Welcome to Arrived’s Q4 2024 review! Let’s review the dividends and appreciation ranges of the 387 Arrived properties operating during Q4 2024.

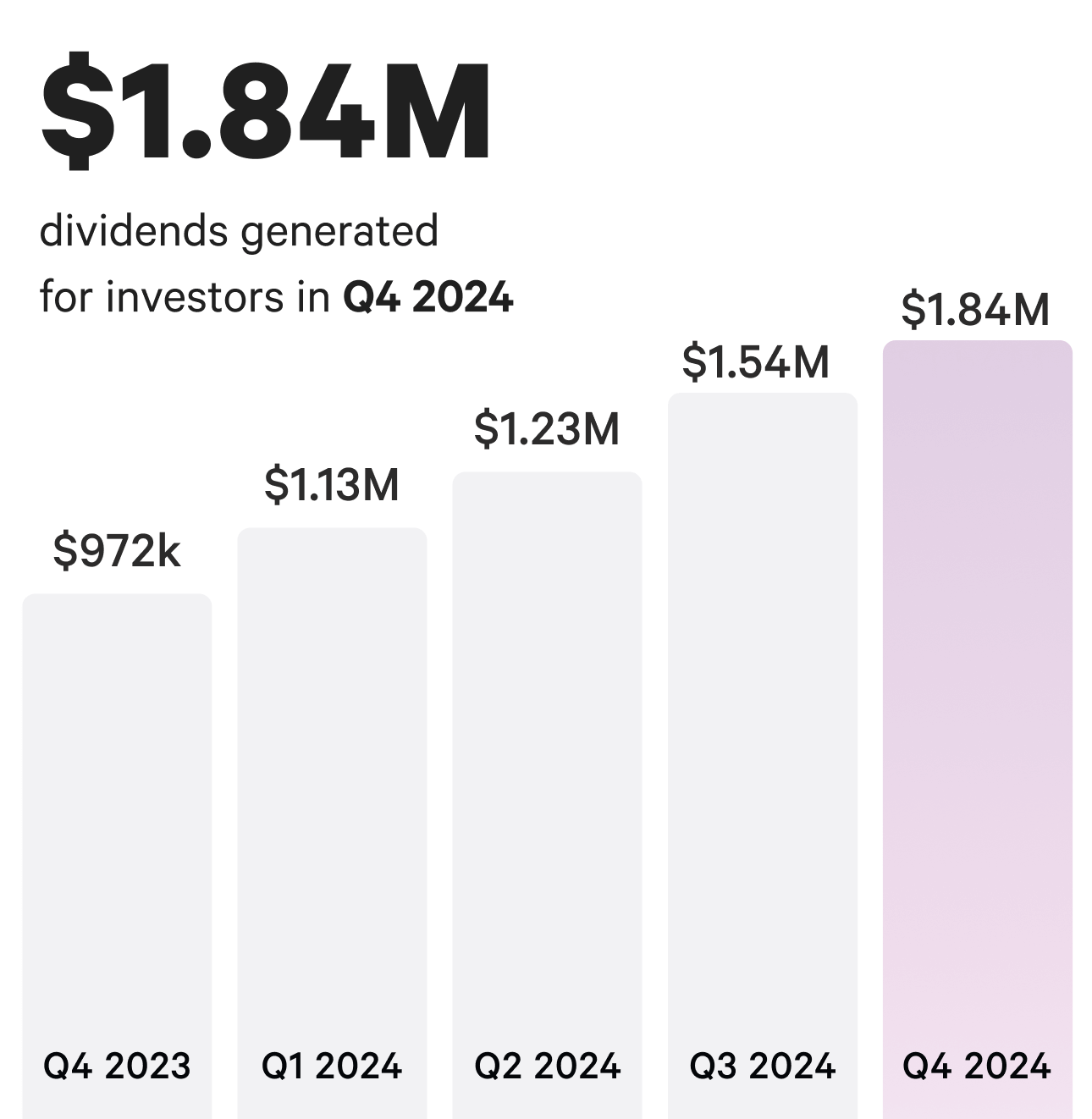

In Q4 2024, investors earned more than $1.84M in dividend income, an increase of approximately 19% from Q3 2024. In total, 365 individual properties paid out dividends. In Q4 2024, single family residential properties earned an average annualized dividend of 4.0%, and vacation rental homes earned an average of 2.3%.

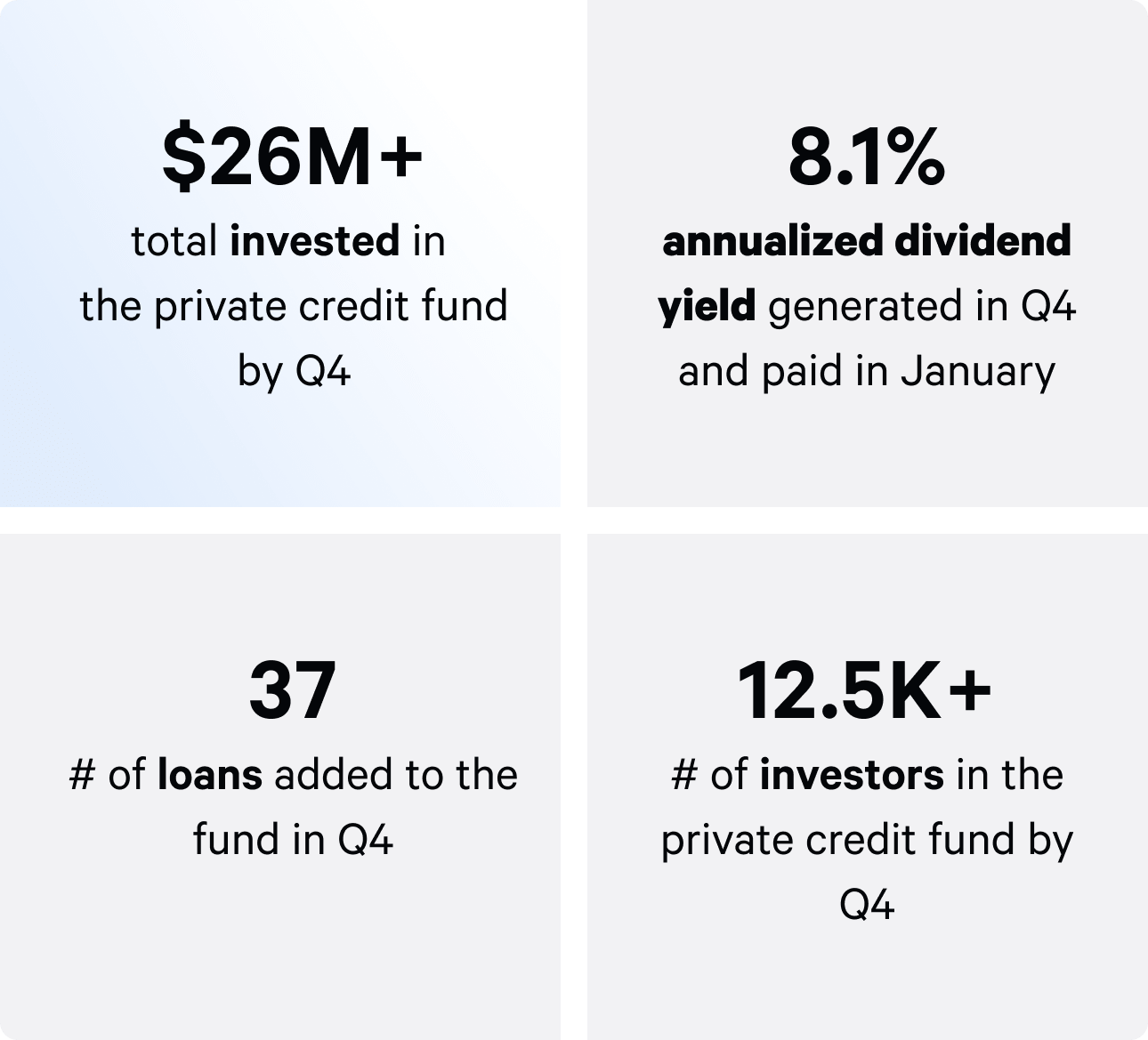

The Arrived Single Family Residential Fund earned a 4.0% annualized dividend, and the Arrived Private Credit Fund earned an 8.1% annualized dividend.

Dividends

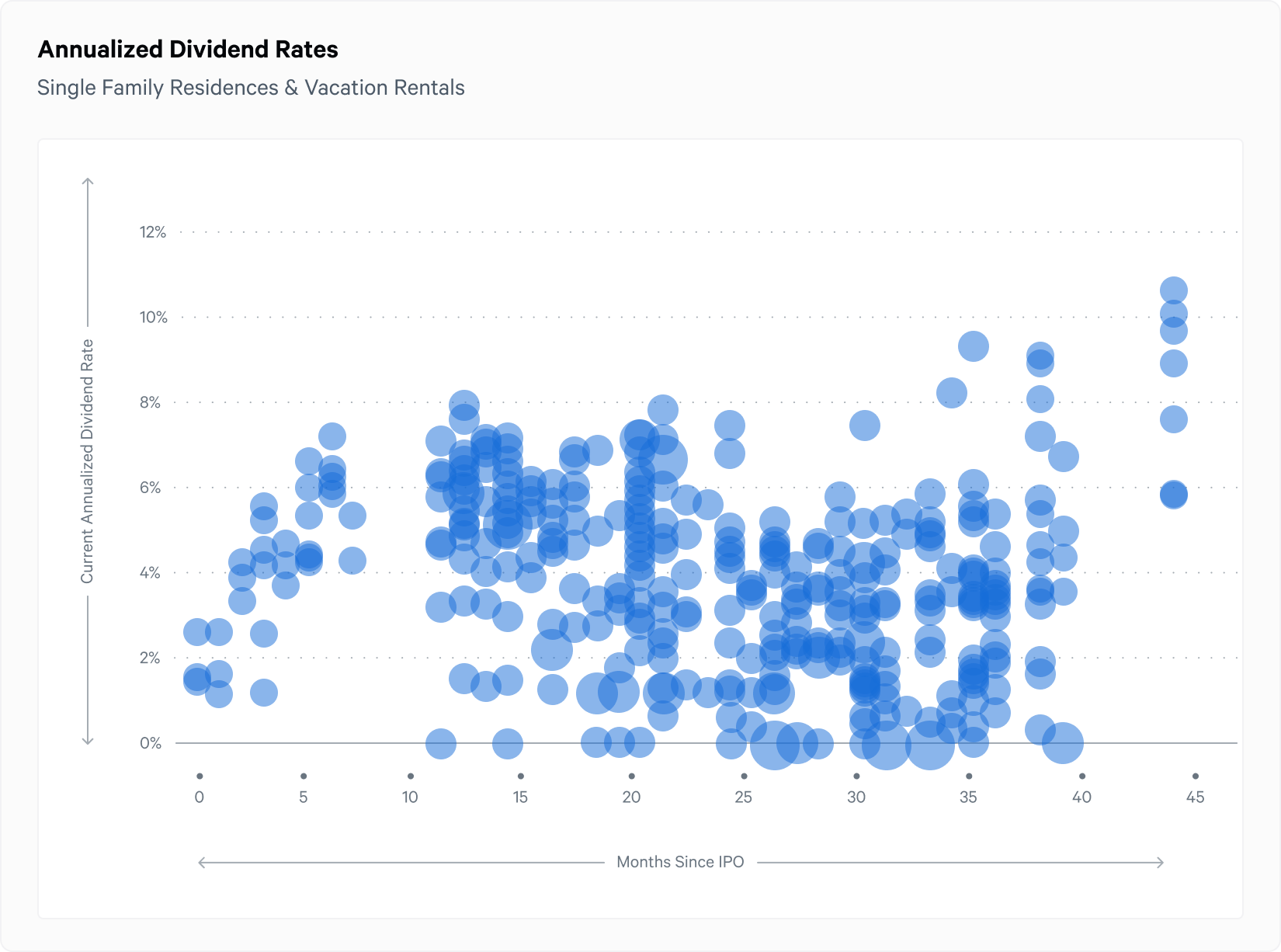

Dividends earned can vary by investment. In Q4 2024, 365 individual single family residential properties paid an annualized dividend between 0.3% and 10.6%¹, with a 4.0% average. 40 vacation rentals paid an annualized dividend between 1.2% and 5.7%¹, with a 2.3% average.

The Arrived Single Family Residential Fund paid an annualized dividend of 4.0%. The Arrived Private Credit Fund generated income resulting in an annualized dividend of 8.1% paid in January.

You can view the dividends for each property on our Historical Returns page.

The annualized dividend for each property is calculated by taking the Q4 dividend and extrapolating it out for an entire year. Building a diversified portfolio across multiple markets can be a great strategy to minimize concentration risk while getting exposure to different real estate markets and earning passive income.

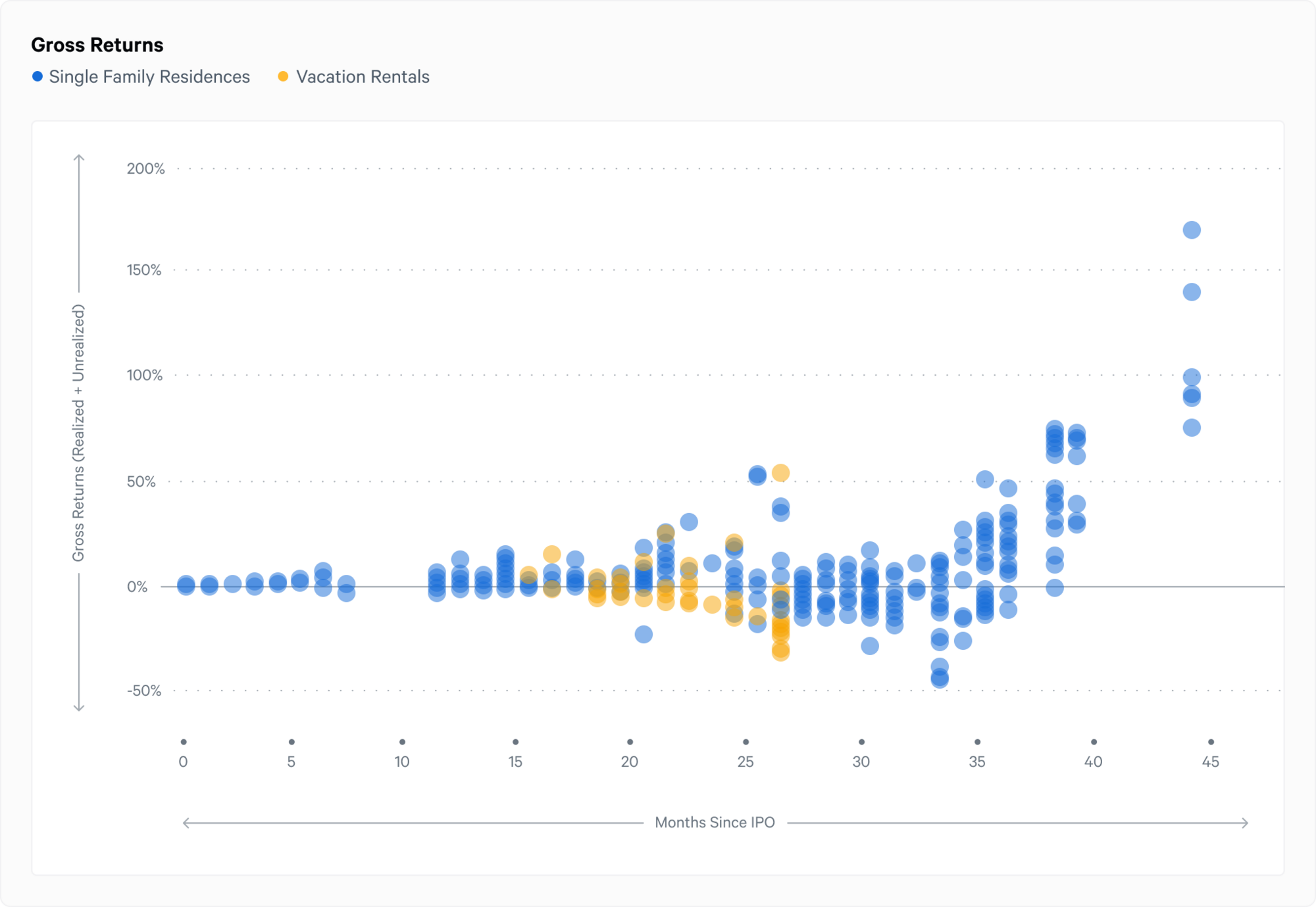

The chart below shows the combined realized dividends and unrealized appreciation of single family residential and vacation properties.

Properties may have lower total returns in the first six months because they have only received dividends and have not received an appreciation update yet. Historically, rental property investments have performed best when held for the long term.

This chart illustrates the potential benefits of diversification and dollar-cost averaging in the real estate market. Diversifying your portfolio by investing in a mix of single family residential properties, vacation homes, and debt and equity products, such as the Arrived Private Credit Fund and the Arrived Single Family Residential Fund, can be an effective strategy for mitigating risk.

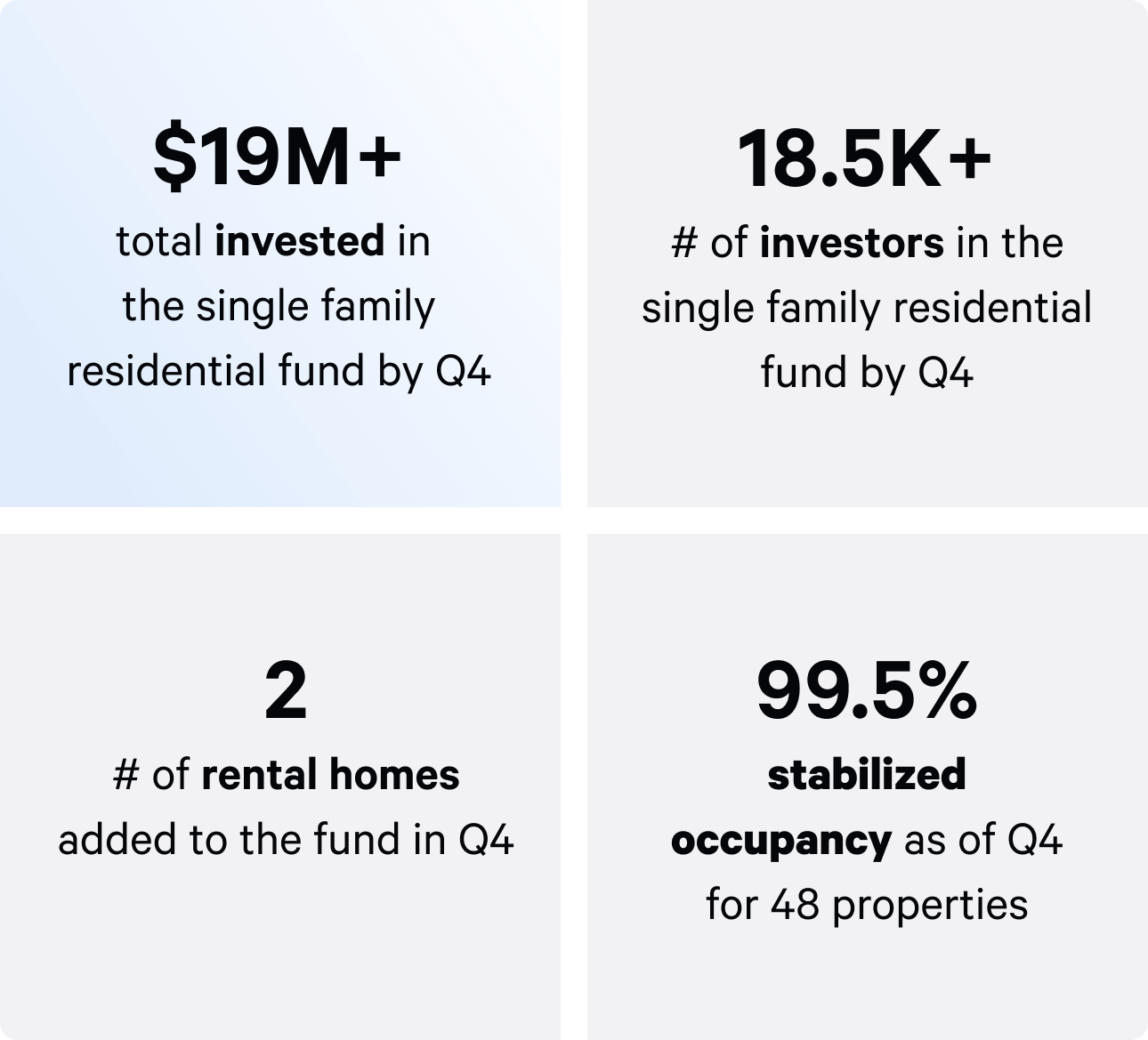

In Q4 2024, 48 Arrived Single Family Residential Fund properties contributed to an average annualized dividend of 4.0%.

The Arrived Private Credit Fund earned income in Q4, leading to a dividend payment in January at an 8.1% annualized rate. More than $19M was invested in the Arrived Private Credit Fund by the end of the quarter, and the Fund added 2 new loans in Q4 2024.

Share Prices

In Q4 2024, 374 Arrived properties received a share price estimate. Among those, 363 operating properties received an updated share price, while 11 received their first share price update. Share Prices are a way to see the value of your investment change over time, much like you would track a portfolio of stocks.

A property’s share price reflects both the property's estimated value and its cash balance. Any actions that affect the cash balance will impact the share price. This could include revenue, vacancy, dividends paid, and operating expenses. For individual property offerings, the share price is unrealized until the disposition of the property. You can learn more about how share prices are calculated in our FAQ.

Single Family Residential Property Share Prices

In Q4 2024, we updated the Share Prices for 374 properties, including 363 properties receiving an updated share price from 3 months ago and 11 properties receiving their first share price since their IPO 6-9 months ago.

The Arrived Single Family Residential Fund received a $10.02 share price valuation, resulting in a 0.6% increase from Q3 2024.

For the 363 single family residential properties receiving an updated share price, the quarterly share price resulted in an average share price change of -1.6% from Q3 2024 to Q4 2024.

The 11 properties receiving their first share price valuation resulted in a change of -1.8% since their IPO 6-19 months ago.

The share price average reflects the low to high range for all Arrived single family residential properties. This range may reflect individual properties impacted by specific circumstances, such as eviction proceedings or significant maintenance issues affecting the property's cash flow. Additionally, leveraged properties can experience more significant impacts from these factors, making returns more volatile and amplifying both potential gains and losses.

Investors can view the performance of individual properties in their portfolio on their Portfolio Page and the offering history of all single family residential properties under the “Performance” section on the Property Page.

Vacation Rental Property Share Prices

In Q4 2024, we updated the share prices for 37 vacation rental properties, which received their last share price valuation three months ago.

The average share price change for the 37 properties receiving an updated share price was -1.7%.

You can learn more about how vacation rental share prices differ in our FAQ.

The above-mentioned share price range may contain individual properties affected by specific circumstances, such as a shift to a new property management partner, and reflects the low, high, and average range for all Arrived vacation rental properties. While share prices react to the current market in the short term, real estate performs best as a long-term investment, all while investors continue earning dividends through rental income.

Share Prices for single family residential properties are updated six months after the initial property funding, using estimates provided by third-party sources. Vacation rental properties are updated 12+ months after initial funding and every quarter after that.

Understanding Unrealized Negative Appreciation: Real Estate Is a Long Term Investment

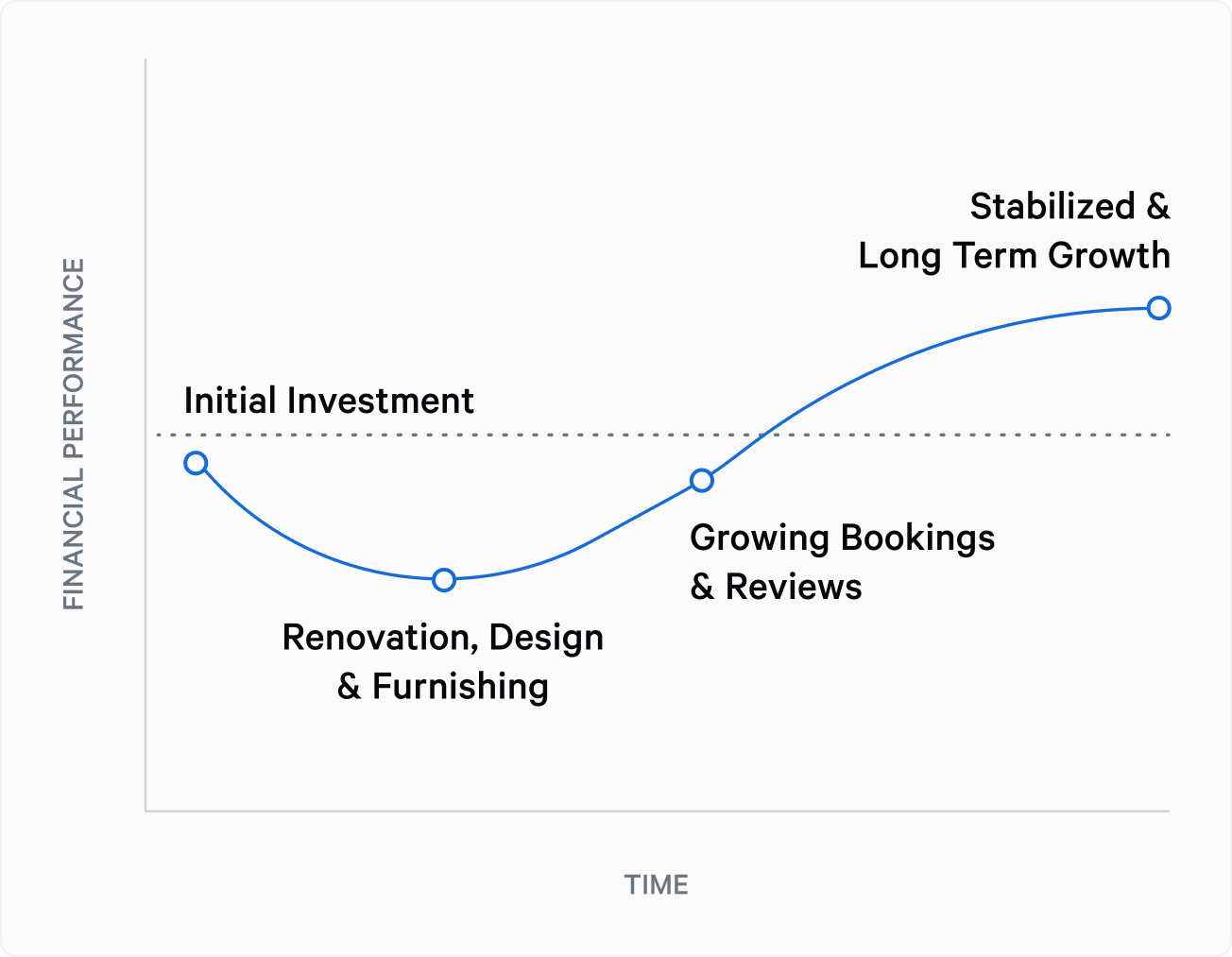

When considering rental share prices, it's crucial to understand the high initial costs and longer ramp-up time needed to increase the potential for strong income performance.

In the early stages of investing in a single family residential property, macroeconomic factors such as prevailing mortgage rates, the strategic use of leverage, and the prevailing market prices of homes can significantly impact initial total returns.

This process follows the investment J-curve pattern. Larger upfront investments in things like property improvements can be accompanied by initially lower dividends or share prices. This dip represents the low point of the J-Curve. As the property stabilizes, returns can increase, reflecting the growth period of the curve. It's important to remember that real estate tends to perform best as a long-term investment, allowing investors to navigate through various market cycles and maximize the potential for returns.

Operational Performance

Single Family Residential Stabilized Occupancy

Arrived closed Q4 2024 with a stabilized occupancy rate of 93.8%² for the single family residential properties in operation during the quarter. This was helped by 66 new leases started in Q4. It’s also worth noting that the average term on these leases was 15.5 months, and 42 leased above our forecasted rent.

Vacation Rental Performance

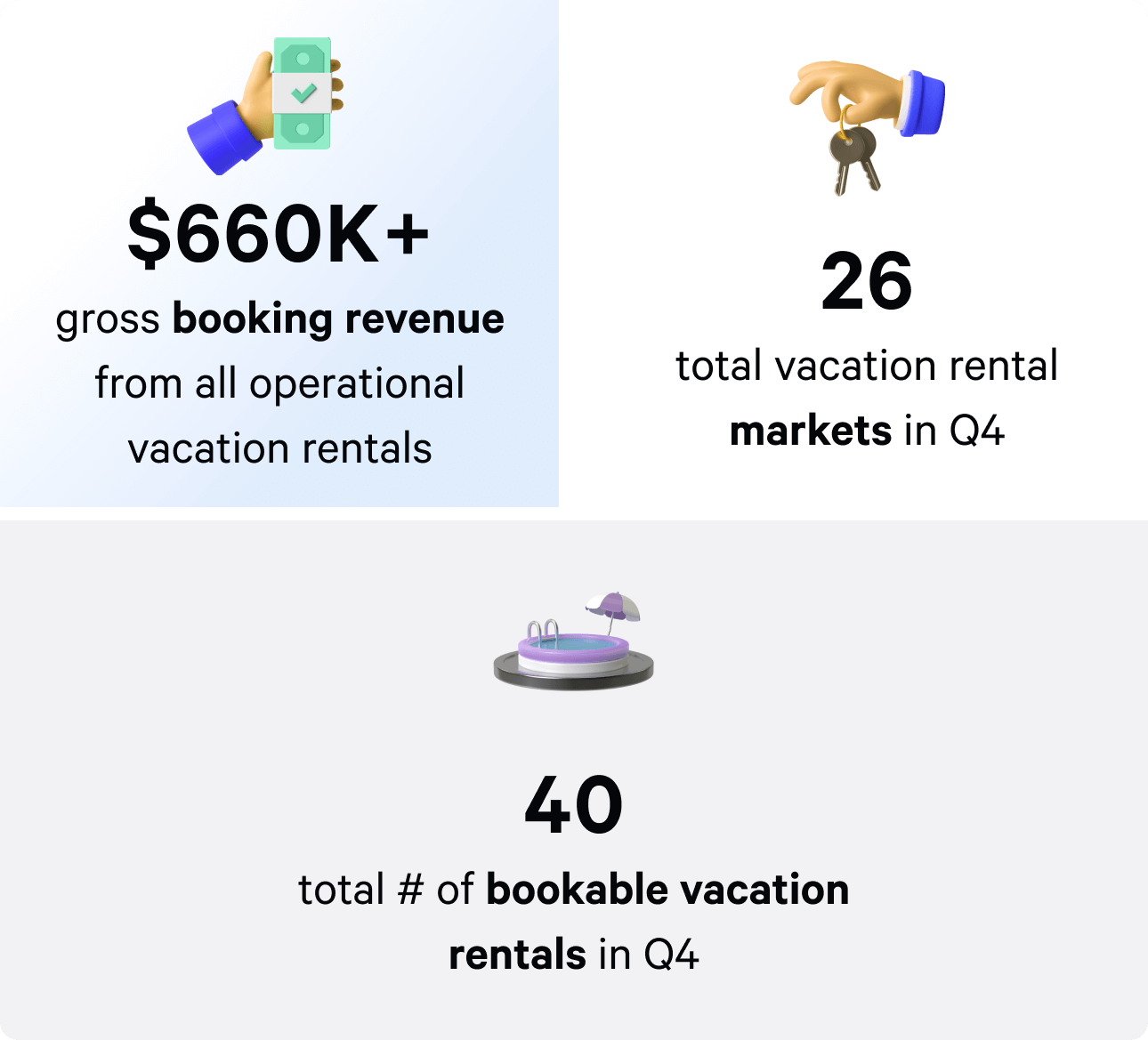

In Q4 2024, there were 40 bookable vacation rental properties. Here are some highlights from the quarter for this asset class:

- $660,731 in gross booking revenue across all operational vacation rentals in Q4³

- 26 total vacation rental markets as of Q4 2024

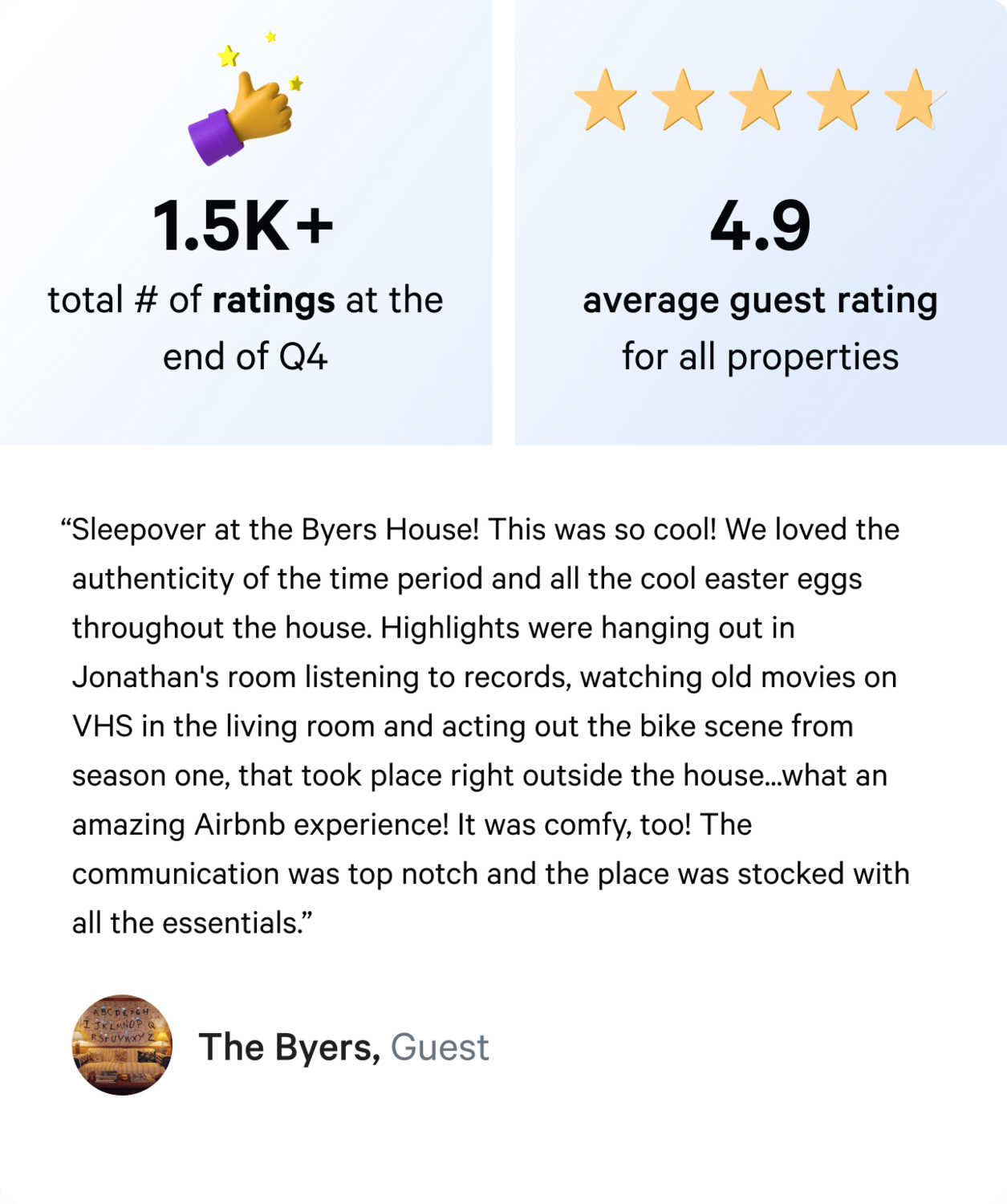

- Q4 2024 ended with an average guest rating of 4.9 out of 5.0 stars⁴

In Q4 2024, 40 vacation rentals were in operation. The gross booking revenue and average guest rating for each rental are below. Gross booking revenue is reported before any deductions for the property management fee, operating expenses, and repairs and maintenance expenses.

See the Property History Timeline for individual updates for each property.

Want to stay at an Arrived vacation rental? Add it to your Airbnb wishlist ✨

Arrived Single Family Residential Fund Occupancy

Arrived closed Q4 2024 with a stabilized occupancy rate of 99.46%² for the properties in operation in the Arrived Single Family Residential Fund during the quarter. This was helped by 5 new leases started in Q4.

Closing Thoughts By Arrived VP of Investments, Cameron Wu

“As we reflect on the final quarter of 2024, our strategy and execution remain focused on delivering meaningful results for investors on Arrived. Our leasing strategy has proven highly effective, starting Q4 with long-term rentals at 92% occupancy and finishing at 95% stabilized occupancy. We also achieved an incredible milestone by closing the year with 100% occupancy across our Single Family Residential Fund properties.

Vacation Rental performance has also improved, thanks to our decision to internalize more properties within Arrived Property Management. This move has enhanced operations and resulted in an impressive 60-day streak of 5-star reviews, underscoring our unwavering commitment to quality.

Our Private Credit Fund continues to perform strongly, with no defaults and full borrower repayment. To maintain high loan quality, we've implemented monthly investment caps per account and are actively expanding our network of originators to meet rising demand.

With our operations running smoothly—from increasing occupancy rates and reducing costs to enhancing vacation rental performance and sustaining loan quality—we've made strategic moves that position us for continued success. We're confident that these efforts will yield dividends—both figuratively and literally—in the months ahead.”