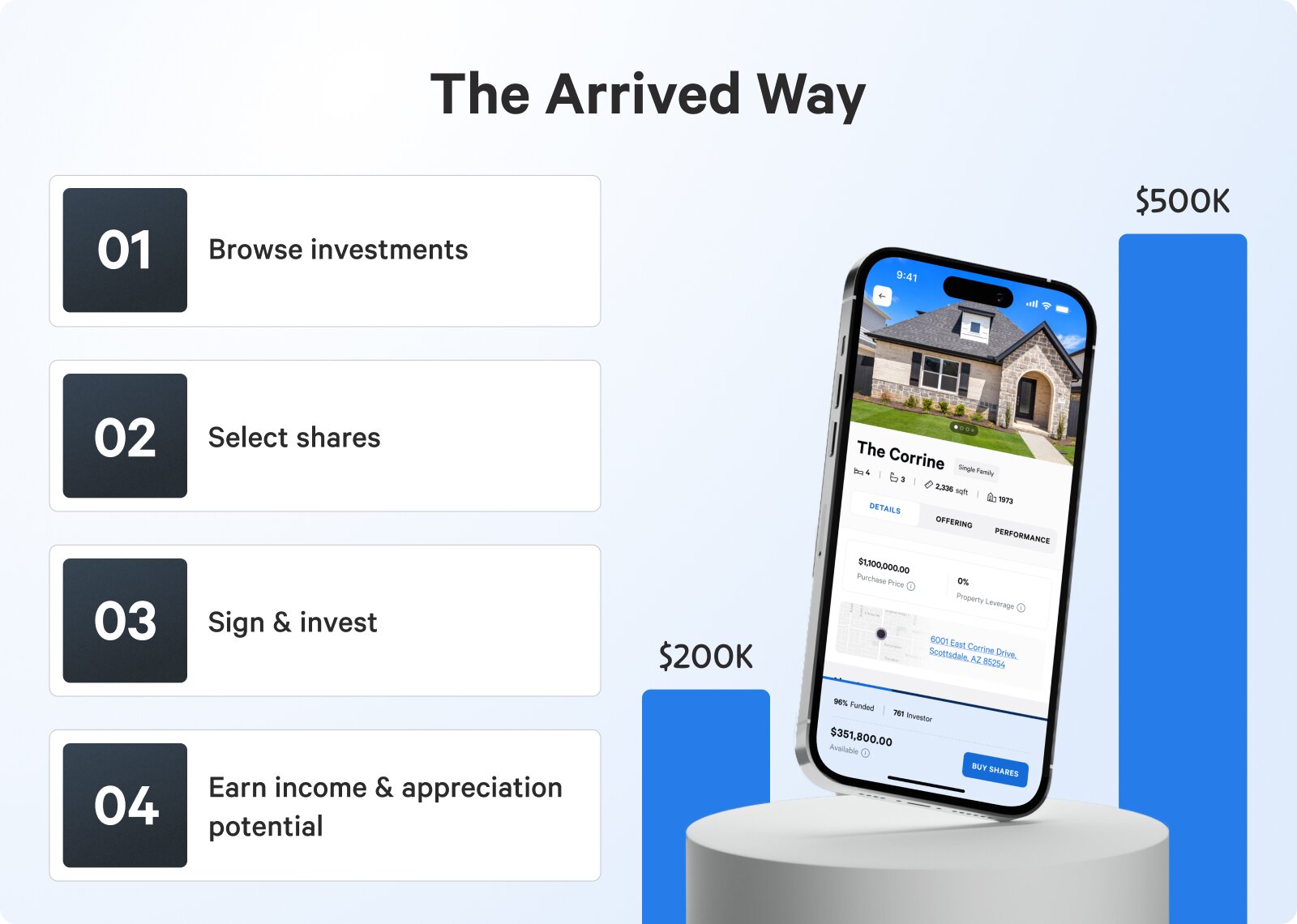

Here’s what to expect when investing with Arrived:

It’s fast

Investing in rental properties is complex and time-consuming. It requires a significant amount of time and resources to realize return potential. Arrived’s process is radically simple. You can start investing in real estate in just four steps in a few minutes.

Invest how much you want

Often, the largest barrier to investing in real estate is the significant initial investment required. Say you want to purchase a $250,000 rental home. Your initial costs for a 20% down conventional mortgage could break down like this:

- Down payment: $50,000

- Closing costs: $6,250

- Cash reserves: $2,200

- Total: $58,405

With Arrived, you can become a fractional real estate owner or invest in the Arrived Private Credit Fund or Arrived Single Family Residential Fund starting at a $100 minimum investment.

Diversification made easy

Diversification is a powerful tool to lower your risk while keeping your potential for returns high. With Arrived, you can allocate investments across multiple rental properties in multiple markets nationwide — a flexibility that helps safeguard your returns from isolated risks like extensive property maintenance issues and market-specific downswings. Or, you can further diversify your portfolio in just a few clicks with the Arrived Single Family Residential Fund.

Significant market potential

Traditionally, real estate investors were either tethered to investment properties in their area or had to take the risk (and the hassle) of managing a rental property remotely.

But why settle? Backed by a team that previously oversaw and managed a $11B+ portfolio of 57K+ rental homes, we analyze hundreds of potential markets nationwide to identify those with the most potential. From there, you can cherry-pick the investment properties and markets that align with your financial goals. Don’t want to hand-select your markets? The Arrived Single Family Residential Fund has you covered with properties spread across several markets—giving you a diversified, expert-managed portfolio with ease.

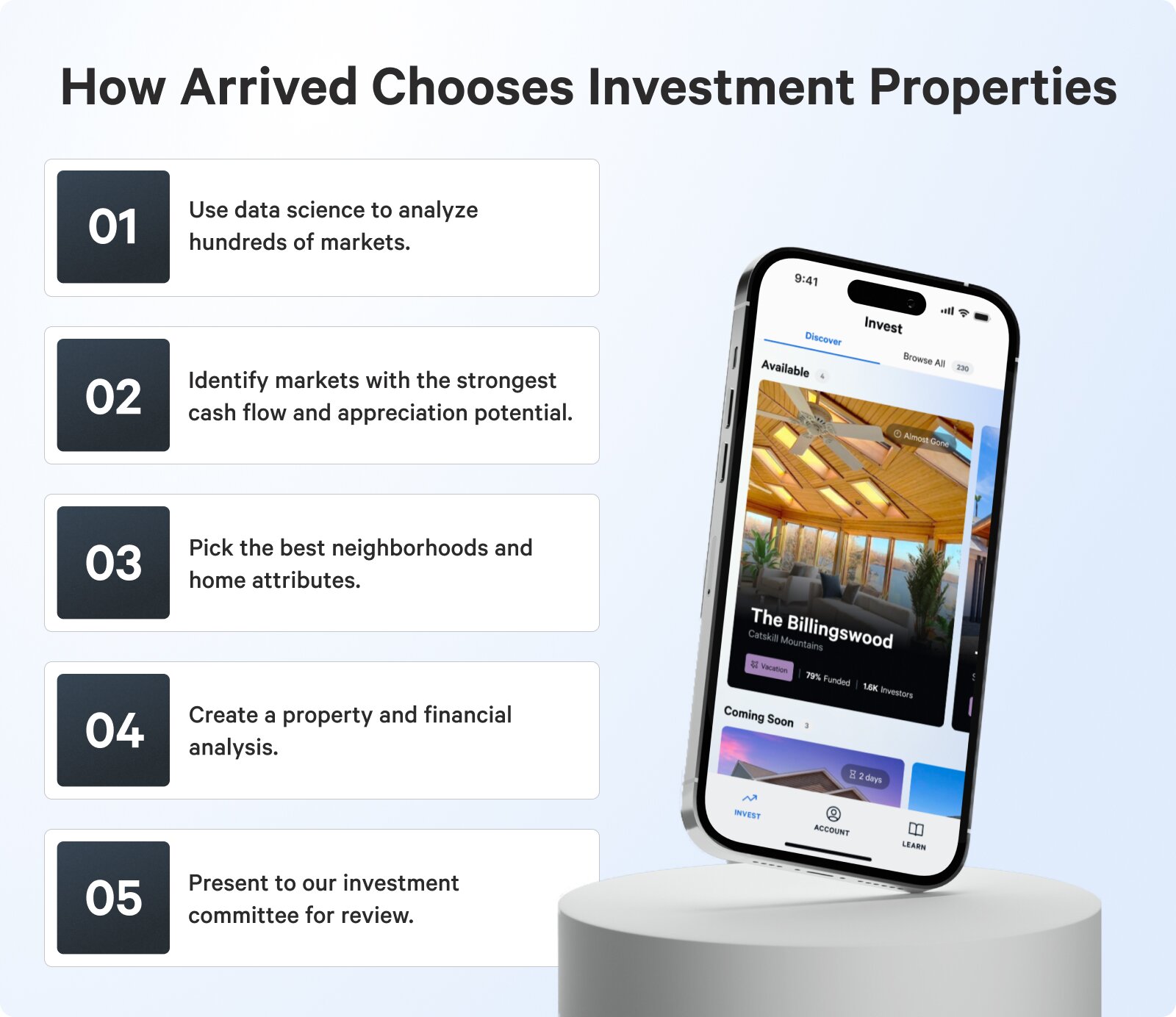

Simplified investment choices

Choosing the right real estate markets and the right investment properties isn’t easy. So, we took out the guesswork. We combine decades of collective real estate experience with state-of-the-art data science to identify what we view as the most promising investment opportunities for our investors.

Our operational model, focused on a fusion of seasoned expertise and advanced analytics, is dedicated to maximizing returns for our investors. Here’s a look behind the curtain:

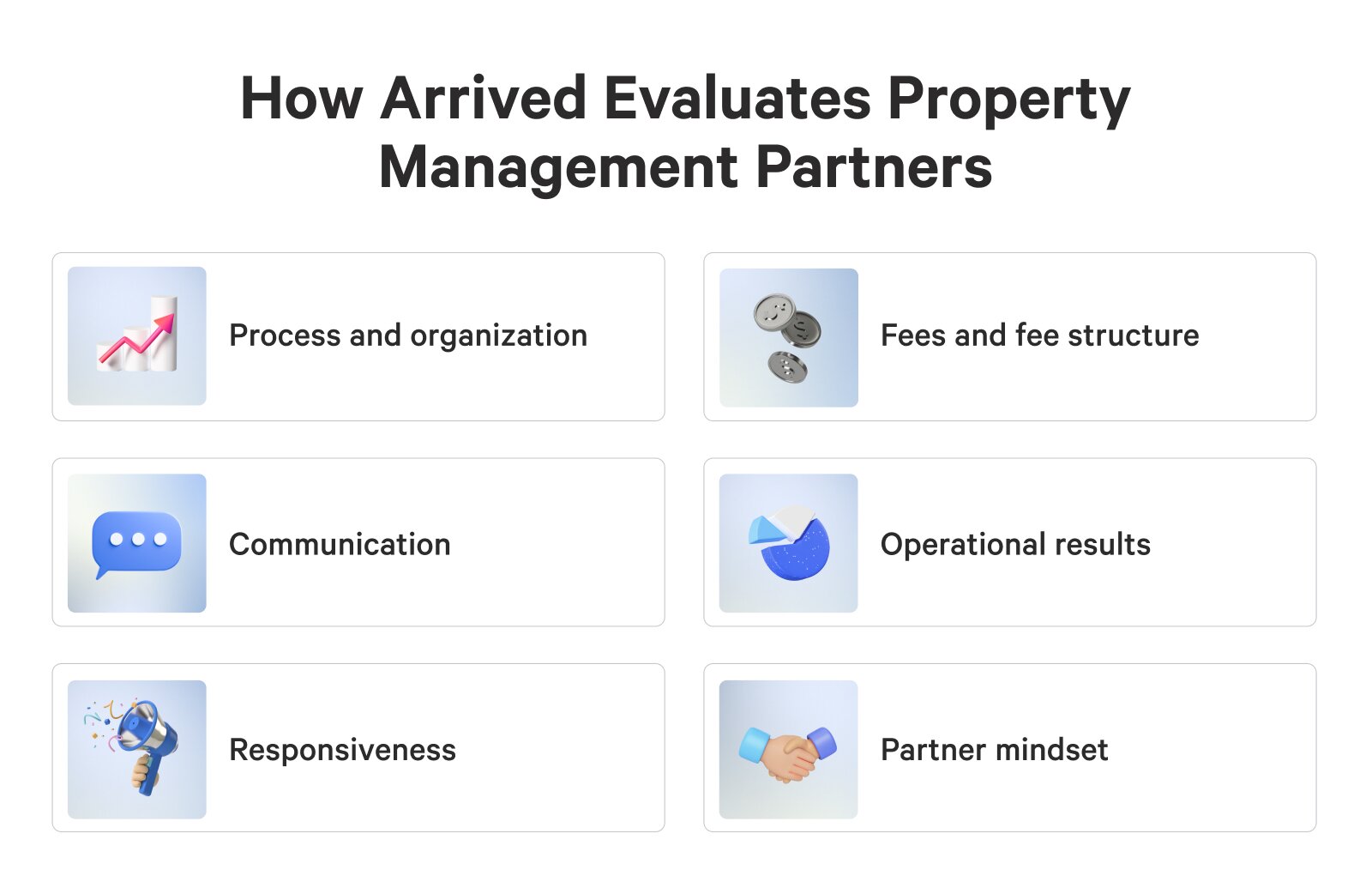

Hassle-free property management

Managing rental properties is hard work. From vetting tenants to managing repairs to collecting rent, landlords put a lot of sweat equity into their investments. At Arrived, we handle everything, so your experience is hassle-free. We work with hand-selected property managers who pass our evaluation criteria.

State-of-the-art tenant screening

We’ve learned that a crucial part of maximizing returns is selecting residents who pay on time, stay at the property longer, and treat the home with care. We’ve developed a proprietary vetting process utilizing a combination of internal assessments and high-quality third-party tools to carefully select the right residents for our single family residential properties.

A flexible investment model with built-in liability protections

Traditionally, investing in single family residential properties required a lot. You needed solid credit and financial backing to secure a property. And once you own it, you could be on the hook financially for anything that might go wrong.

With Arrived, anyone can become an investor. You can be accredited or non-accredited. We do not require a specific credit history.

Every Arrived individual property offering is also placed in an LLC Series that shields our investors from liability the property or its operations may incur — including potential lawsuits and financing matters. It’s a straightforward and secure way to invest in real estate without worrying about personal financial risks.

Passive income

Real estate investors often share a common aspiration: receiving a reliable source of passive income. So, we set out to make it happen. Arrived investors receive regular monthly dividends. To maintain consistency in our model, we strategically plan for larger one-time expenses, preventing wild fluctuations in monthly payments.

Estimated historical annual return range for a diversified portfolio

Single-Family Residential (Individual Properties or Fund)

- Return Type: Income + Appreciation

- Total Historical Returns: 6 - 10% annual

- Income Portion: 3 - 5% annual*

- Appreciation: Included

- Minimum investment Hold: Individual properties must be held for a minimum of 5-7 years. Single Family Residential Fund investors may request redemptions 6 months after their initial investment. (More Info)

Private Credit Fund

- Return Type: Income

- Total Returns: 8.1%*

- Income Portion: 8.1% annual

- Appreciation: Not Included

- Minimum investment Hold: Investors may request redemptions 6 months after their initial investment. (More Info)

Lower operating costs

Capitalizing on the scale achieved through managing multiple properties, we work to strategically lower operating costs to enhance returns for our investors. This extends beyond negotiating favorable rates with sales agents and contractors, including bulk purchasing of specific maintenance services.

We’ve also worked hard to streamline our processes, improving resident experiences. And happier residents lead to higher satisfaction, longer stays, and the potential of increased returns for our investors.

Watch the Intro to Investing on Arrived webinar

FAQ

Who can invest?

How much can I invest?

What type of products are available on Arrived?

Will I have any responsibilities for managing properties I invest in? If not, who is responsible?

What type of returns can I obtain?