Welcome to Arrived’s Q3 2024 review! Let’s review the dividends and appreciation ranges of the 377 Arrived properties operating during Q3 2024.

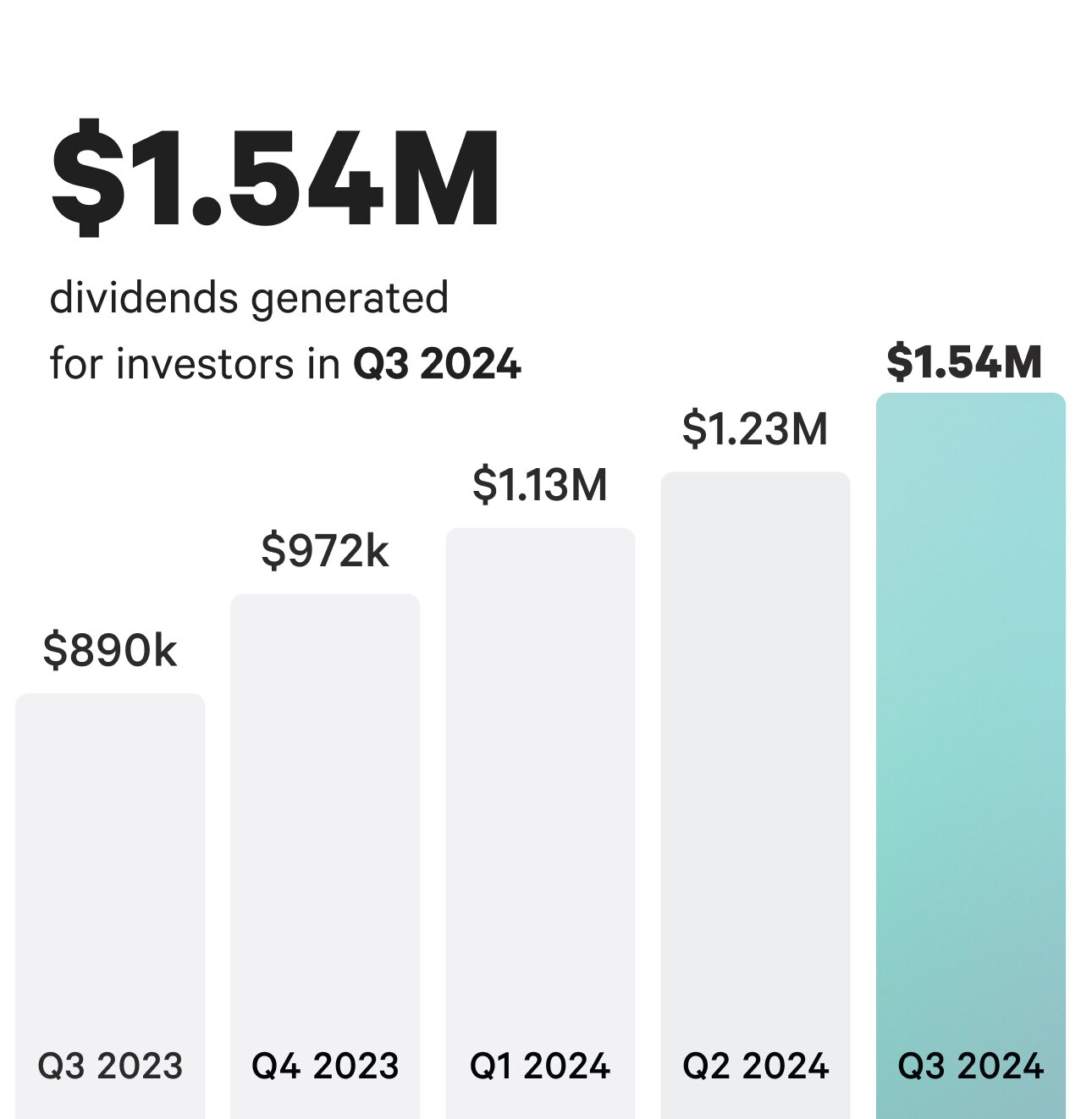

In Q3 2024, investors earned more than $1.54M in dividend income, an increase of approximately 25% from Q2 2024. In total, 354 individual properties paid out dividends. In Q3 2024, single family residential properties earned an average of 3.7%, and vacation rental homes earned an average of 2.8%.

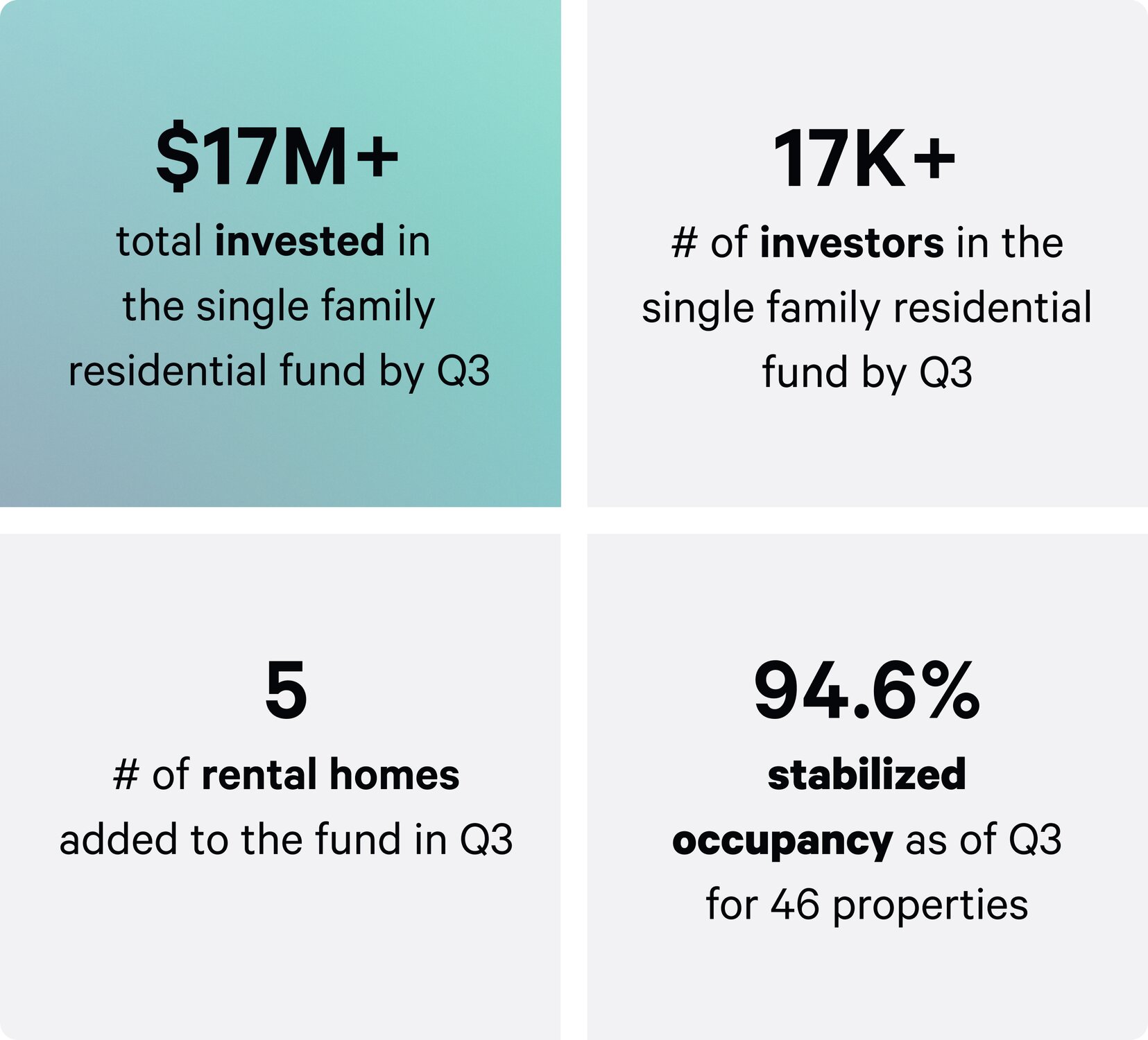

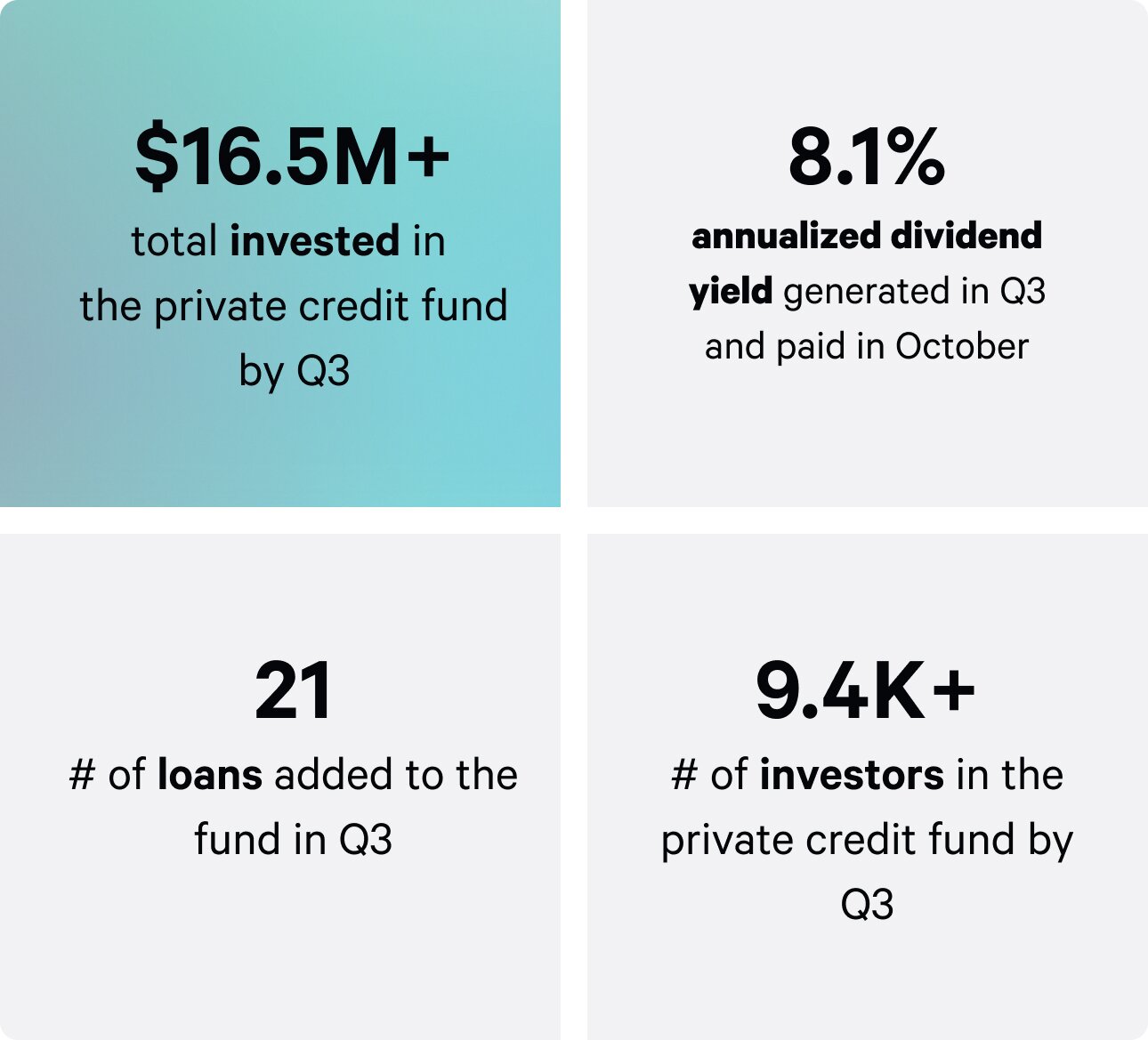

The Arrived Single Family Residential Fund earned a 4.0% annualized dividend, and the Arrived Private Credit Fund earned an 8.1% annualized dividend.

Dividends

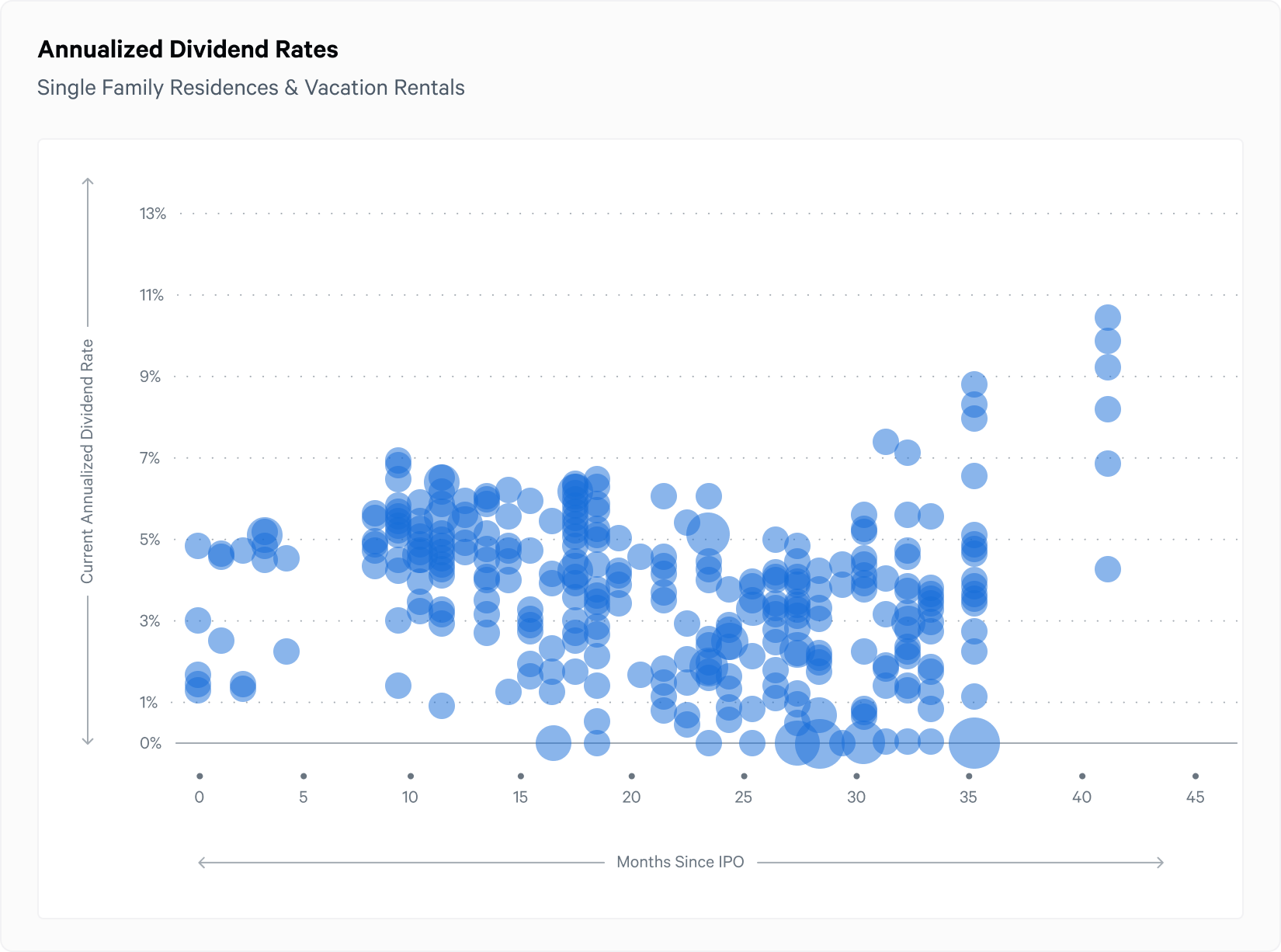

Dividends earned can vary by investment. In Q3 2024, 316 individual single family residential properties paid an annualized dividend between 0.4% and 10.4%*, with a 3.7% average. 38 vacation rentals paid an annualized dividend between 1.3% and 5.5%, with a 2.9% average. The Arrived Single Family Residential Fund paid an annualized dividend of 4.0%. The Arrived Private Credit Fund generated income resulting in an annualized dividend of 8.1% paid in October.

You can view the dividends for each property on our Historical Returns page.

The annualized dividend for each property is calculated by taking the Q3 dividend and extrapolating it out for an entire year. Building a diversified portfolio across multiple markets can be a great strategy to minimize concentration risk while getting exposure to different real estate markets and earning passive income.

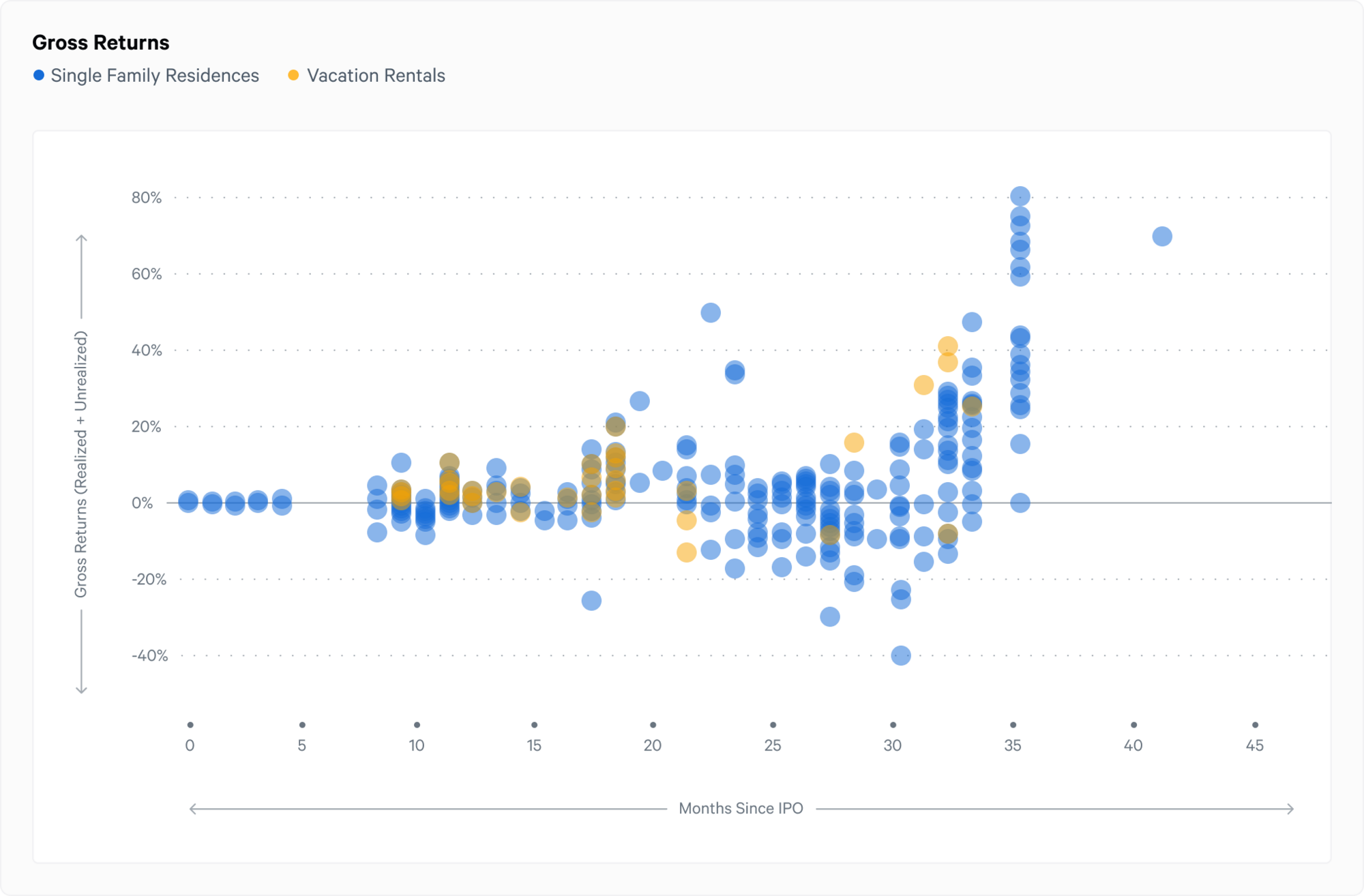

The chart below shows the combined realized dividends and unrealized appreciation of single family residential and vacation properties.

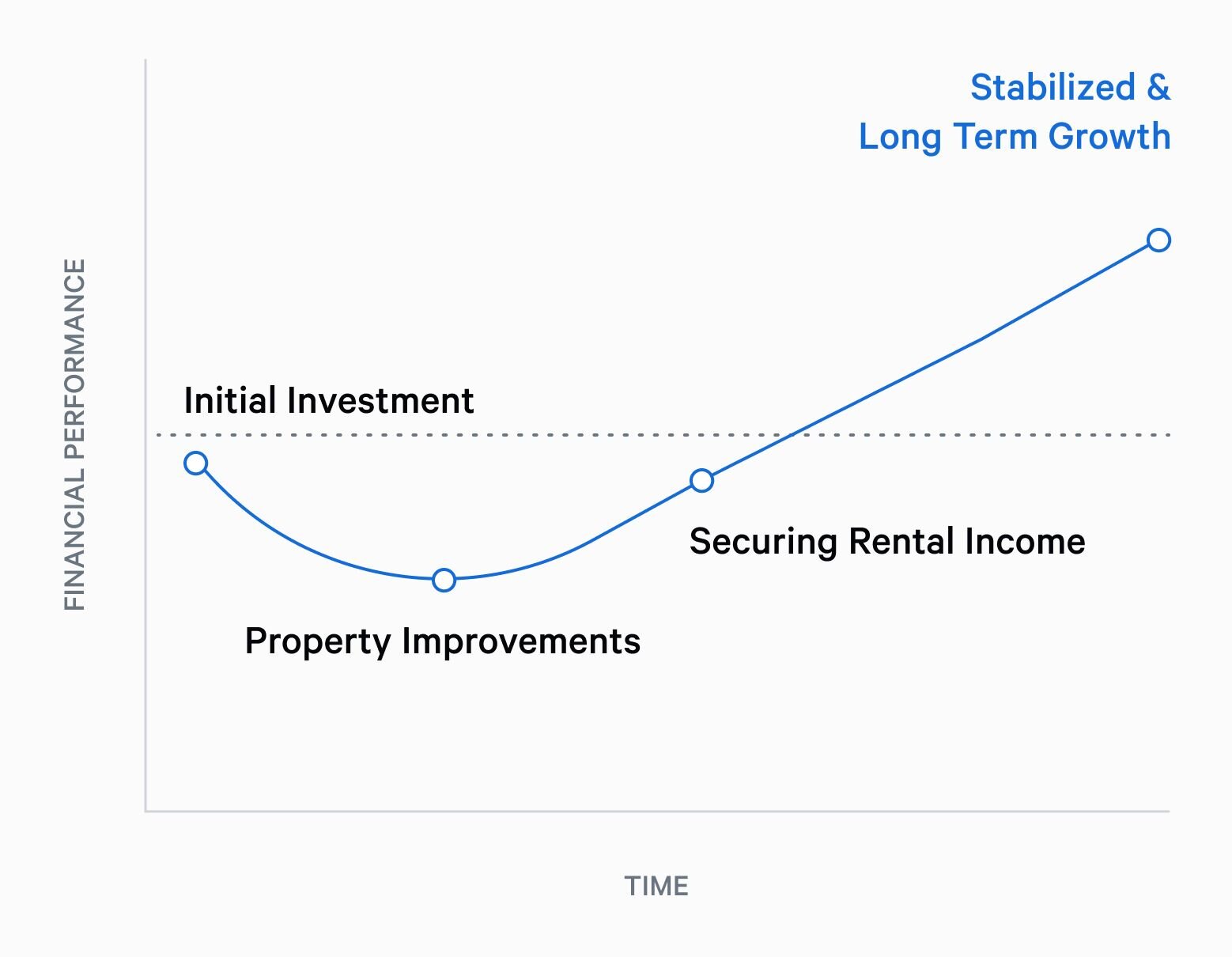

Properties may have lower total returns in the first six months because they have only received dividends and have not received an appreciation update yet. Historically, rental property investments have performed best when held for the long term.

This chart illustrates the potential benefits of diversification and dollar-cost averaging in the real estate market. Diversifying your portfolio by investing in a mix of single family residential properties, vacation homes, and debt and equity products, such as the Arrived Private Credit Fund and the Arrived Single Family Residential Fund, can be an effective strategy for mitigating risk.

In Q3 2024, 46 properties in the Arrived Single Family Residential Fund contributed to an average annualized dividend of 4%.

The Arrived Private Credit Fund earned income in Q3, leading to a dividend payment in October at an 8.1% annualized rate. More than $16.5M was invested in the Arrived Private Credit Fund by the end of quarter, and the Fund added 21 new loans in Q3 2024.

Share Prices

In Q3 2024, 358 Arrived properties received an updated share price estimate. Among those, 344 operating properties received an updated share price, while 14 received their first share price update.

Share Prices are a way to see the value of your investment change over time, much like you would track a portfolio of stocks.

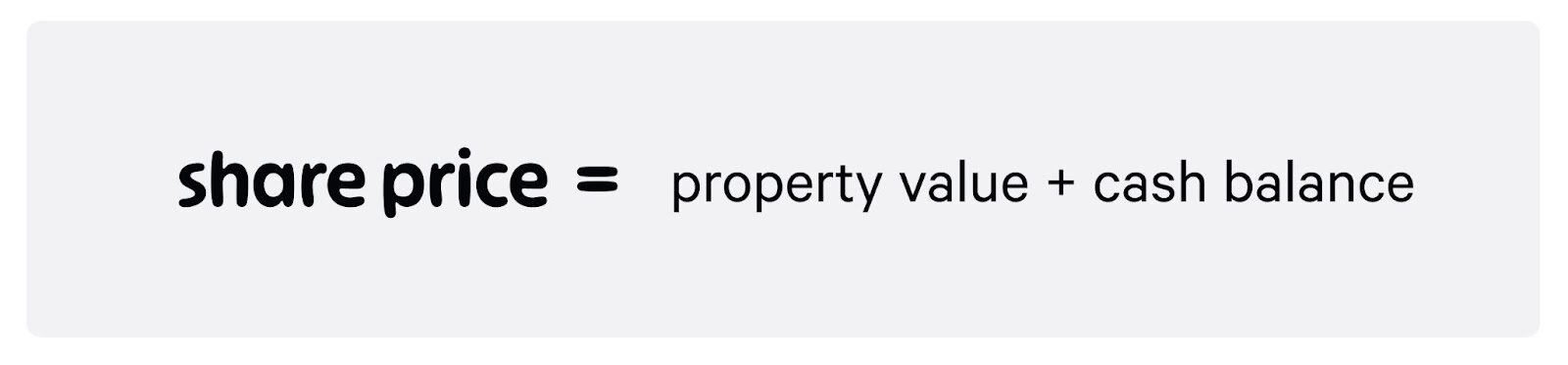

A property’s share price reflects both the property's estimated value and its cash balance. Any actions that affect the cash balance will impact the share price. This could include revenue, vacancy, dividends paid, and operating expenses. For individual property offerings, the share price is unrealized until the disposition of the property. You can learn more about how share prices are calculated in our FAQ.

Single Family Residential Property Share Prices

In Q3 2024, we updated the Share Prices for 320 properties, including 310 properties receiving an updated share price from 3 months ago and 10 properties receiving their first share price since their IPO 6-9 months ago.

The Arrived Single Family Residential Fund received a $9.96 share price, resulting in a -0.1% decline from Q2 2024.

For the 310 single family residential properties receiving an updated share price, the quarterly share price resulted in an average share price change of -2.2% from Q2 2024 to Q3 2024 after seeing a +.03% increase the previous quarter.

The 10 properties receiving their first share price valuation resulted in a change of -0.8% since their IPO 6-19 months ago.

The share price average reflects the low to high range for all Arrived single family residential properties. This range may reflect individual properties impacted by specific circumstances, such as eviction proceedings or significant maintenance issues affecting the property's cash flow. Additionally, leveraged properties can experience more significant impacts from these factors, making returns more volatile and amplifying both potential gains and losses.

Investors can view the performance of individual properties in their portfolio on their Portfolio Page and also view the offering history of all single family residential properties under the “Performance” section on the Property Page.

Vacation Rental Property Share Prices

In Q3 2024, we updated the Share Prices for 38 vacation rental properties, 34 of which received an updated share price from three months ago and 4 of which received their first share price.

The average share price change for the 34 properties receiving an updated share price was -0.9%, and for the 4 properties receiving a share price for the first time, it was 2.3%.

You can learn more about how vacation rental share prices differ in our FAQ.

The above-mentioned share price range may contain individual properties affected by specific circumstances, such as a shift to a new property management partner, and reflects the low, high, and average range for all Arrived vacation rental properties. While share prices react to the current market in the short term, real estate performs best as a long-term investment, all while investors continue earning dividends through rental income.

*Share Prices for single family residential properties are updated six months after the initial property funding, using estimates provided by third-party sources. Vacation rental properties are updated 12+ months after initial funding and every quarter after that.

Understanding Unrealized Negative Appreciation: Real Estate Is a Long Term Investment

When considering rental share prices, it's crucial to understand the high initial costs and longer ramp-up time needed to increase the potential for strong income performance.

In the early stages of investing in a single family residential property, macroeconomic factors such as prevailing mortgage rates, the strategic use of leverage, and the prevailing market prices of homes can significantly impact initial total returns.

This process follows the investment J-curve pattern. Larger upfront investments in things like property improvements can be accompanied by initially lower dividends or share prices. This initial dip represents the low point of the J-Curve. As the property stabilizes, returns can increase, reflecting the growth period of the curve. It's important to remember that real estate tends to perform best as a long-term investment, allowing investors to navigate through various market cycles and maximize the potential for returns.

Operational Performance

Single Family Residential Stabilized Occupancy

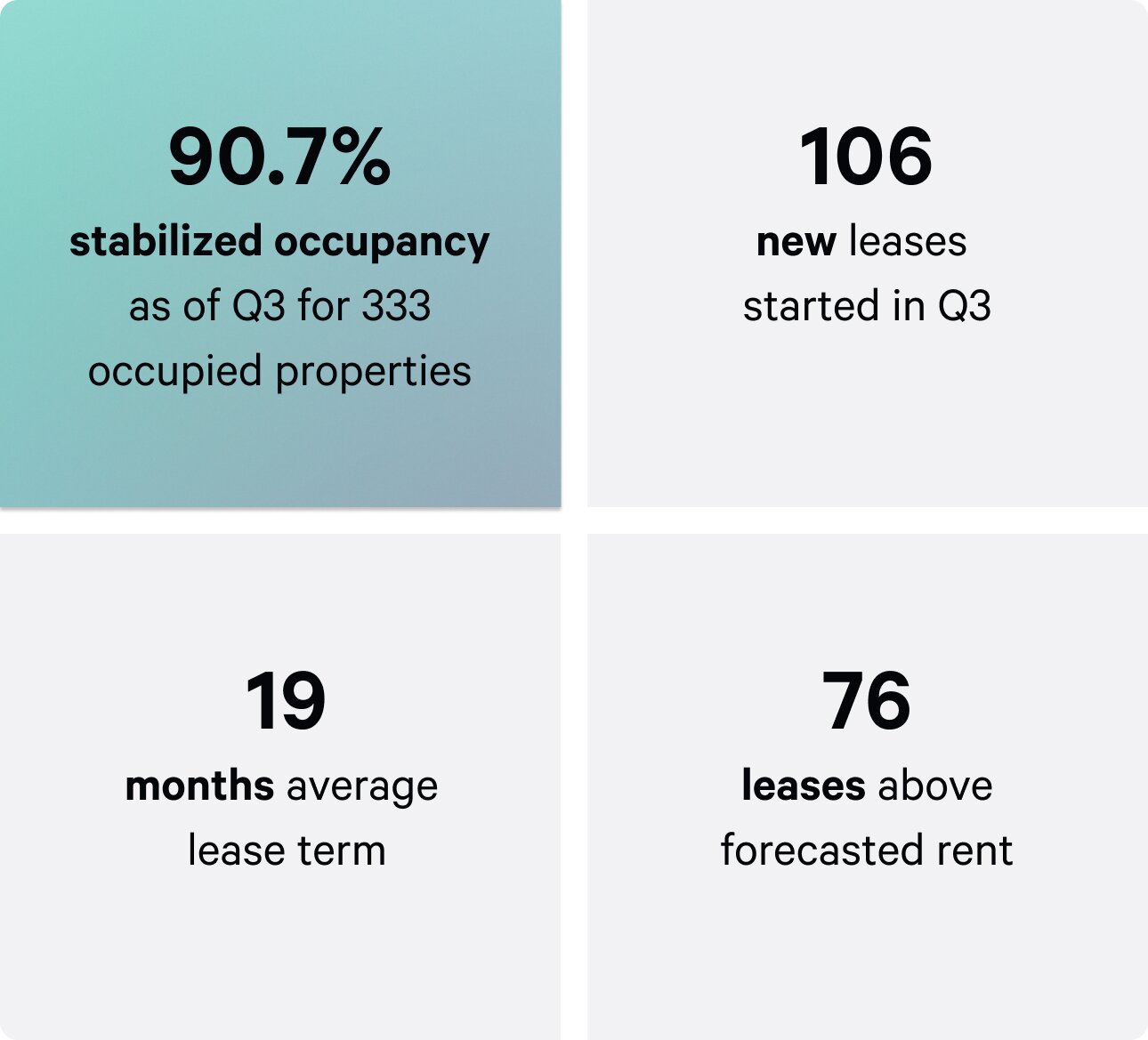

Arrived closed Q3 2024 with a stabilized occupancy rate of 90.7%* for the single family residential properties in operation during the quarter. This was helped by 106 new leases started in Q3. It’s also worth noting that the average term on these leases was 19 months, and 76 leased above our forecasted rent.

*Stabilized Occupancy includes homes that are occupied or are 90+ days rent-ready from their initial improvements (single family residential properties only). A property may be removed from stabilized if significant impairment outside of the ordinary course of operations requires material action for an extended period.

Vacation Rental Performance

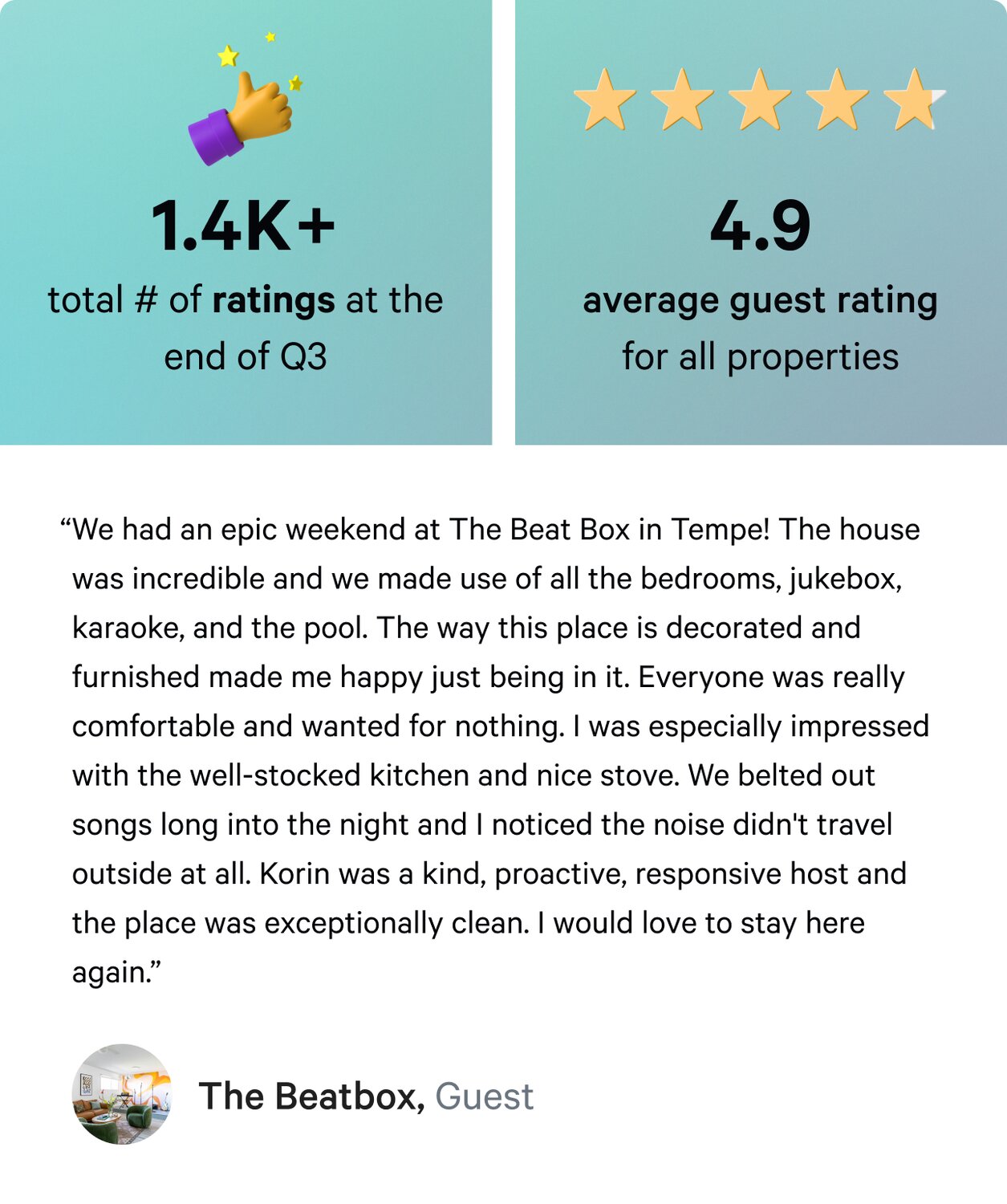

As of the end of Q3 2024, we have 38 bookable vacation rental properties. Here are some highlights from the quarter for this asset class:

- $679K gross booking revenue across all operational vacation rentals in Q3*

- 25 total vacation rental markets as of Q3 2024

- Q3 2024 ended with an average guest rating of 4.9 out of 5.0

*Our guest rating is a weighted average for all bookable vacation rentals from the property’s bookable date to the end of Q3 2024.

*These figures include only stabilized IPO properties. All figures are unaudited and subject to change.

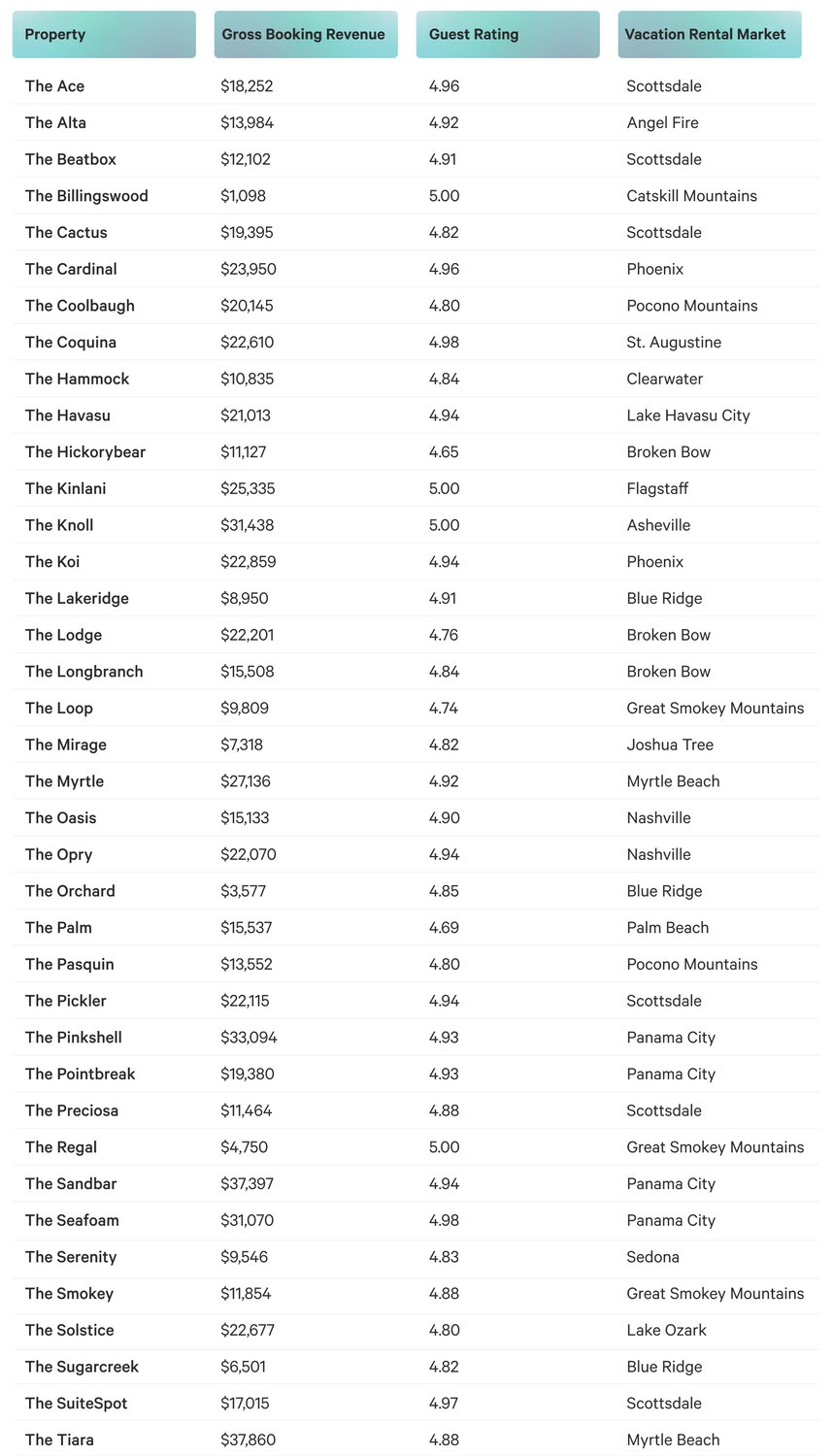

In Q3 2024, 37 vacation rentals were in operation. The gross booking revenue and average guest rating for each rental are below. Gross booking revenue is reported before any deductions for the property management fee, operating expenses, and repairs and maintenance expenses.

Arrived Single Family Residential Fund Occupancy

Arrived closed Q3 2024 with a stabilized occupancy rate of 95.53%* for the single family residential properties in operation in the Arrived Single Family Residential Fund during the quarter. This was helped by 13 new leases started in Q3.

Closing Thoughts By Arrived VP of Investments, Cameron Wu

“As we move forward after the Fed's recent 50 basis point rate cut in September—the first since the onset of the pandemic—we are observing significant effects on real estate activity. For the past two years, we’ve been sitting at mortgage rates in excess of 7% which had a chilling effect on the supply of available housing. This helped maintain the price of real estate assets despite affordability challenges with the increased rates.

Looking ahead, we are cautiously optimistic about upcoming buying opportunities. While we don’t expect a dramatic rise in prices as mortgage rates decrease, we do anticipate that the market will provide more options as sellers increase inventory and market transactions increase. For our income-focused investors, we remain confident in the stability of our Private Credit Fund’s yields, which offer a strong alternative to the diminishing returns seen in traditional banking.“

Watch the Q3 2024 Financials Webinar and Q&A Session

Co-founder and Arrived CEO Ryan Frazier, VP of Investments Cameron Wu, and Head of Operations Jake Pruchno speak on the Q3 2024 performance. Head of Investor Relations Korin Hedlund leads the Q&A.