Investing in real estate is a proven strategy for building wealth, offering both long-term market appreciation and steady monthly cash flow. Historically, real estate has demonstrated strong reliability as an asset.

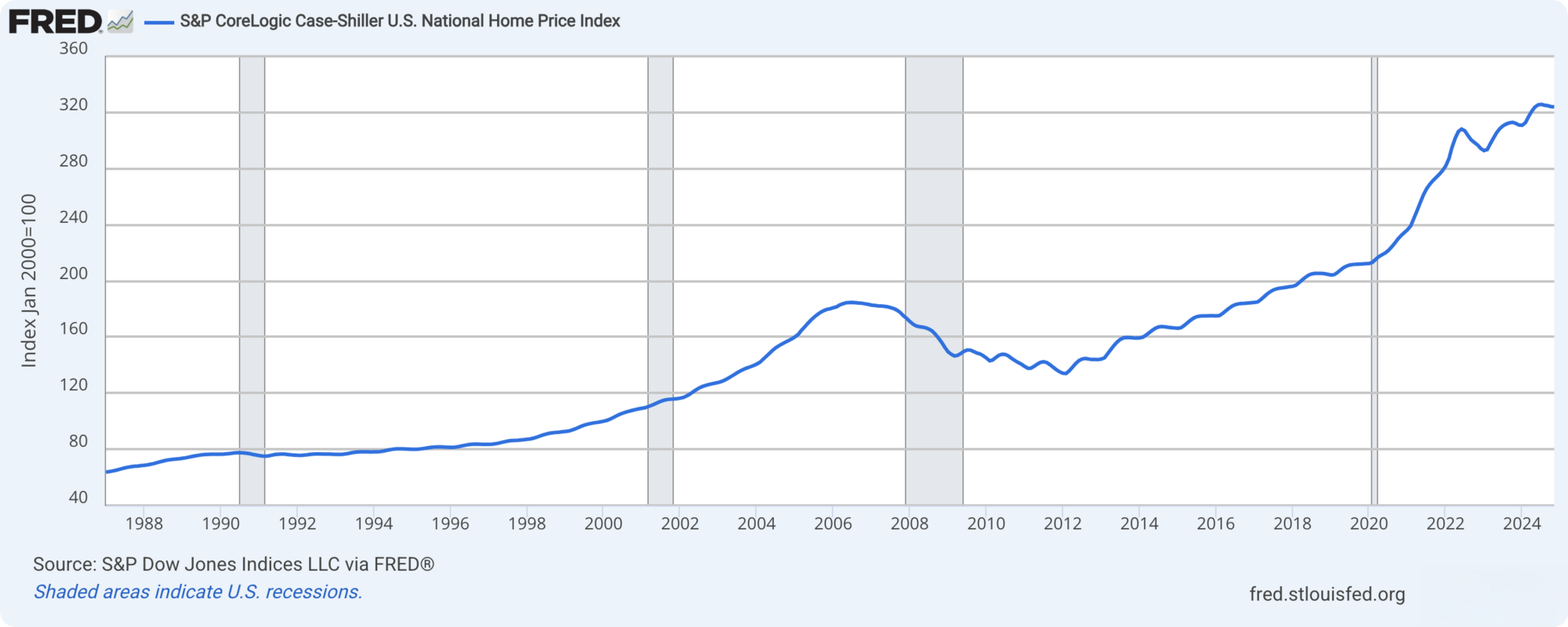

The US national home price has increased 408% since January 1987 and rebounded 119% since the post-2008 financial crisis low as of November 2024. These numbers suggest that building wealth through real estate is not only a possibility but a dependable reality for many investors.

Why building wealth through real estate is so popular

From long-term and stable growth to a ton of tax breaks, real estate offers wealth-building advantages that few other asset classes can. Plus, given the diversity of choices available, real estate appeals to investors on all rungs of the financial ladder. Here are some reasons building wealth and financial freedom through real estate properties is so popular, and why you should consider adding real estate to your investment portfolio.

Historically high returns

On a long-term trajectory, real estate naturally appreciates, which means if you hold on to a real estate investment, you will likely be able to sell it at a higher value than when you purchased it. While values have been known to fall (the housing crisis of 2008 being a good example), they aren’t common, and the housing market tends to bounce back.

Findings from an in-depth study we commissioned at Arrived revealed that investing in single-family rental homes over the past 20 years would have resulted in an 11.7% annual return on investment, outperforming the S&P 500, the annualized return for which was 9.43% during that same period.

Consistent cash flow

In addition to the appreciation in value that a real estate investment generates, it can also be a consistent and reliable source of income and cash flow. The options are many.

You can rent single-family or multi-family homes. You can invest in vacation properties and short-term rentals like those listed on sites like Airbnb. Alternatively, you could invest in fractional real estate or REITs, allowing you to collect rental income and dividends without the challenges of being a landlord.

With good investments, the rent pays not only the mortgage but also for the day-to-day expenses of running the property, which means you’re basically building a valuable and appreciating asset with very little investment.

Multiple revenue streams

The secret to building wealth is diversifying your assets to diversify your risk. What makes real estate so incredibly appealing for investors seeking diversification is its many options. From renting out homes to investing in commercial real estate to buying shares in a Real Estate Investment Trust (REIT), the choices are as varied as you want them to be.

If you’re risk-averse and don’t mind lower returns, invest in a small single-home property and pay off the mortgage before buying anything else. If you’d like to see faster returns and don’t mind taking a higher risk, consider flipping houses and selling them at a profit. If you’d rather collect the cash and leave the experts to figure out what the market is doing, consider fractional real estate or ETFs (real estate exchange-traded funds).

Low-cost financing

The only challenge investors –especially new investors – face when entering the real estate market is having enough cash to fund the down payment on a property. Debt financing in real estate is widely supported, meaning securing a mortgage from a bank, mortgage lender, or credit union is feasible and often comes with competitive rates.

Real estate investors understand that borrowing money can make sense for long-term investments. You might pay 6-7% interest rates on your mortgage while seeing 10-12% or more returns on that property, putting you solidly in the green.

Low volatility

The necessity of real estate (people will always need a place to live) makes it a historically dependable investment. As long as people require homes, vacationers need places to stay, and businesses need storefronts and warehouses, there will be a demand for real estate. This stability helps ensure that your real estate portfolio is less susceptible to significant and unpredictable daily fluctuations compared to the stock market, making it a relatively secure investment.

Tax benefits

One of the main reasons real estate is seen as an attractive wealth-building opportunity is because of the considerable tax benefits it offers. Some of these include:

- Real estate deductions: Any expenses associated with an investment property's maintenance, mortgage, and operating expenses qualify as tax write-offs. These include property taxes, insurance, mortgage interest, repair and maintenance costs, equipment expenditures, and property management fees.

- Pass-through deductions: The Tax Cuts and Jobs Act of 2017 enables businesses that earn Qualified Business Income (QBI), which includes rental income, to pass up to 20 percent of their taxable income with a pass-through deduction, reducing the effective income tax rate by 20 percent.

- Capital gains: When you sell a property for more than you bought it after at least a year of holding it, that profit is called capital gains and is taxed at a lower rate than your ordinary income.

- Depreciation: The IRS allows property owners to take an annual depreciation deduction on income-generating properties, reducing taxable income and improving overall profitability.

- 1031 Exchange: If you’re using the profits from the sale of a property to invest in a new one, you can defer the taxes on the sale using a tax code called the 1031 Exchange.

- Opportunity zones: There are 8,700 opportunity zones across the US, created as an economic development tool to help growth in some of the country’s most distressed and disadvantaged areas. Investors can get significant tax breaks by investing in these regions.

- Tax-deferred retirement accounts: You can use a Health Savings Account (HSA) or SDIRA (Self-Directed IRA) to invest in real estate and defer taxes.

Hedge against inflation

What makes real estate pretty unique among most, if not all, investment classes is how it can act as a hedge against inflation. Cash loses purchasing power over time, so it would still hold its value even if a property weren’t appreciated in real terms. Simply put, the value of your real estate investment doesn’t decline from year to year, which means that inflation alone can cause an appreciation in real estate value.

Ways to build wealth through real estate

Real estate can be especially appealing to many types of investors because there are so many ways to build wealth through real estate. Investing in real estate can mean buying a house and renting it out as a single-family home as much as it can mean buying shares in a REIT (real estate investment trust) and being completely hands-off while collecting annual dividends. Here are some of the most common ways to build wealth through real estate.

Rental properties

What multiplies wealth is buying properties that appreciate over time and create enough cash to pay off the mortgage and expenses. Rental properties come in many forms, including residential real estate, commercial properties, and raw land (you can rent the land for agricultural production or get regular payments or royalties for allowing companies to build structures such as pipelines, gravel pits, cellular towers, etc.).

REITs

REITs or Real Estate Investment Trusts are an easy way for investors to get started in real estate without a significant cash investment. Much like mutual funds, REITs allow you to purchase shares in a company that operates or finances income-producing real estate and pays you dividends.

Fractional real estate

Fractional ownership in real estate is a way of buying a portion or percentage of a property. The cost of the property is split between multiple shareholders, and, therefore, so is the profit. A fractional property is like any other income-producing real estate investment, the only difference being that the ownership is divided between multiple people.

Wholesaling

Wholesaling is a way to profit from a short-term real estate holding by finding a new seller before the closing. This way, the contract is transferred to the new buyer, with the investor acting as a middleman. The investor buys a (usually distressed) property and finds a seller before money is exchanged.

House flipping

House flipping refers to buying a property, fixing it up, forcing appreciation through renovations and upgrades, and then selling it for more than your purchase price. Flipping has become an incredibly common way of investing in recent years, with the US Home Flipping report noting that nearly 6% of all single-family and condo sales in the third quarter of 2021 were flips.

Rent out your own home

Depending on your location and occupancy rates, an Airbnb could be more lucrative than renting to a long-term tenant. The costs are higher, too, because you are expected to provide furnishings, pay utilities, and clean the place after each stay. Still, the average host earns $14K annually, with the average nightly rate nationwide in 2024 being $296.

How to determine which real estate investing method is right for you

When deciding which real estate method is right for you, it’s helpful to keep the following factors in mind:

- Finances: How much money can you afford to spend right now? How much can you borrow? Are you already a homeowner? Did you refinance recently?

- Risk tolerance: What is your appetite for risk, and which investments are more likely to feel comfortable – not stressful – to own?

- Long-term vs. short-term: Can you invest in long-term assets that take time to appreciate, or is your goal to profit quickly and get out of the investment?

- Liquidity: Would you prefer to invest in assets that you can quickly sell or are you comfortable having your money tied up for more extended periods?

- Landlord responsibilities: How hands-on do you want to be regarding rental properties? Do you want to deal with renters and repairs, or would you rather outsource that work?

- Diversification: How important is it for you to have diversified investments right from the get-go?

Easily invest in real estate

Real estate is widely considered a reliable and effective way to build wealth, and despite popular belief, it’s not difficult to get started.

Our mission at Arrived is to make real estate investing accessible to everyone at every rung of the investment ladder. This is why, at Arrived, you can get started buying shares of real estate and let us handle the rest. No deposits, loans, or mortgage payments are required.

Browse through our available properties and start building your portfolio today.