At Arrived, we’ve always believed that real estate should be accessible, diversified, and built for long-term impact. Today, we’re taking that vision a step further with the launch of Arrived City Funds—a product designed to give you focused exposure to high-potential real estate markets, one city at a time.

Arrived City Funds make it easier than ever to invest in a city you believe in. Rather than investing in a single rental property or our national Single Family Residential Fund, your capital is allocated across a portfolio of rental homes within a specific metropolitan area. Whether you live in that city or simply believe in its future, it's a more strategic way to invest locally.

What is a City Fund?

A City Fund is a targeted, diversified real estate investment built around a specific market. It combines the local focus of traditional property investing with the efficiency and diversification of a fund model.

Each City Fund is designed to:

- Concentrate investments in a single metro area, capturing local growth and housing trends.

- Diversify across multiple rental homes, helping mitigate the risk of any single property.

- Lower fees by pooling operational costs, such as tax prep and audits, across properties.

- Offer liquidity options after a 6-month hold period through a quarterly redemption program.

The first City Fund: Seattle

We’re proud to launch our first City Fund in a place we know well: Seattle.

As a city rooted in innovation, nature, and long-term growth, Seattle offers a compelling investment story. It’s home to tech giants like Amazon and Microsoft, with a thriving startup ecosystem, a robust housing market, and a quality of life that continues to draw talent and renters from across the country.

Here’s why we’re excited about the Seattle City Fund:

Strong economic fundamentals

Global businesses, top-tier universities, and a steady stream of high-income professionals anchor Seattle’s economy.

Built-in diversification

The fund will invest across multiple rental homes throughout the greater Seattle-Tacoma region, across a range of assets.

A strategy focused on long-term growth

We don’t just look at today’s rent—we evaluate future land potential, proximity to transit, and regional spillover markets, where demand remains high and property values are rising.

A city we call home

Seattle isn’t just a strategic choice—it’s personal. Our company was founded here, and many of us live and work there. That local connection gives us firsthand insight into the city’s economic strength, housing demand, and long-term investment opportunities, making Seattle a natural starting point to launch City Funds.

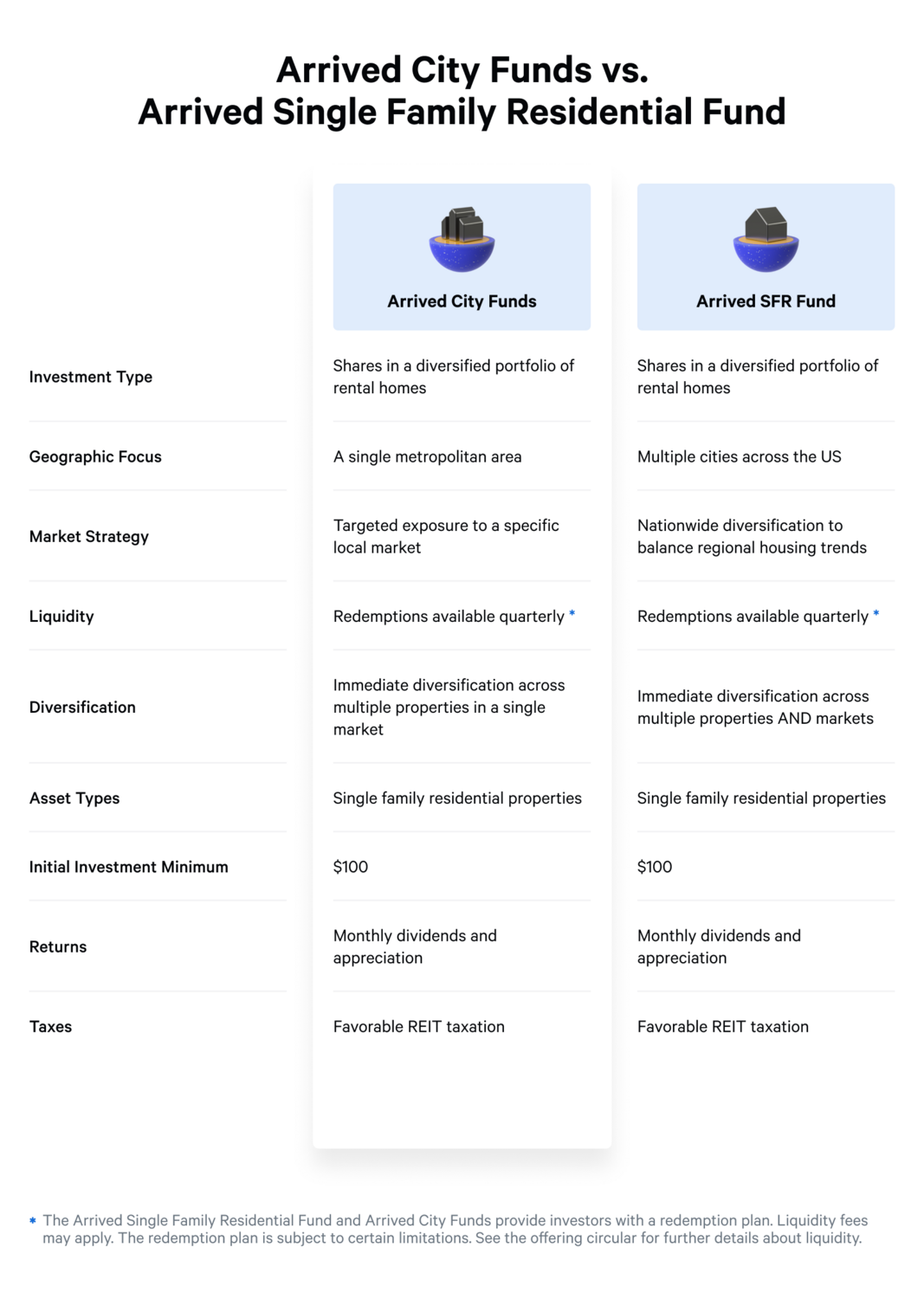

How City Funds compare to the Arrived Single Family Residential Fund

City Funds and the Arrived Single Family Residential Fund are designed to make real estate investing simple, diversified, and passive. However, each serves a distinct purpose depending on your investment goals.

What They Have in Common

- Operational efficiencies: Both funds benefit from bundling multiple properties into a single fund structure, which helps reduce costs related to LLC formation, accounting, audits, and tax preparation—improving overall efficiency and potential investor returns.

- Instant diversification: Both funds allocate your investment across a carefully selected and growing portfolio of rental homes.

- Fully managed by Arrived: No need to deal with tenants, maintenance, or paperwork—we handle everything.

- Access for all investors: Open to both accredited and non-accredited investors.

- Passive income & growth potential: Returns can be obtained through rental income and any potential equity appreciation from the properties in the fund.

Key differences

- Geographic and market strategy: City Funds concentrate investments within a single metropolitan area, offering targeted exposure to local market dynamics. In contrast, the Single Family Residential Fund spans multiple U.S. cities, providing nationwide diversification to help balance regional housing trends.

- Property selection approach: City Funds tailor property selection to each local market's specific strengths and characteristics. By comparison, the Single Family Residential Fund selects properties to perform well across a diverse mix of markets, using a nationwide lens to identify opportunities.

- Investor goals: City Funds are ideal for investors who want to double down on a specific city’s future, while the Single Family Residential Fund is suited for those seeking a more hands-off, broadly diversified real estate investment.

Watch the City Funds launch webinar

More city funds are coming!

The Seattle City Fund is just the beginning. We plan to expand to other promising cities across the U.S., with each City Fund designed to reflect its local area's unique character, market trends, and investment potential.

Ready to invest in a city you believe in?

The Seattle City Fund is now open. Whether you’re a seasoned investor or just getting started, Arrived City Funds make it easy to tap into local real estate markets and grow your portfolio—without the burden of property management.