Highlights

- The Private Credit Fund delivered an 8.38% annualized return in July.

- The Single Family Residential Fund maintained a strong 97% stabilized occupancy

- Three properties in the Seattle City Fund completed renovations and were marketed for rent, with one already receiving a signed lease.

Geographic diversification

The Arrived Private Credit Fund and Single Family Residential property offerings provide investors with access to distinct segments of the real estate market—real estate-backed debt and equity.

The map below shows Arrived's active markets and loan footprint, which illustrates the geographic diversification of these investments.

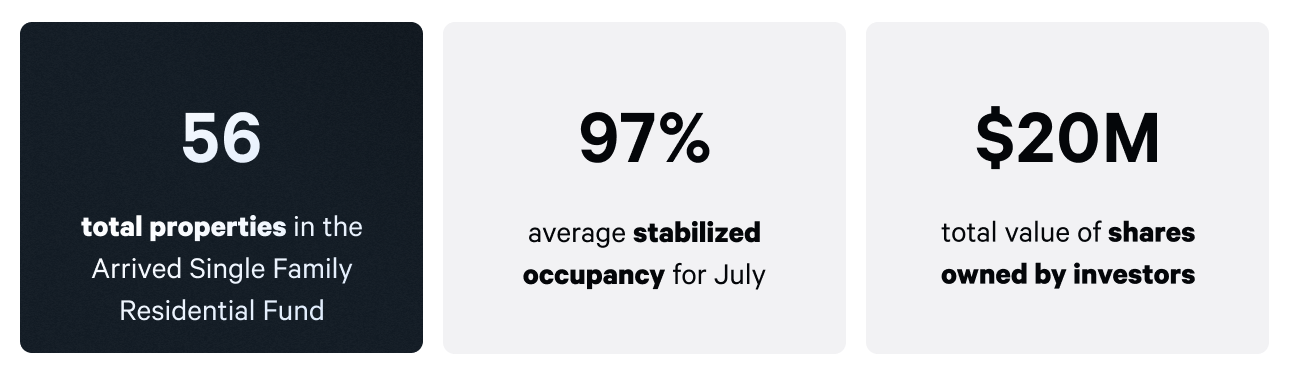

Arrived Single Family Residential Fund

The Single Family Residential Fund maintained an average stabilized occupancy of 97%* for July. This fund currently has properties in 25 markets nationwide.

Investors in the Single Family Residential Fund benefit from rental income and any appreciation that occurs when a property is sold. As new properties are added, the fund’s diversification grows.

Seattle City Fund

In July, three properties in the Seattle City Fund completed renovations and marketed for rent, with one already securing a signed lease. This rental activity positions the fund to generate income and support its first dividend distribution.

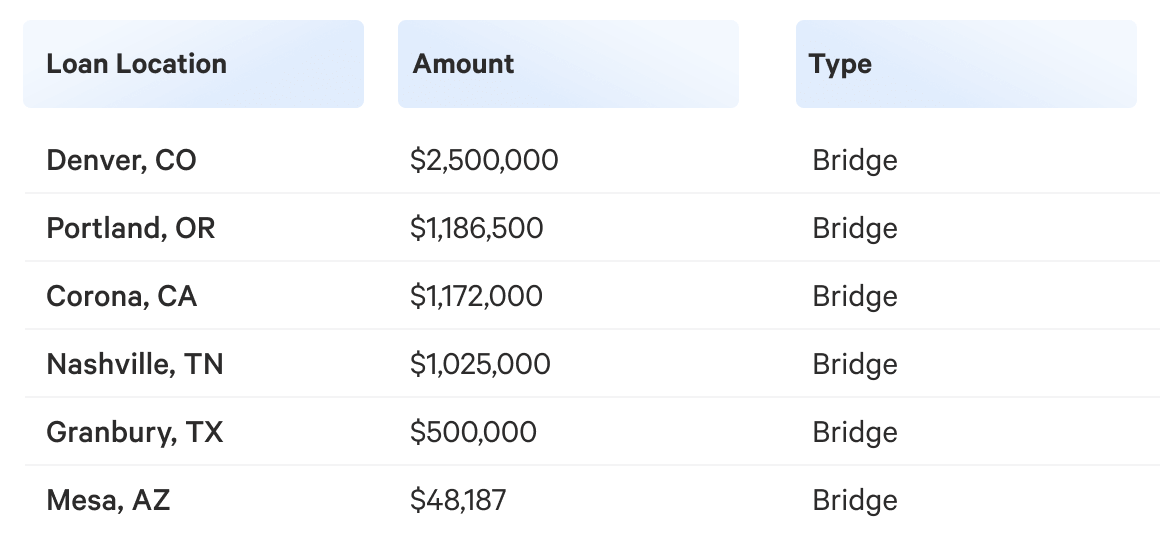

Arrived Private Credit Fund

With over 18K investors and $56M invested, the Arrived Private Credit Fund delivered an 8.34% annualized return in July and added 6 new loans. The fund currently holds 75 active loans, with repayments and new acquisitions being acquired on an ongoing basis.

The table below details the new loans added to the Arrived Private Credit Fund in July.

Single Family Residential IPOs

All rental income generated from Arrived properties benefits its investors by adding to the property’s cash reserves or by being paid out as future monthly dividends.

Overall, individual Single Family Residential properties had a stabilized occupancy rate of 91% for 425 total properties, collecting a total of $803,641 in rent revenue in July.

In July, 43 new leases were started, with an average lease term of 19 months. Of those new leases, 35 were leased above the forecasted amount.

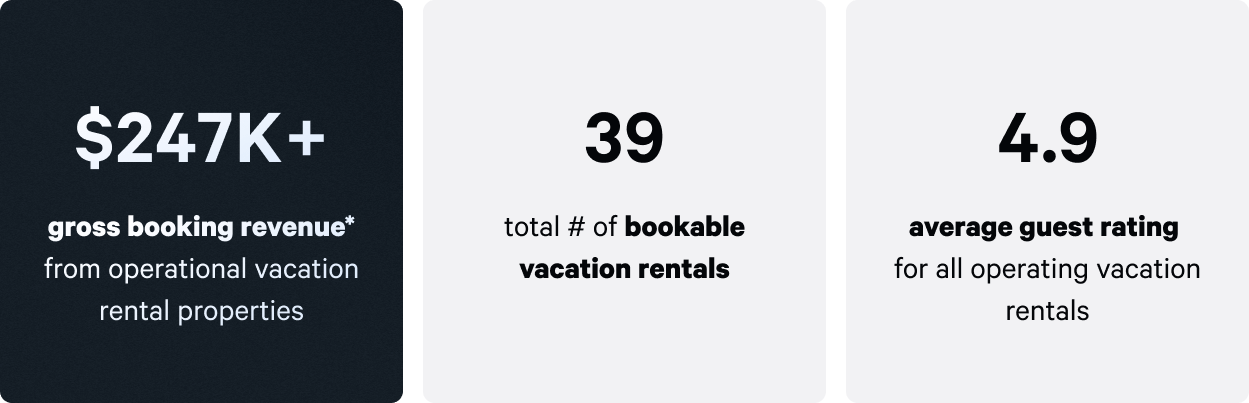

Vacation Rental IPOs

Arrived vacation rentals generated $247,588 in gross booking revenue for 39 booking-ready properties in July.

The table below presents the gross booking revenue for each property in July, along with the current guest rating score.

¹ Booking revenue was impacted due to a maintenance issue.

See the Property History Timeline for individual updates for each property.

Want to stay at an Arrived vacation rental? Add it to your Airbnb wishlist ✨

Guest review highlights

- Guest review of The Solano

- Guest review of The Suitespot

- Guest review of The Coquina