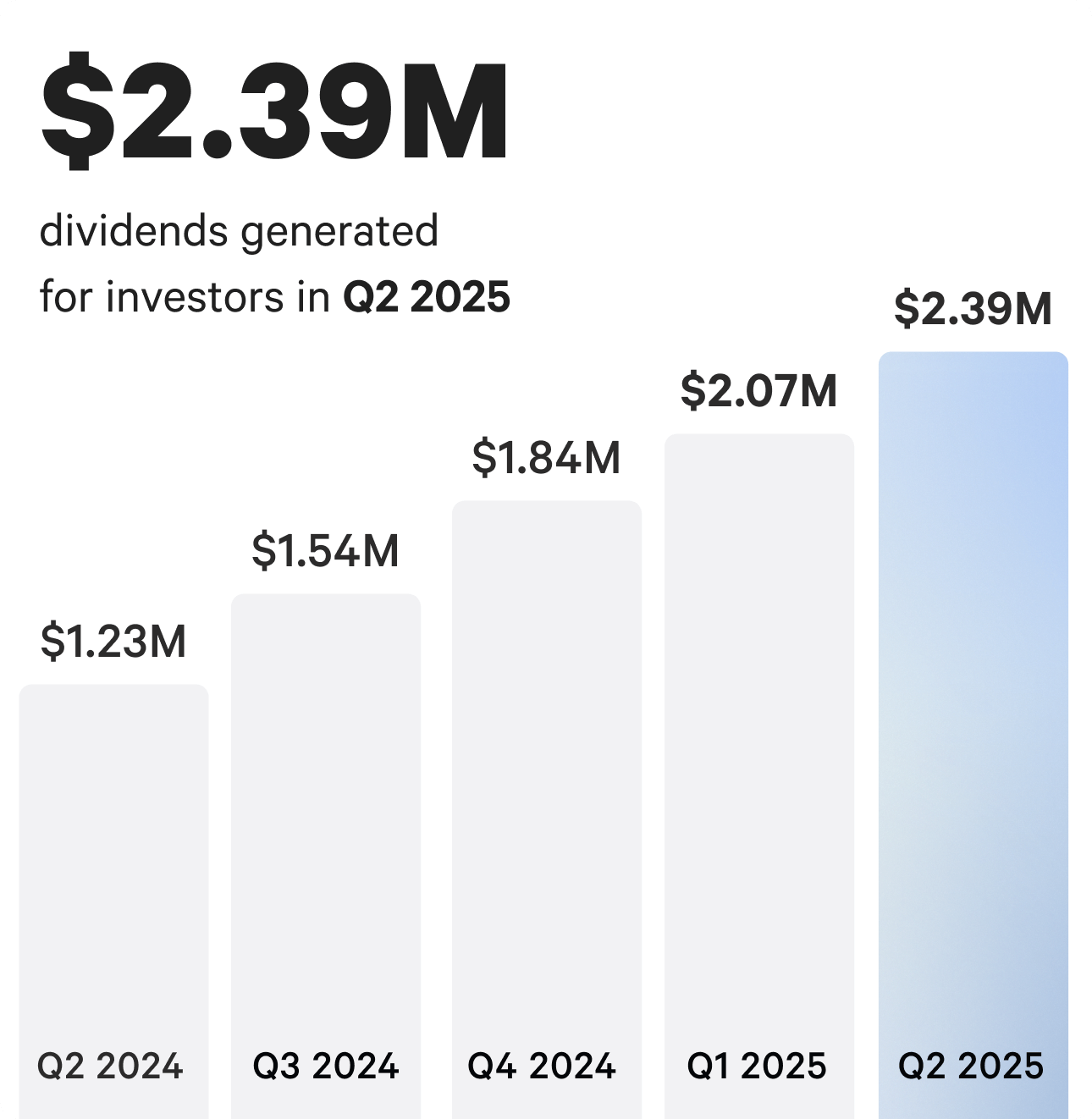

Welcome to Arrived’s Q2 2025 review! Let’s review the dividends and appreciation ranges of the 466 Arrived properties operating during Q2 2025.

In Q2 2025, investors earned more than $2.39M in dividend income, representing an approximately 15% increase from Q1 2025. In Q2 2025, individual single family residential properties earned an average annualized dividend of 3.7%, and vacation rental homes earned an average of 2.4%.

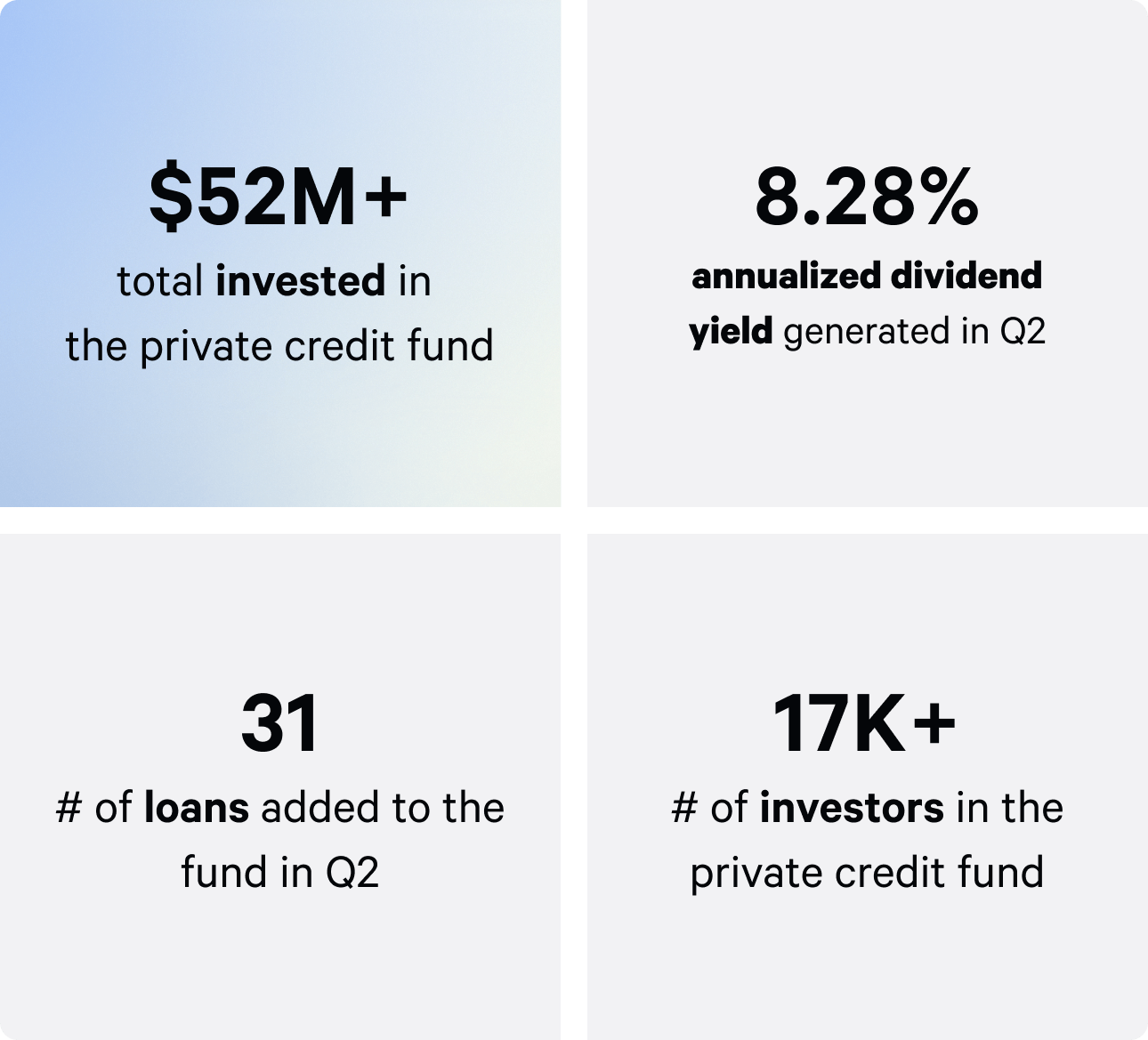

This quarter, we launched the Seattle City Fund, giving investors targeted exposure to one of the country’s most dynamic real estate markets. At the same time, we removed the monthly investment cap for the Private Credit Fund, enabling greater access and flexibility for those looking to allocate more capital into this income-focused offering.

Dividends

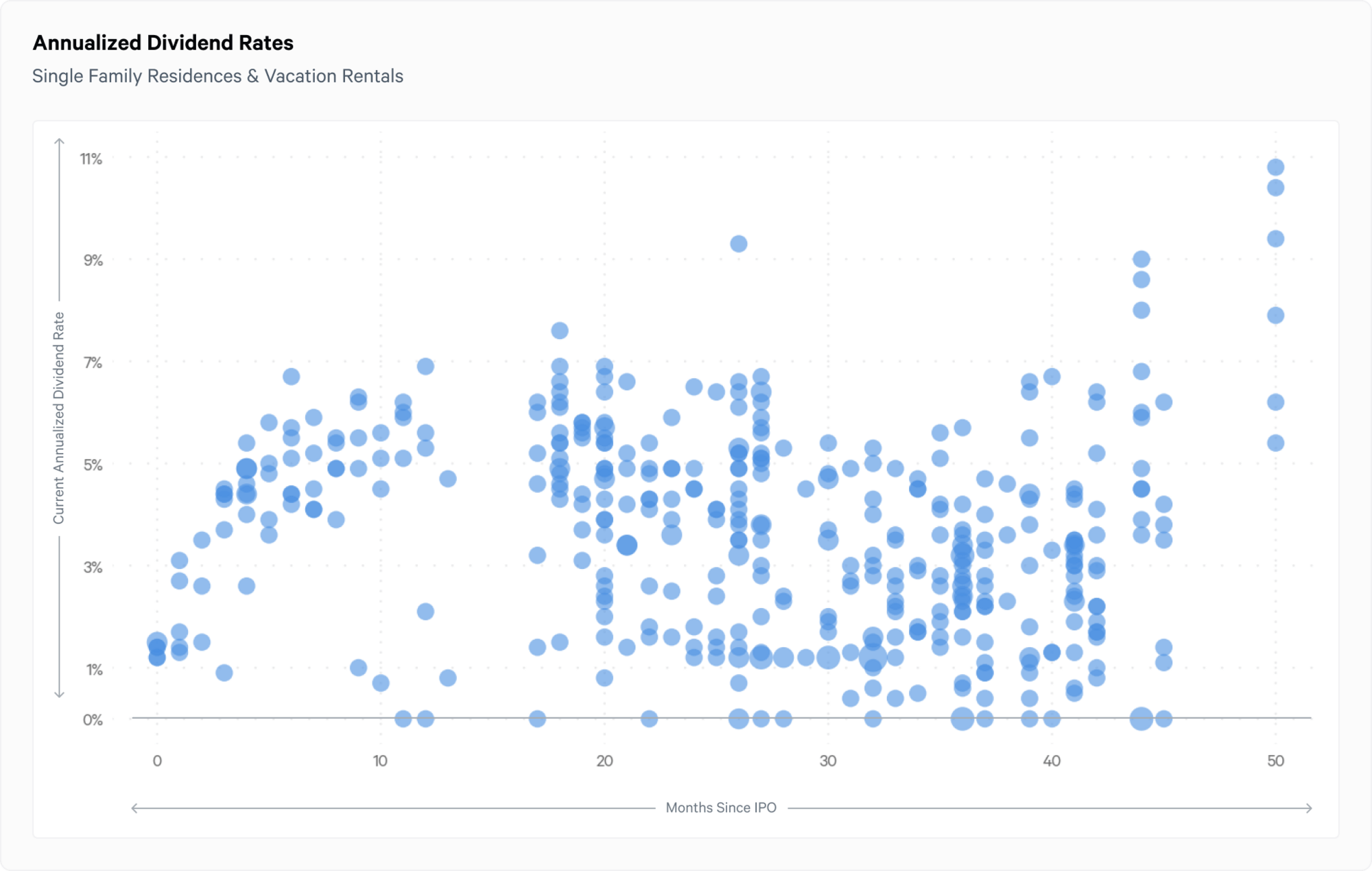

Dividends earned can vary by investment. In Q2 2025, individual single family residential properties paid an annualized dividend between 0.4% and 10.8%, with a 3.6%¹ average. Vacation rentals paid an annualized dividend between 0.4% and 9.3%, with an average of 2.5%¹.

The Arrived Single Family Residential Fund paid an annualized dividend of 4.0%, and the Arrived Private Credit Fund generated income, resulting in an annualized dividend of 8.28% for Q2.

You can view the dividends for each property on our Historical Returns page.

The annualized dividend for each property is calculated by taking the Q2 dividend and extrapolating it out for an entire year. Building a diversified portfolio across multiple markets can be a great strategy to minimize concentration risk while getting exposure to different real estate markets and earning passive income.

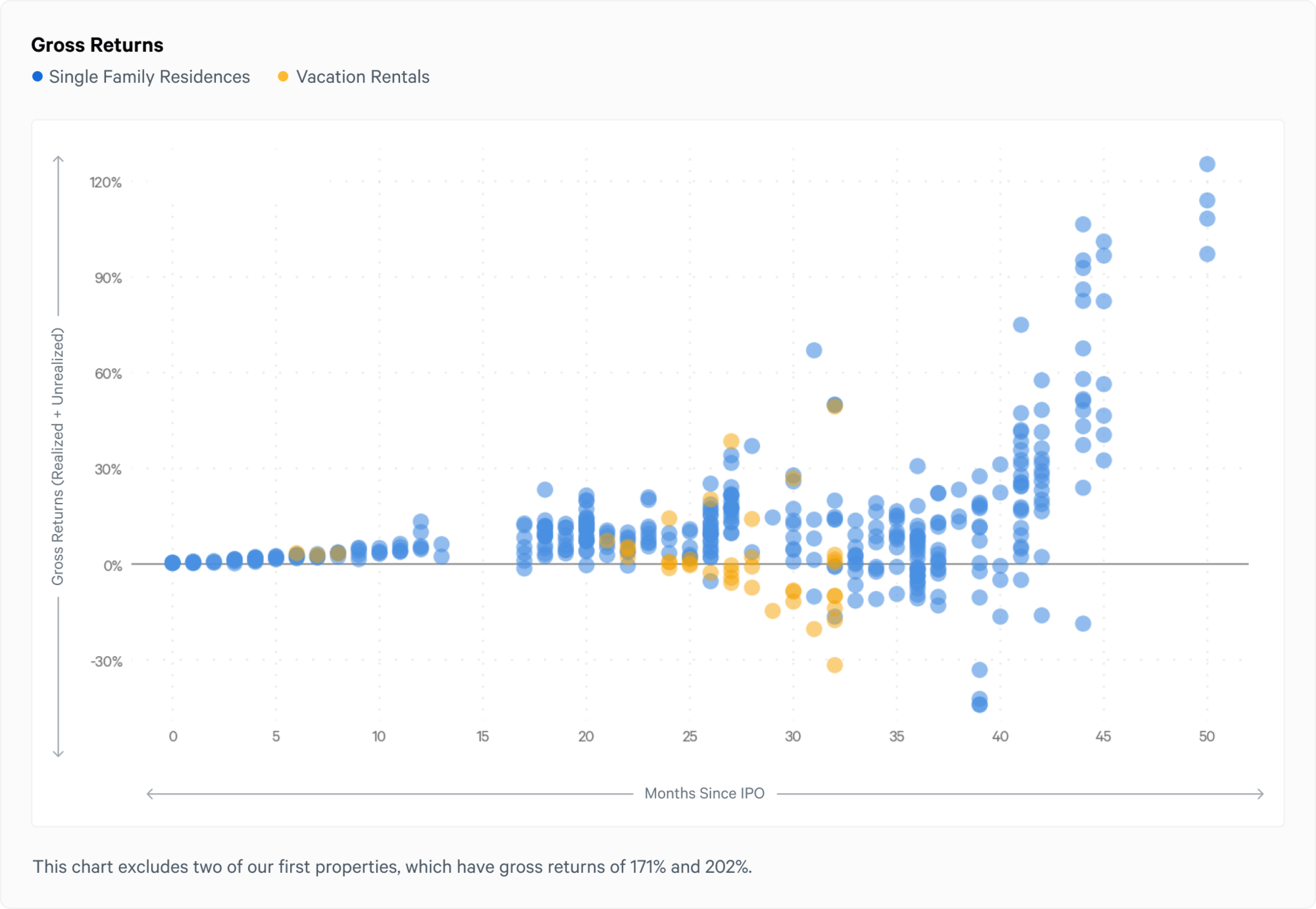

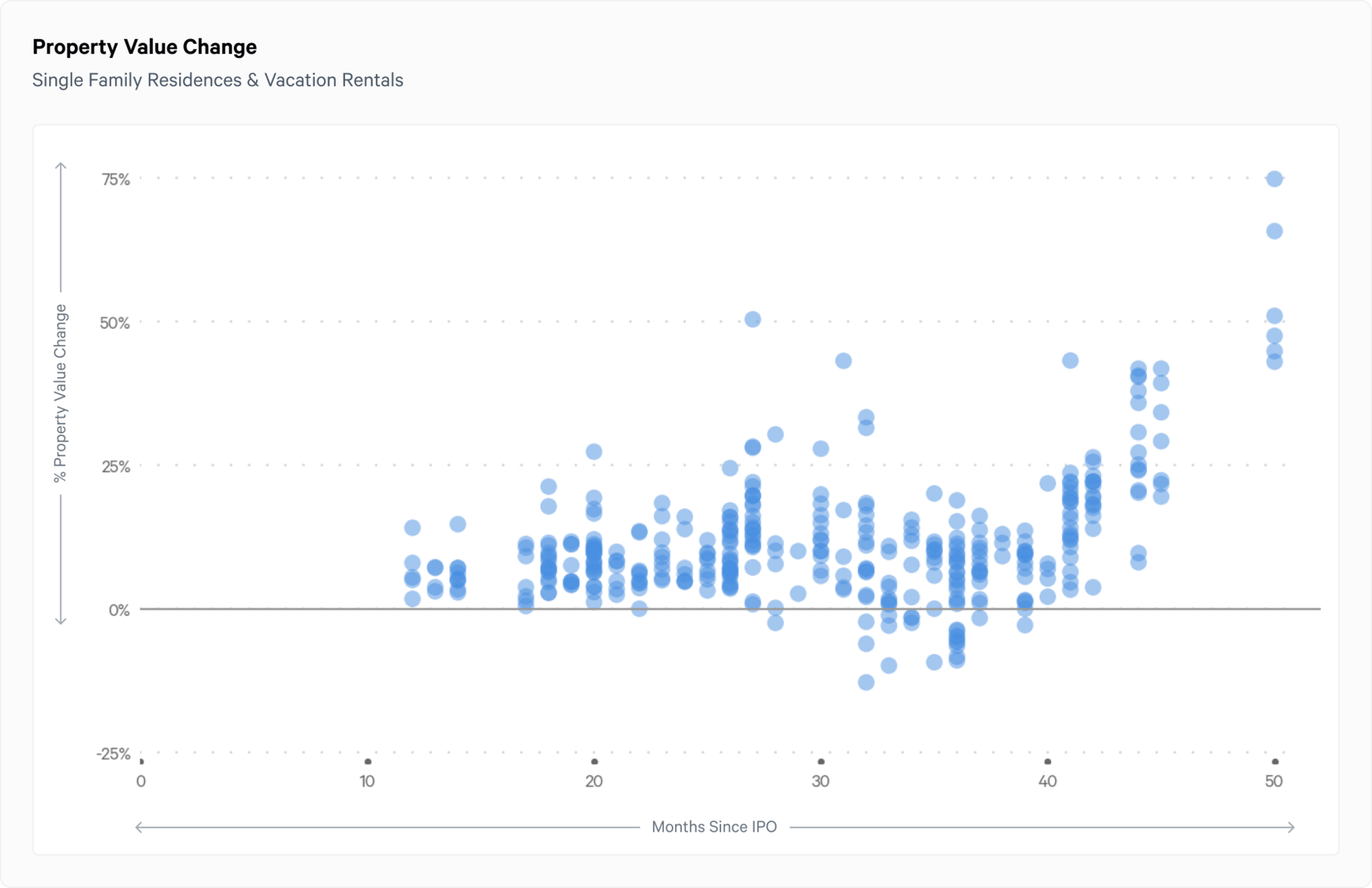

The chart below shows the combined realized dividends and unrealized appreciation of single family residential and vacation properties.

Properties may have lower total returns in the first six months because they have only received dividends and have not received an appreciation update. Historically, rental property investments have performed best when held for the long term.

This chart illustrates the potential benefits of diversification and dollar-cost averaging in the real estate market. Diversifying your portfolio by investing in a mix of single family residential properties, vacation homes, and debt and equity products, such as the Arrived Private Credit Fund and the Arrived Single Family Residential Fund, can be an effective strategy for mitigating risk.

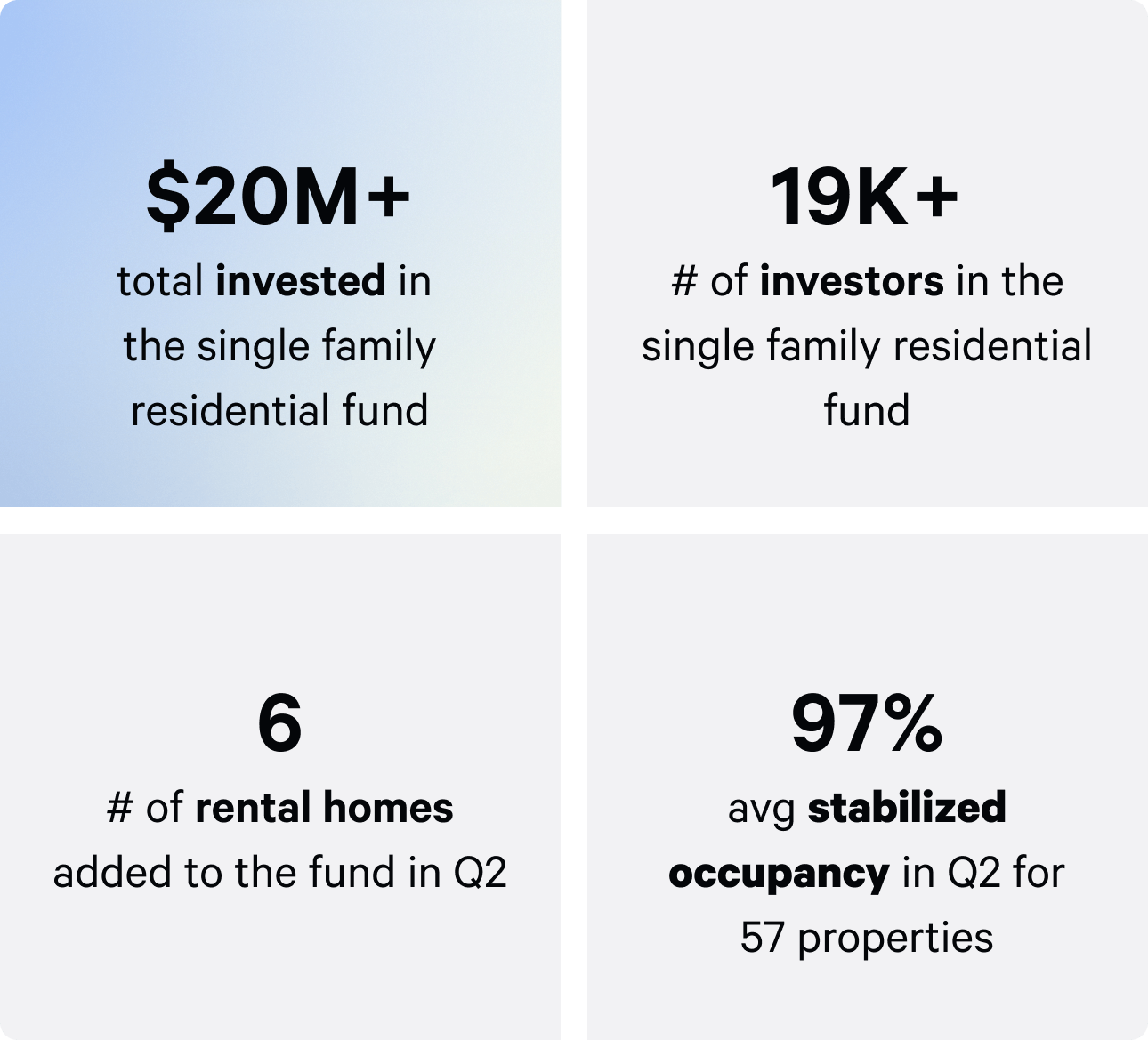

In Q2 2025, 57 Arrived Single Family Residential Fund properties contributed to an average annualized dividend of 4.0%.

The Arrived Private Credit Fund generated income in Q2, resulting in a dividend payment in July at an 8.28% annualized rate. To date, more than $52M has been invested in the fund. The Private Credit Fund added 31 new loans in Q2 2025.

Continuing to track your investment performance with updated metrics

This quarter, as part of our ongoing commitment to transparency and portfolio insights, investors can continue tracking two core performance metrics on their Portfolio Page: Property Value and Arrived Valuation.

Property Value: Track the real assets behind your returns

Each property’s estimated market value—calculated using a combination of comparable sales and income-based approaches—is now available in your portfolio view. These estimates help you monitor how real estate market conditions are impacting the underlying assets in your portfolio over time. You’ll see both the current estimate and the percentage change since the last valuation update.

- What is it? Property Value reflects the estimated market price of a home, similar to estimates you might find on platforms like Zillow or Redfin.

- Where to find it? On your Portfolio Page, you can review the estimated Property Value for each investment, along with any changes since the previous period.

Arrived Valuation: A comprehensive look at your estimated investment value

The Arrived Valuation provides an updated estimate of the current value of each share you own. This metric combines the property’s estimated market value with the LLC’s overall financial position—including cash reserves, outstanding loans, and amortized expenses—to give you a clearer picture of your investment’s estimated worth.

- What is it? Arrived Valuation = Property Value + Assets - Liabilities. This reflects the estimated current value of your shares based on today’s conditions, not future projections.

- Where to track it? You can view the Arrived Valuation and its percentage change directly on your Portfolio Page and in your quarterly report.

Key methodology updates

As a reminder, here’s how our valuation process works today:

- Hybrid property valuation model: We combine comparable sales data with income-based valuation for single-family residential homes, providing a more balanced market estimate.

- Updated timelines: Valuations for single family residential properties typically occur 12 months after initial funding to ensure sufficient market and rental data are available.

- Improved expense treatment: We now utilize tailored amortization schedules for property improvements and furnishings, aligning expenses more closely with the actual lifespan of these assets.

- Disposition costs removed: Projected sale costs are no longer deducted from current valuations, improving clarity and reflecting present-day value.

- Hold period alignment: Our hold period assumptions are evolving to better align with more realistic investment durations and secondary market flexibility. Fixed-rate financed homes will align with the loan term (e.g., 5–10 years), while fund and unleveraged properties will follow extended timelines (5–15+ years).

We’ll continue to include both Property Value and Arrived Valuation in all quarterly performance updates moving forward. For a deeper dive into how these metrics are calculated, you can read more about Arrived Valuation here.

Below, you’ll find a chart that shows the estimated market value performance for the individual rental properties in the Arrived portfolio.

Navigating short-term value changes: real estate is built for the long term

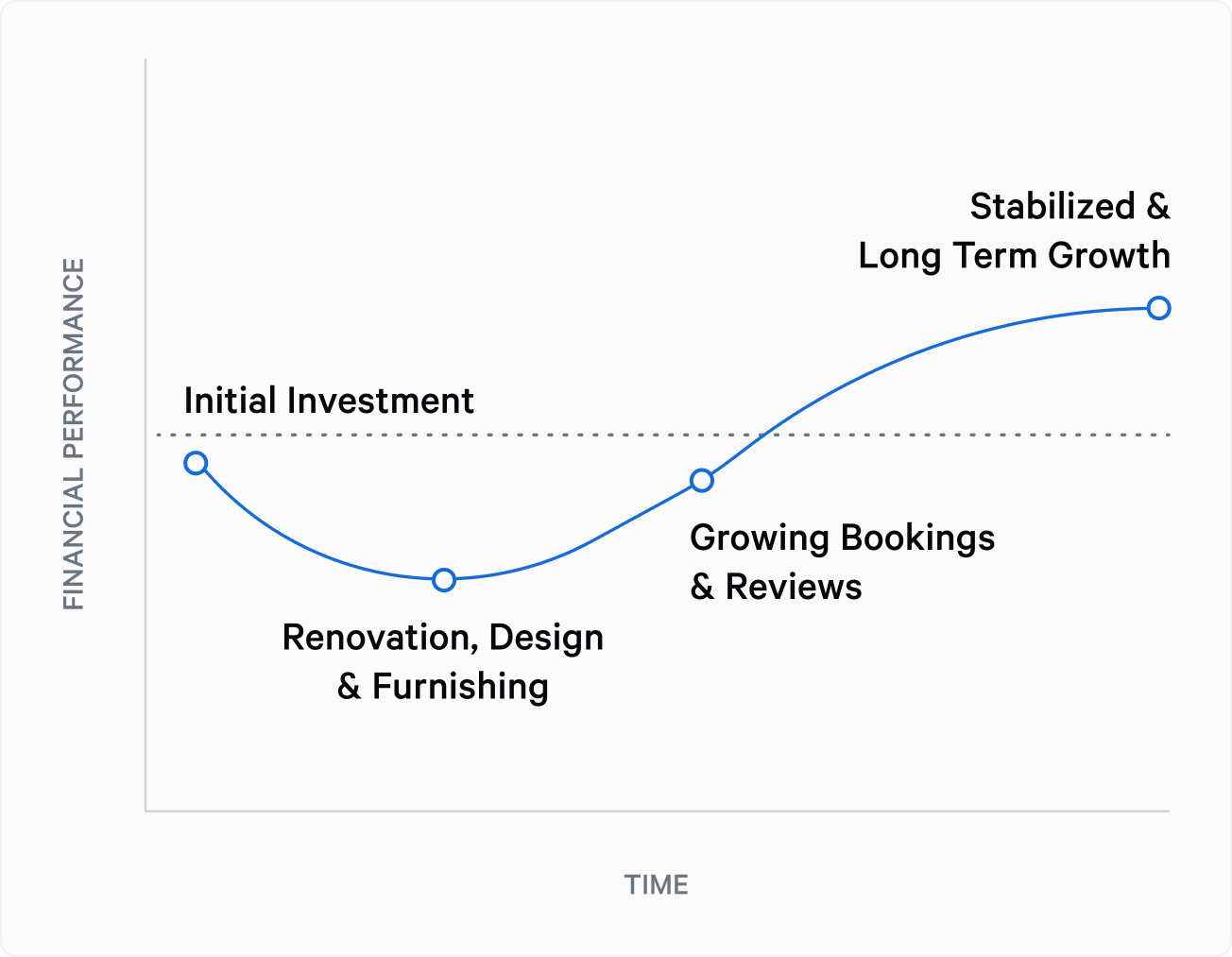

When considering Arrived Valuations, it's crucial to understand the high initial costs and longer ramp-up time needed to increase the potential for strong income performance.

In the early stages of investing in a single family residential property, macroeconomic factors such as prevailing mortgage rates, the strategic use of leverage, and the prevailing market prices of homes can significantly impact initial total returns.

This process follows the investment J-curve pattern. Initially, lower dividends or share prices can accompany larger upfront investments in things like property improvements. This dip represents the low point of the J-Curve. As the property stabilizes, returns can increase, reflecting the growth period of the curve. It's essential to remember that real estate tends to perform best as a long-term investment, enabling investors to navigate various market cycles and maximize their potential returns.

Operational performance

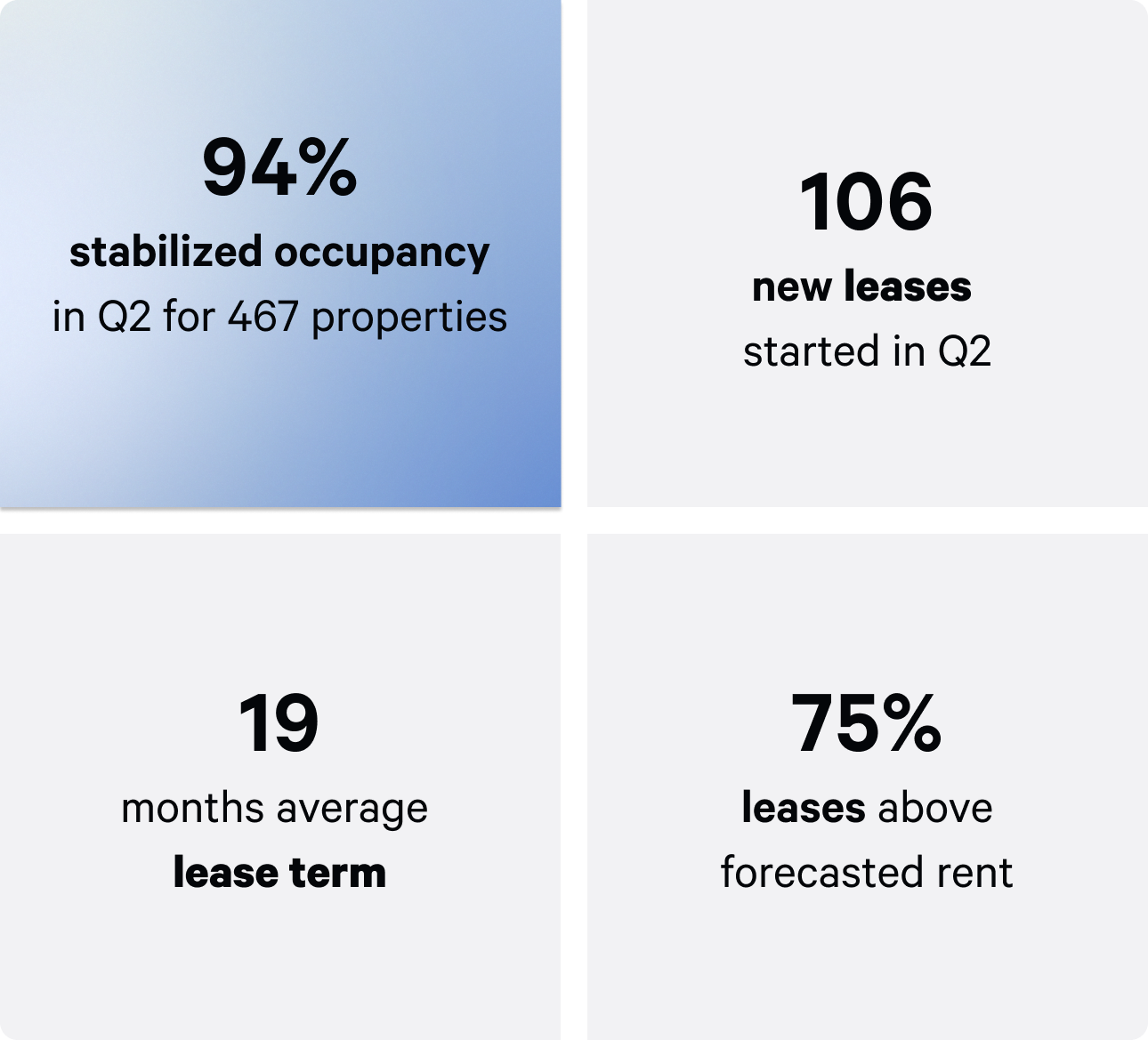

Single Family Residential stabilized occupancy

Arrived closed Q2 2025 with an average stabilized occupancy rate of 94%² for the single family residential properties in operation during the quarter. This was helped by 106 new leases started in Q2. It’s also worth noting that the average term on these leases was 19 months, with 80 leases above the forecasted rent.

Vacation Rental performance

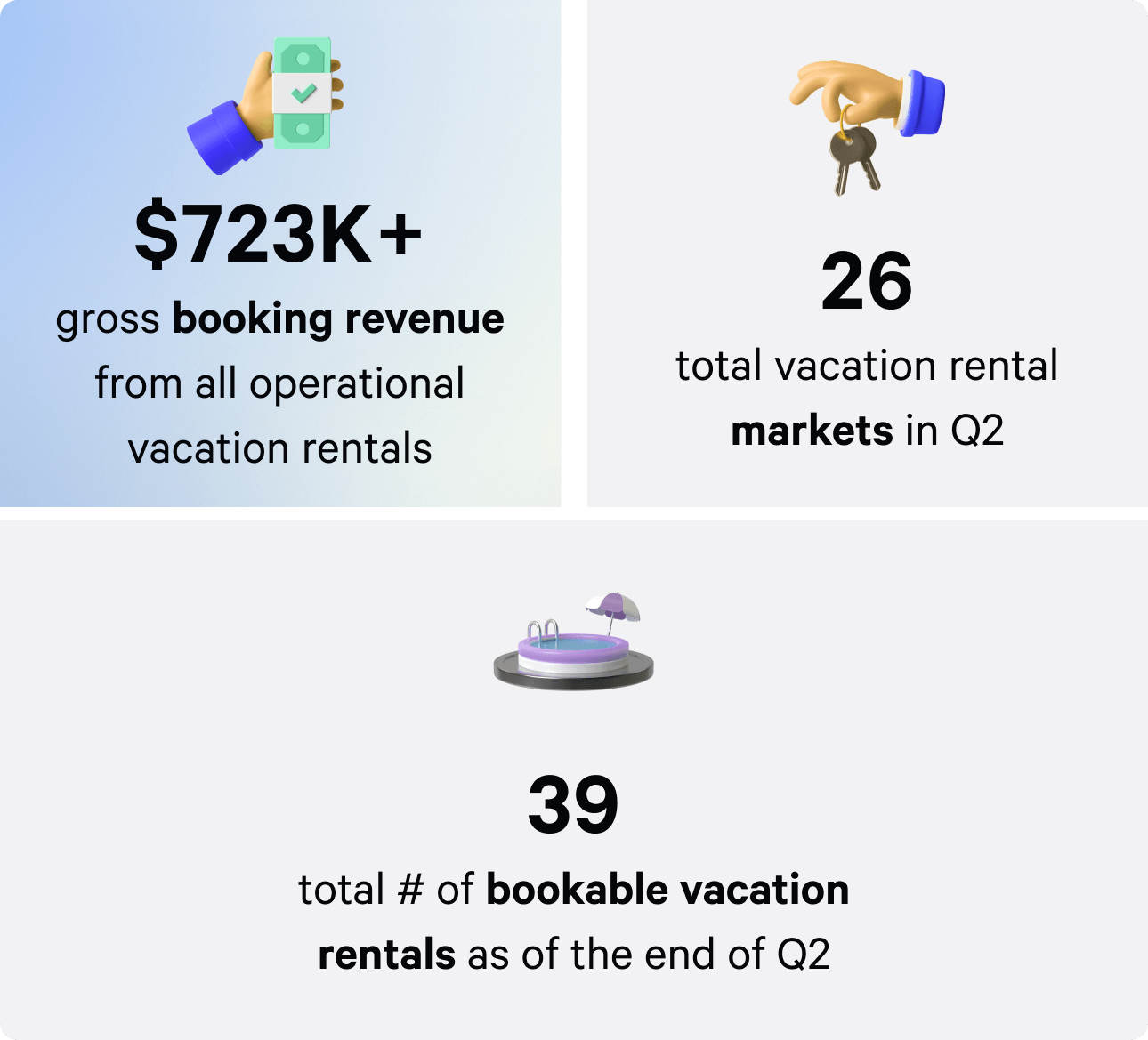

In Q2 2025, there were 39 bookable vacation rental properties. Here are some highlights from the quarter for this asset class:

- $723,451 in gross booking revenue across all operational vacation rentals in Q2³

- 26 total vacation rental markets as of Q2 2025

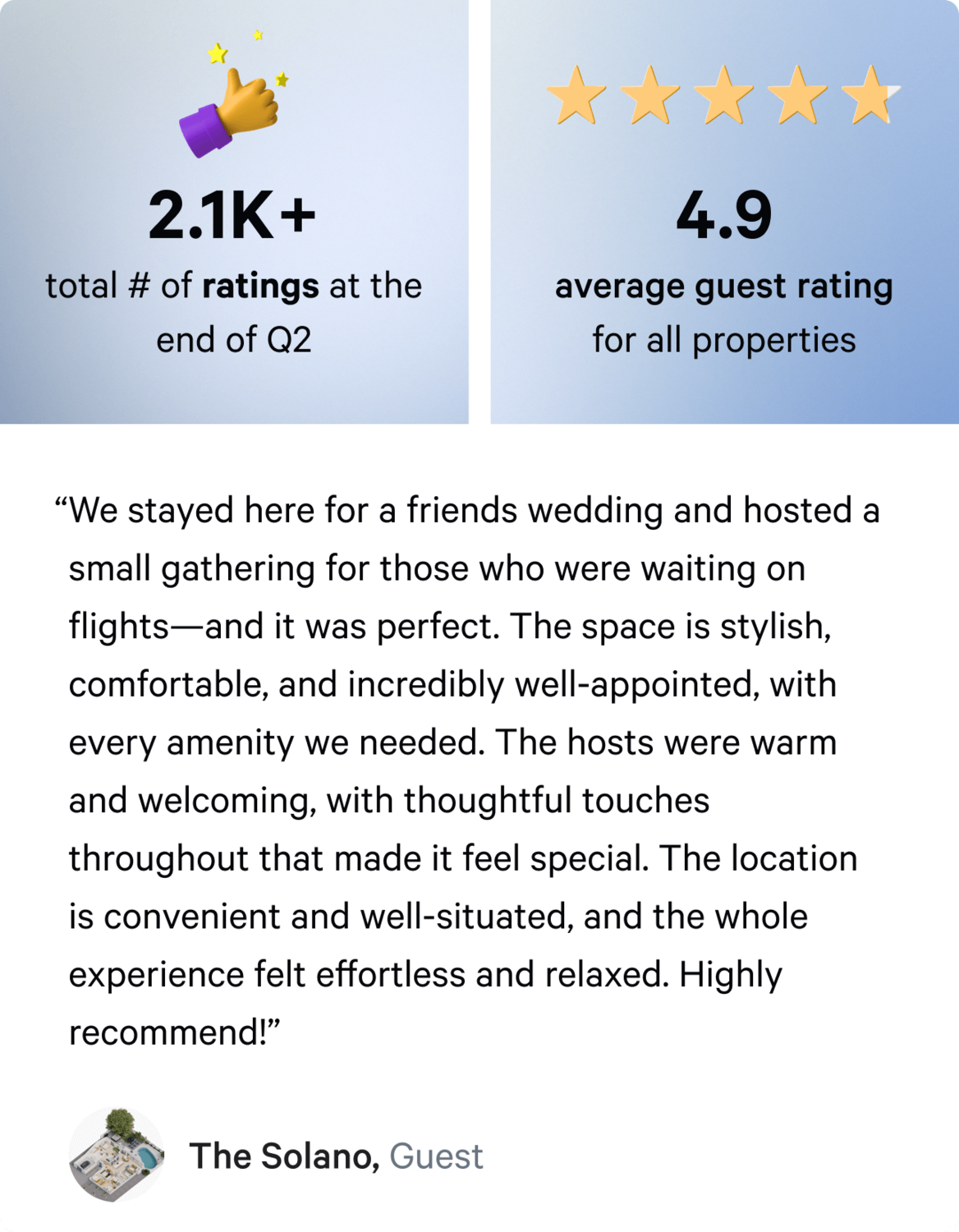

- Q2 2025 ended with an average guest rating of 4.95 out of 5.0 stars⁴

In Q2 2025, 39 vacation rentals were in operation. The gross booking revenue and average guest rating for each rental are below. Gross booking revenue is reported before any deductions for the property management fee, operating expenses, and repairs and maintenance expenses.

*Booking revenue was impacted due to a maintenance issue.

See the Property History Timeline for individual updates for each property.

Want to stay at an Arrived vacation rental? Add it to your Airbnb wishlist ✨

Arrived Single Family Residential Fund Occupancy

Arrived closed Q2 2025 with an average stabilized occupancy rate of 97%² for the properties in operation in the Arrived Single Family Residential Fund during the quarter. This was helped by the start of 10 new leases in Q2.

Closing Thoughts By Arrived VP of Investments, Cameron Wu

As we reflect on Q2 2025, I’m proud of the operational strides our team has made. With a portfolio-wide occupancy rate averaging 94.5%, we’re seeing the benefits of our proactive leasing strategy—especially our efforts to realign lease expirations to the early spring months. This quarter, average days on market dropped to 35, and 84% of new leases were signed at or above underwritten rents. That’s a meaningful improvement over last year, and we’re confident that continuing to optimize lease timing will further support both speed and pricing power.

We’re also seeing strong resident retention, with a trailing 12-month turnover rate of just 26.8%, which implies average stays of nearly four years. That kind of stability not only reduces operating friction but also helps deliver consistent income across the portfolio—an outcome we’re proud to deliver on behalf of our investors.

On the credit side, our Private Credit Fund remains a bright spot. The fund continues to generate consistent income, with monthly dividends in the 8.1% to 8.4% range and no defaults to date. As our fund grows, our increased scale enhances our purchasing power with originators and unlocks access to even higher-quality loan opportunities.

Looking ahead, we’re keeping a close eye on the residential market, particularly new construction. Builders facing tighter margins are increasingly motivated sellers, and while we remain selective, we’re finding compelling opportunities in the right places. Our approach remains disciplined—we’re focused on underwriting for quality and resilience, not just short-term upside.

As always, thank you for your trust and partnership. We look forward to what’s ahead.