Seattle has long stood out as one of the most dynamic and resilient housing markets in the country—and today, it continues to offer compelling opportunities for real estate investors. Through the Seattle City Fund, we’re focused on acquiring rental properties across the Seattle-Tacoma region with the goal of delivering both steady income and the potential for long-term appreciation.

Why Seattle?

Seattle continues to thrive as a major tech and business hub, anchored by global giants like Amazon, Microsoft, Starbucks, and Boeing. These companies not only provide stability to the local economy but also attract a highly skilled, high-income workforce. As a result, demand for housing in nearby residential neighborhoods remains strong.

The rental market in Seattle is equally compelling. With more than half of the city’s residents choosing to rent¹, there’s a steady and reliable demand for rental housing. The tight supply of available homes keeps vacancy rates low and rental prices competitive. Over the years, Seattle’s real estate values have consistently outperformed national averages, offering strong appreciation potential for investors.

Population and job growth further reinforce the strength of the market. In recent years, Seattle has ranked as one of the fastest-growing metro areas in the U.S., buoyed by stable employment in tech, healthcare, aerospace, and education. The widespread adoption of remote work has only added to the city’s appeal, drawing talent from across the country who value Seattle’s mix of professional opportunity and lifestyle.

Finally, Seattle’s high quality of life continues to be a draw for residents and investors alike. The city is home to top-tier institutions like the University of Washington and Seattle University, which help power a steady pipeline of educated talent. Significant investments in infrastructure and public transit are improving accessibility and livability. At the same time, the region’s proximity to water, mountains, and year-round outdoor recreation makes it one of the country's most desirable places to live.

Seattle City Fund property strategy: investing for appreciation and income

We take a hybrid acquisition strategy—balancing properties that can deliver strong cash flow in the short term with those positioned for long-term appreciation. Here’s how we’re focused on maximizing investor returns in the Seattle City Fund:

Unlocking value through land potential

Seattle’s evolving housing landscape highlights the importance of land characteristics. We may target properties with valuable land attributes, such as:

- Large, flat, corner lots well-suited for DADUs (Detached Accessory Dwelling Units)

- Expandable footprints with potential to add square footage or ADU (Accessory Dwelling Unit)

Transit-oriented investment

Seattle’s investments in light rail and public transit are reshaping urban development. We may prioritize properties near:

- Link light rail stations

- Major transit corridors and park-and-rides

- Freeway access points like I-5 and I-405

Homes in these areas can benefit from sustained renter demand and can be better positioned for long-term appreciation as the city grows.

Neighborhood-driven selection

We may look for properties in neighborhoods with long-term potential. Our selection is guided by on-the-ground knowledge of what makes an area desirable today—and resilient tomorrow:

- Strong community appeal and livability

- Proximity to quality schools, transit, and amenities

- Well-maintained homes with solid structural condition

- Neighborhoods with consistent rental demand

- Areas showing signs of long-term growth and investment

How City Funds compare to the Arrived Single Family Residential Fund

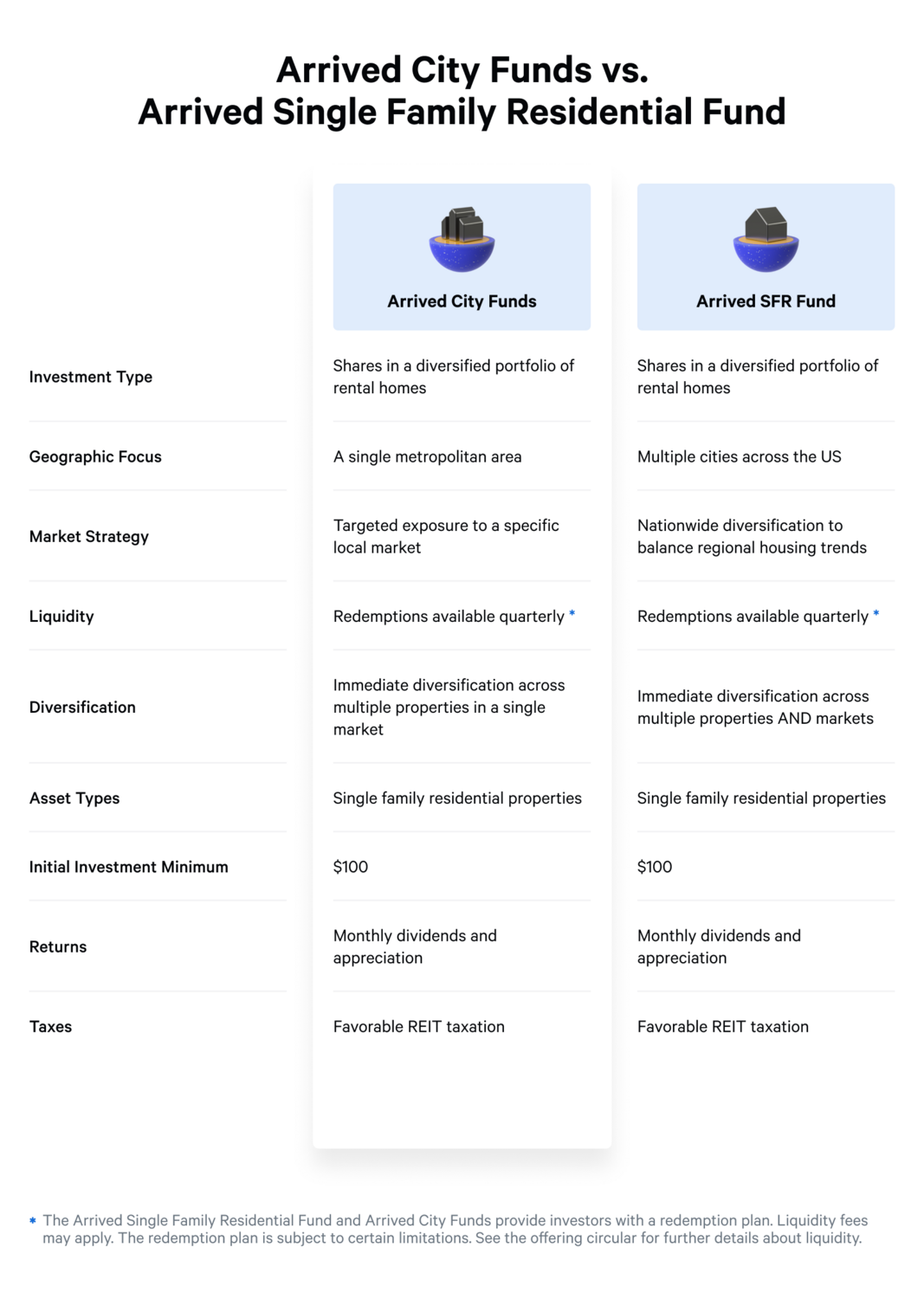

City Funds and the Arrived Single Family Residential Fund are designed to make real estate investing simple, diversified, and passive. However, each serves a distinct purpose depending on your investment goals.

What They Have in Common

- Operational efficiencies: Both funds benefit from bundling multiple properties into a single fund structure, which helps reduce costs related to LLC formation, accounting, audits, and tax preparation—improving overall efficiency and potential investor returns.

- Instant diversification: Both funds allocate your investment across a carefully selected and growing portfolio of rental homes.

- Fully managed by Arrived: No need to deal with tenants, maintenance, or paperwork—we handle everything.

- Access for all investors: Open to both accredited and non-accredited investors.

- Passive income & growth potential: Returns can be obtained through rental income and any potential equity appreciation from the properties in the fund.

Key differences

- Geographic and market strategy: City Funds concentrate investments within a single metropolitan area, offering targeted exposure to local market dynamics. In contrast, the Single Family Residential Fund spans multiple U.S. cities, providing nationwide diversification to help balance regional housing trends.

- Property selection approach: City Funds tailor property selection to each local market's specific strengths and characteristics. By comparison, the Single Family Residential Fund selects properties to perform well across a diverse mix of markets, using a nationwide lens to identify opportunities.

- Investor goals: City Funds are ideal for investors who want to double down on a specific city’s future, while the Single Family Residential Fund is suited for those seeking a more hands-off, broadly diversified real estate investment.

A look inside the fund: sample Seattle properties

Here are a few examples of properties included in the Seattle City Fund.

The Chihuly

This 4-bed, 2-bath home offers 1,680 square feet of rental-friendly space with central ducting, a spacious layout, and a large deck. The RV garage provides flexible use, and the lot layout suggests potential for future expansion. With minor updates, this property is well-positioned for long-term rental appeal.

The Bollito

This 3-bedroom, 2-bathroom home spans 1,317 square feet and sits on a spacious lot that may allow for additional development, such as accessory dwelling units. The location of the property offers convenient access to nearby amenities and transit options. A separate side entrance and existing signage may suggest prior consideration for ADU use, presenting potential for added utility and flexibility over time.

Watch the City Funds launch webinar

Closing thoughts

Seattle represents one of the most compelling urban real estate markets in the U.S. Our Seattle City Fund is designed to capture the full value of this market—from strong rental fundamentals to land-driven appreciation potential. By targeting the right neighborhoods, leveraging smart property configurations, and positioning for long-term zoning tailwinds, we believe we can drive superior risk-adjusted returns for our investors.

Want to gain exposure to Seattle real estate without buying a home yourself? The Seattle City Fund could be your opportunity to invest like a local—at scale.