Investing in real estate used to be complicated.

At Arrived, we simplify it by offering diverse opportunities. You can invest in equity and buy shares directly in rental homes or invest in real estate-backed debt and provide short-term financing for real estate projects.

Our offerings are designed to complement each other, allowing you to tailor your portfolio to your financial goals and risk appetite. Our team selects only the top 0.2% of properties they evaluate.

Choosing the right real estate investment with arrived

Understanding the differences between Arrived’s investment options can help you decide which strategy fits your goals:

- Return type: Investments may generate returns through rental income, potential appreciation, or both, depending on the offering.

- Income potential: Properties in established rental markets may provide steady income, while investments in emerging markets may offer greater potential for appreciation.

- Minimum hold periods: The minimum investment hold period varies across Arrived products. Some investments may require a longer commitment to fully realize their appreciation potential, while others may offer shorter hold periods with steady cash flow returns.

- Diversification: Arrived allows you to diversify across property types and locations, which can help manage risk in your portfolio.

Building the right arrived portfolio for you

With Arrived, you can mix and match which investment types best suit you. Arrived’s investment products are designed to complement each other.

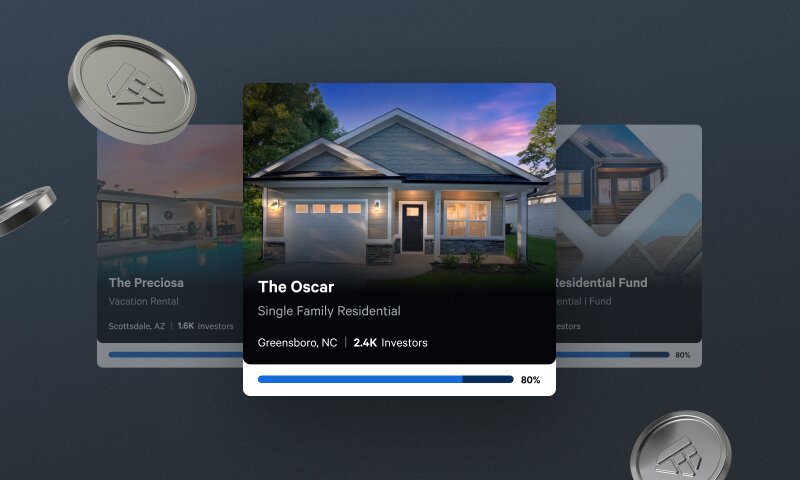

Individual property offerings

Arrived investors can explore a curated selection of rental properties; each pre-vetted for its potential to appreciate and generate income. Investors can choose how much to invest in each property, fund their initial investment within minutes, and quickly start building their rental investment portfolio.

Single family residential properties

Arrived focuses on purchasing single family residential homes and renting them out to long-term tenants, typically with one to two-year leases. The goal is not just to provide rental housing but also to eventually sell the property for a profit after value appreciation.

- Return Type: Income + appreciation

- Total Historical Returns: 6 - 10% annual*

- Income Portion: 3 - 5% annual*

- Appreciation: Included

- Minimum Investment Hold: After a 6-month minimum hold period, investors have the option to sell shares of individual properties through the secondary market. For funds, investors become eligible to request redemptions six months after their initial investment, subject to the fund’s quarterly redemption schedule and terms.

- Diversification: Diversifying across at least five properties can help reduce risk and stabilize returns by spreading exposure and balancing income and appreciation potential.

Funds

Arrived offers expertly managed funds focused on single family residential properties and private credit. These funds allow investors to easily diversify their portfolios, guided by Arrived’s experienced team and proven operational track record.

The Arrived Single Family Residential Fund

The Arrived Single Family Residential Fund makes it easy for investors to diversify by pooling capital into a portfolio of residential properties across multiple markets nationwide.

- Return Type: Income & appreciation

- Total Historical Returns: 6 -10% annual*

- Income Portion: 3 - 4% annual*

- Appreciation: Included

- Minimum Investment Hold: Single Family Residential Fund investors may request redemptions six months after their initial investment.

- Diversification: The Single Family Residential Funds offers diversification by including a portfolio of homes, balancing risk and returns across various properties nationwide.

Arrived City Funds

Arrived City Funds focus investments in a single metropolitan area, offering targeted market exposure while maintaining the diversification of pooled assets. Unlike the Single Family Residential Fund, which spans multiple markets nationwide, a City Fund allows investors to concentrate on a specific market.

- Return Type: Income & appreciation

- Total Historical Returns: 6 -10% annual*

- Income Portion: 3 - 4% annual*

- Appreciation: Included

- Minimum Investment Hold: City Fund investors may request redemptions six months after their initial investment.

- Diversification: City Funds offer diversification by including a portfolio of homes, balancing risk and returns across various properties in a single market.

The Arrived Private Credit Fund provides nationwide funding for renovations, rehabs, and new construction. Investors can benefit from interest-based returns secured by residential real estate assets, offering the potential for consistent, secured income.

- Return Type: Income

- Total HIstorical Returns: 7 -9% annual*

- Income Portion: 7-9% annual*

- Appreciation: Not Included

- Minimum investment Hold: Investors may request redemptions 6 months after their initial investment.

- Diversification: The Private Credit Fund provides diversification through a portfolio of real estate-backed loans, helping to balance risk and return across a range of investments.

Investing in equity vs. Real estate-backed debt

Investing in real estate can take two forms: equity or debt.

Choosing between equity and debt investments depends on your financial goals and risk tolerance. Many investors opt for a mix of both to diversify their portfolios and balance potential returns with risk management.

With Arrived, equity investments include individual property offerings, the Single Family Residential Fund, Arrived City Funds, and debt investments include the Arrived Private Credit Fund.

Equity investments

When you invest in equity, you're buying a stake in a property. This offers the potential for higher returns, especially if the property appreciates or generates significant rental income. However, these higher returns come with greater risk, as market fluctuations can impact property values and rental income.

Debt investments

Debt investments involve lending money for real estate projects and earning regular interest payments plus principal repayment. These investments generally carry lower risk but offer lower potential returns, as they don’t participate in long-term property appreciation like equity investments.

The importance of diversification in real estate investment portfolios

At Arrived, we believe the best portfolios include a mix of investments and investment products.

Diversification is a crucial strategy when building a real estate investment portfolio. By spreading your investments across different types of properties, locations, and investment methods, you can reduce risk and enhance potential returns.

FAQ

Who can invest?

How much can I invest?

What type of products are available on Arrived?

Will I have any responsibilities for managing properties I invest in? If not, who is responsible?

What type of returns can I obtain?

Disclosure

The opinions expressed in this article are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product. The views reflected in the commentary are subject to change at any time without notice.

*Past performance does not guarantee future results and there is no guarantee this trend will continue. Note: The above scenarios are for illustrative purposes only and are not intended to be used to estimate the returns of an individual property.

The table is estimated by combining the 20-year historical home price appreciation from the Zillow Home Value Index (ending Q1 2023) and average historical dividend yields from the Arrived portfolio (ending Q1 2023). These data sources were combined to estimate a hypothetical IRR for each asset type and leverage classification and then rounded to whole numbers. The single family residential and vacation rental calculations also assume an average hold period of 7 years, 6% property disposition costs, and an average annual net operating income increase of 3%. The leverage classification estimates an average of 63% financing and a 4.75% interest rate, which was selected based on existing properties with leverage at the time of calculation. The Private Credit Fund return is based on annualized dividends paid from August 2024 to April 2025.

The income return range is for new properties and does not include properties that do not receive a monthly dividend due to specific circumstances, such as vacancies, eviction proceedings, significant maintenance issues impacting the property’s cash flow, or not yet booking-ready. Any operating income for these properties will be added to the property’s cash reserves and distributed at a later dividend date.

View Arrived's disclaimers