“In this world, nothing can be said to be certain, except death and taxes.” – Benjamin Franklin

Like any investment, your earnings from Arrived properties are subject to income taxes and must be reported each year on your tax return.

Thankfully, real estate investments have historically had better tax treatment than other types of earnings. In our Tax Benefits of Real Estate article, you can read more about those benefits, including how depreciation allows investors to minimize their tax bill.

Arrived purposefully structures every single family residential property offering, and our Single Family Residential Fund and Private Credit Fund as REITs so our investors can benefit from REIT-specific tax exemptions (note: vacation rentals are considered ‘active’ income and, therefore, not REIT eligible). These additional benefits include not being subject to corporate income tax (single versus double taxation) and qualifying for the Qualified Business Income deduction, which allows investors to reduce the taxable income from their investment by up to 20%.

Notably, because of the way Arrived is structured, investors will not need to file tax returns in any states where they do not live.

In this article, we’ll break down all the tax implications for Arrived investments.

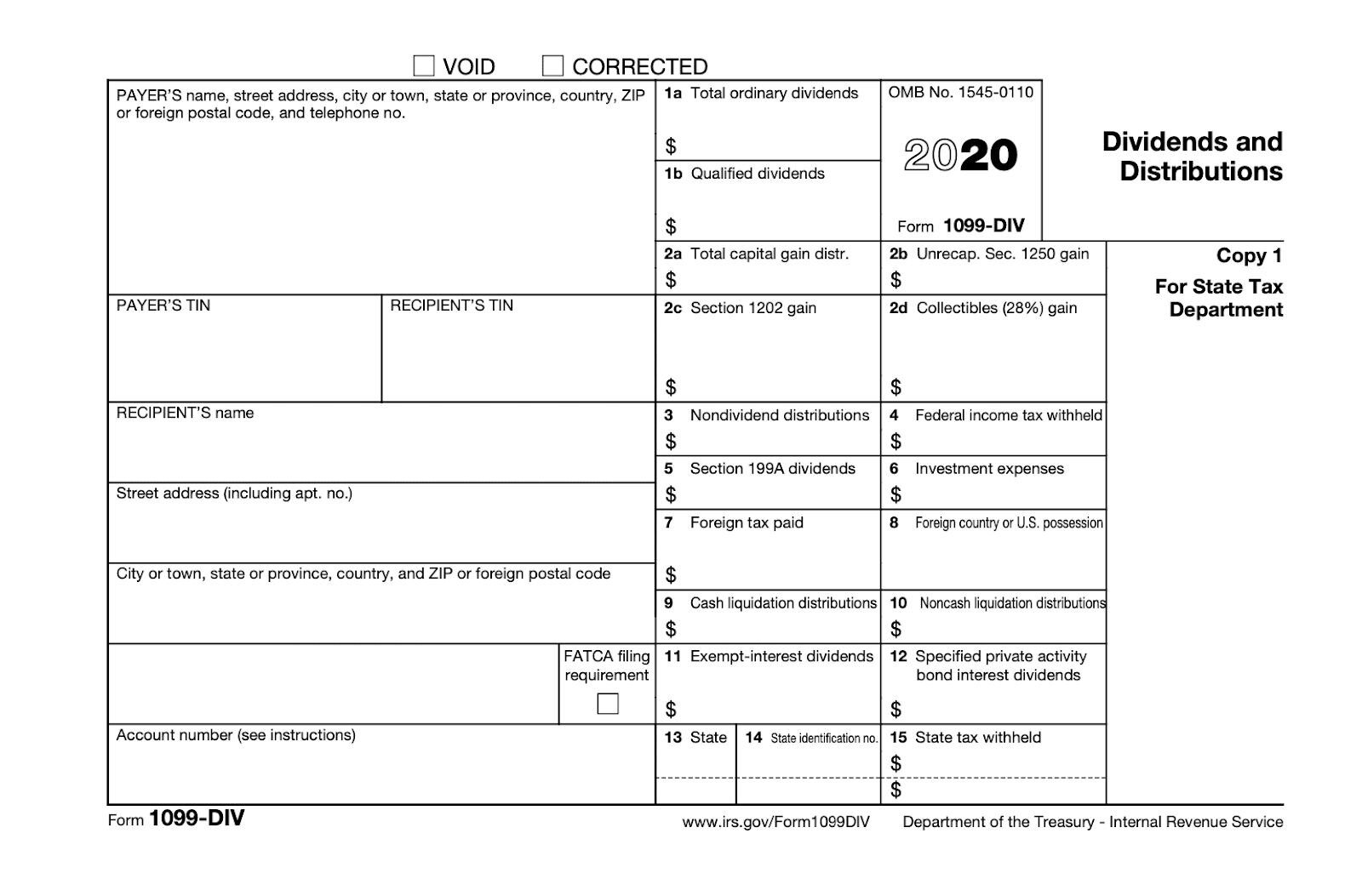

We simplify your tax preparation by sending you a single 1099-DIV tax form each January that summarizes the different types of taxable income for all of your properties. The 1099-DIV can be sent to your tax preparer or entered into a program like TurboTax in just a minute or two.

The following tax information does not apply to investors using an IRA account. Investors using an IRA account will not receive a 1099 since earnings within your IRA account are not taxable. Please speak with your tax consultant about your specific situation.

The following information is all related to federal income taxes. Most states do not tax REIT income, but you should still consult your tax advisor to understand all the tax implications of investing in Arrived properties.

Tax Filing Requirements

Each year, Arrived will upload your 1099 into the Documents section of your Arrived account before January 31st. Then, Arrived investors will report any income when they file their taxes.

Notably, as a REIT, investors are only required to file taxes on their income at the federal level, and in the state, they file their taxes. Because of the way Arrived structures the investments, it does not matter where the property is located.

For example, if you live in California and invest in a property in North Carolina, you would only need to file federal and California tax returns. There would be no additional tax burden to file in North Carolina.

Total ordinary dividends (box 1a) and section 199a dividends (box 5)

This is the total taxable ordinary income. This is the taxable income that the property earned from its rental operations.

Most years, there won’t be a very large number in this box because of the depreciation on the property. Depreciation is a tax method that allows investors to record a non-cash expense to account for the wear and tear on a property.

This is a key benefit of investing in real estate, as it lets you earn income while drastically reducing the amount of income that’s subject to taxes.

Usually, ordinary income is taxed at your marginal tax rate. However, REIT dividends are considered Section 199a Dividends, as they qualify for the Qualified Business Income deduction. With this deduction, 20% of the income is excluded from taxes, effectively lowering the tax rate on your income by 20%.

For example, assume you earned $100 in taxable income from Arrived. Ordinarily, if you were in the 32% bracket, you’d owe $32 in taxes and be left with $68.

With this tax deduction, 20% of the income is excluded. That means you’d have $80 in taxable income and pay $25.60 in taxes at the 32% bracket.

At the end of the day, you’d pay $25.60 in taxes instead of $32! This special REIT tax deduction represents a 20% tax reduction.

For Arrived dividends qualified as REIT dividends, Box 5 will be the same number as Box 1a, indicating that all the taxable income you’ve earned is eligible for this deduction.

Non-dividend distributions (box 3)

In most years, Arrived dividends will exceed our taxable profits. This is a good thing, and it doesn’t mean the property didn’t make money!

We talked earlier about how depreciation reduces taxable income without really being an expense. You can check out our depreciation article here if you need a refresher.

Sometimes, more dividends are paid to investors than profits on the property because of this extra “expense.” When that happens, the dividends paid to investors over the property’s income are considered a non-dividend distribution.

No tax is due for this kind of dividend (as it is considered a return of capital).

Capital gains (box 2a)

At the end of the investment period, Arrived will sell the property. Assuming the property value has appreciated, this box will be filled in with your capital gain. A capital gain is when you sell an asset for more than you paid.

The tax rate on long-term gains is typically 15% or 20%, depending on your income.

Capital gains are beneficial because, in many cases, they’re taxed at a lower rate than income from a job. That’s part of the reason Arrived designs investments are to be held for the long term.

Conclusion

Filling out taxes can be confusing and overwhelming, and we’re hoping this article helped inform you instead of just raising stress levels.

Arrived uses a team of real estate and tax professionals to make sure investors receive the best tax treatment possible. This is one of the reasons that DIY real estate investing can be more complex than it looks from the outside.

The critical takeaway is that Arrived investments are tax efficient because each long-term rental property and our diversified funds are qualified as REITs. As such, investors benefit from tax exemptions, like passthrough taxation, depreciation, and long-term capital gains.

Please contact your financial advisor or CPA if you have specific questions about your tax situation. Additional tax implications, such as the Net Investment Tax or state taxes, may apply to individuals depending on their circumstances.