Real estate investing can be a reliable way to build long-lasting wealth and generate steady cash flow, tax benefits, and potential property value appreciation.

"Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate." - Andrew Carnegie

Competitive risk-adjusted returns

Historically, real estate investments have offered competitive risk-adjusted returns, often outperforming the S&P 500 with tangible assets.

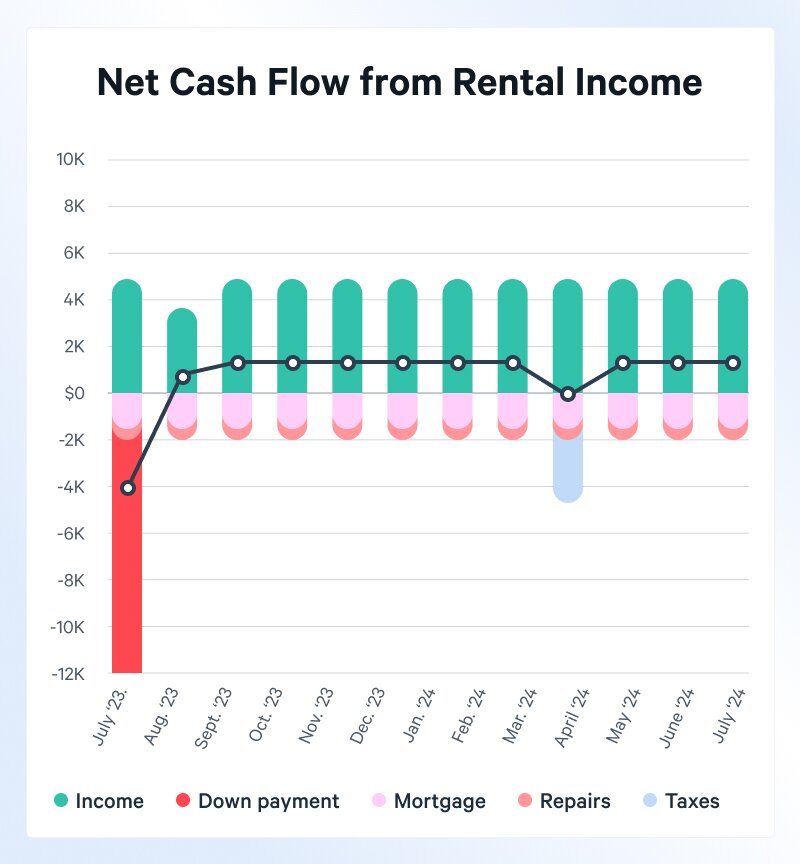

Consistent cash flow

Real estate investments can provide consistent cash flow and passive income through monthly rental dividends. Over time, your property's value can appreciate, leading to significant returns when you sell.

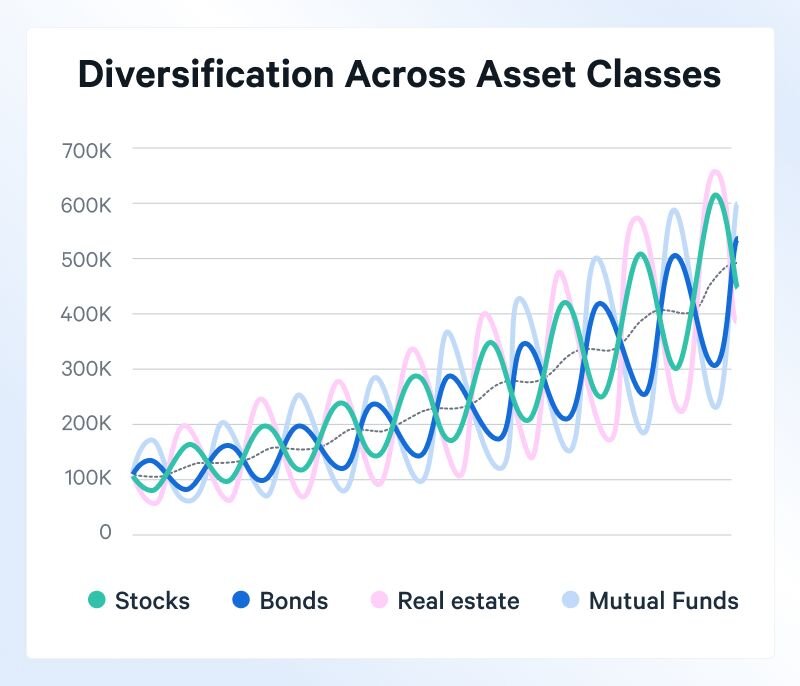

Diversification and stability

Diversification across asset classes can reduce the impact of volatility in any single investment. Real estate is less volatile and closely tied to market fluctuations, potentially making it a stable investment. Arrived enhances this stability by offering diversified real estate investments through our Private Credit Fund, Single Family Residential Fund, and custom property portfolios.

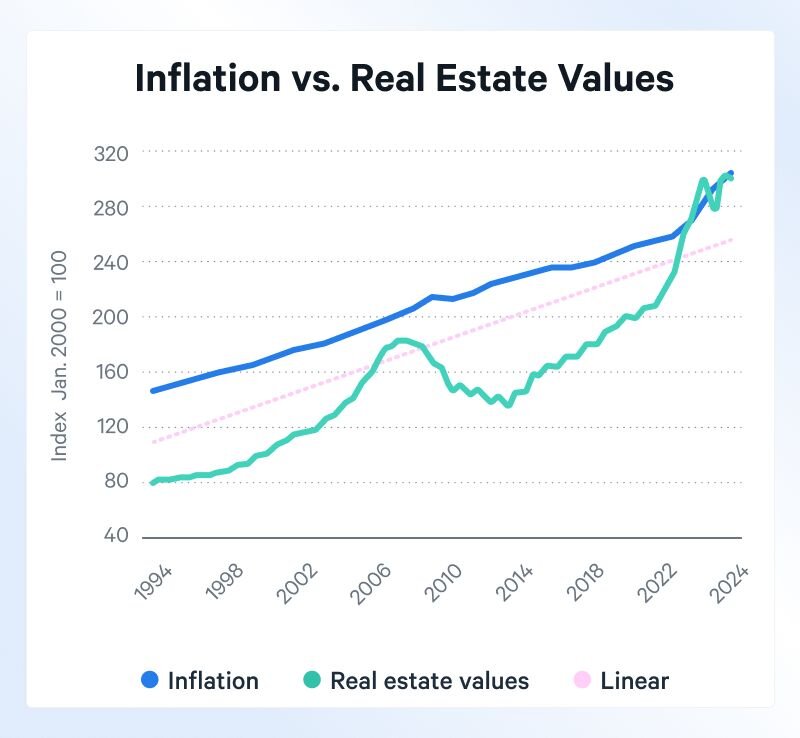

Real estate as an inflation hedge

Real estate can hedge against inflation in three key ways:

- Rising Rent Income: Inflation often drives up rent.

- Property Appreciation: Inflation usually increases real estate value.

- Locked-in Interest Rates: Fixed-rate mortgage payments stay the same while rental income rises, boosting cash flow.

Tax benefits

Real estate investing offers powerful tax benefits, making it an attractive option for building wealth. On Arrived, individual properties, the Single Family Residential Fund, and Private Credit Fund qualify for various advantages, including pass-through taxation, capital gains tax deferral, depreciation, mortgage interest deduction, and property tax deduction. Best of all, Arrived handles all tax preparation, ensuring every eligible deduction is fully utilized. Learn more about the tax benefits of investing with Arrived here.

FAQ

Who can invest?

How much can I invest?

What type of products are available on Arrived?

Will I have any responsibilities for managing properties I invest in? If not, who is responsible?

What type of returns can I obtain?