Highlights

- The Private Credit Fund investment limit was removed due to an increase in loan supply, allowing investors greater flexibility to increase their contributions. May loan portfolio performance supported an 8.38% annualized dividend paid in June.

- The Seattle City Fund, the first of Arrived’s City Funds, was launched in May, providing investors with diversified exposure to Seattle’s residential real estate market.

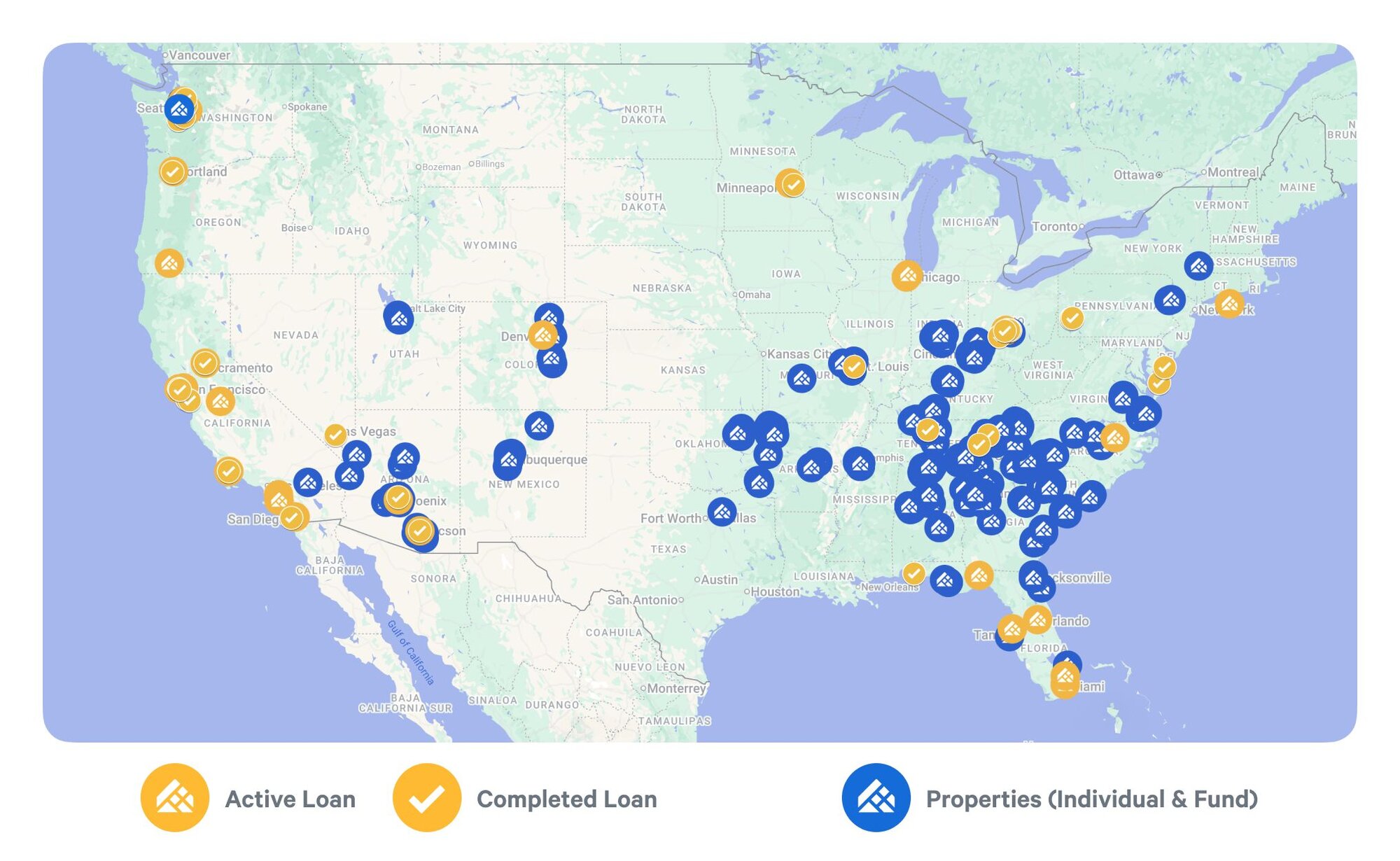

Geographic diversification

The Arrived Private Credit Fund and Single Family Residential property offerings provide investors with access to distinct segments of the real estate market—real estate-backed debt and equity.

The map below shows Arrived's active markets and loan footprint, which illustrates the geographic diversification of these investments.

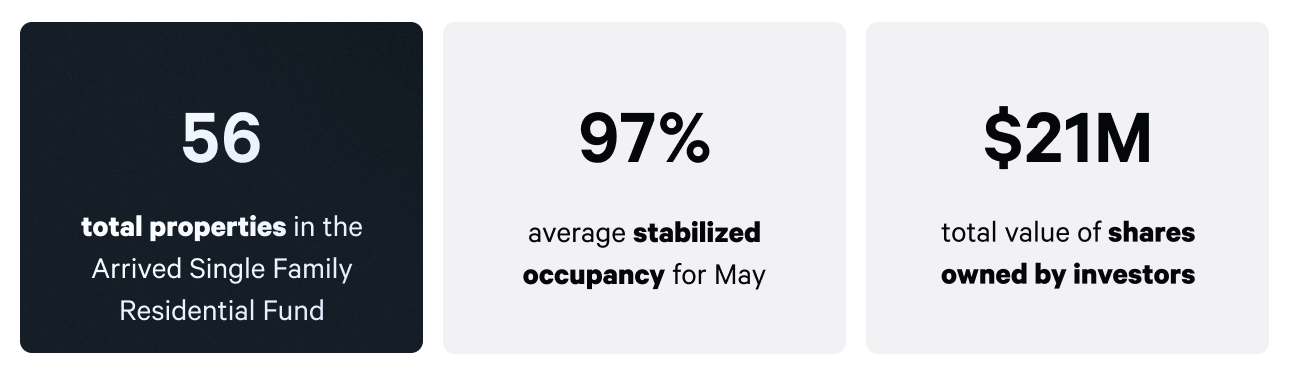

Arrived Single Family Residential Fund

The Single Family Residential Fund maintained an average stabilized occupancy of 97%* for May. This fund currently has properties in 25 markets nationwide.

Investors in the Single Family Residential Fund benefit from rental income and any appreciation that occurs when a property is sold. As new properties are added, the fund’s diversification grows.

Seattle City Fund

May marked the launch of our first-ever City Fund, starting with Seattle. This new fund format gives investors a simple way to focus their investment in a single market, starting with one we know well. With strong long-term fundamentals and deep local insight from our team on the ground, Seattle was a natural choice for launch—with more City Funds to come in the future.

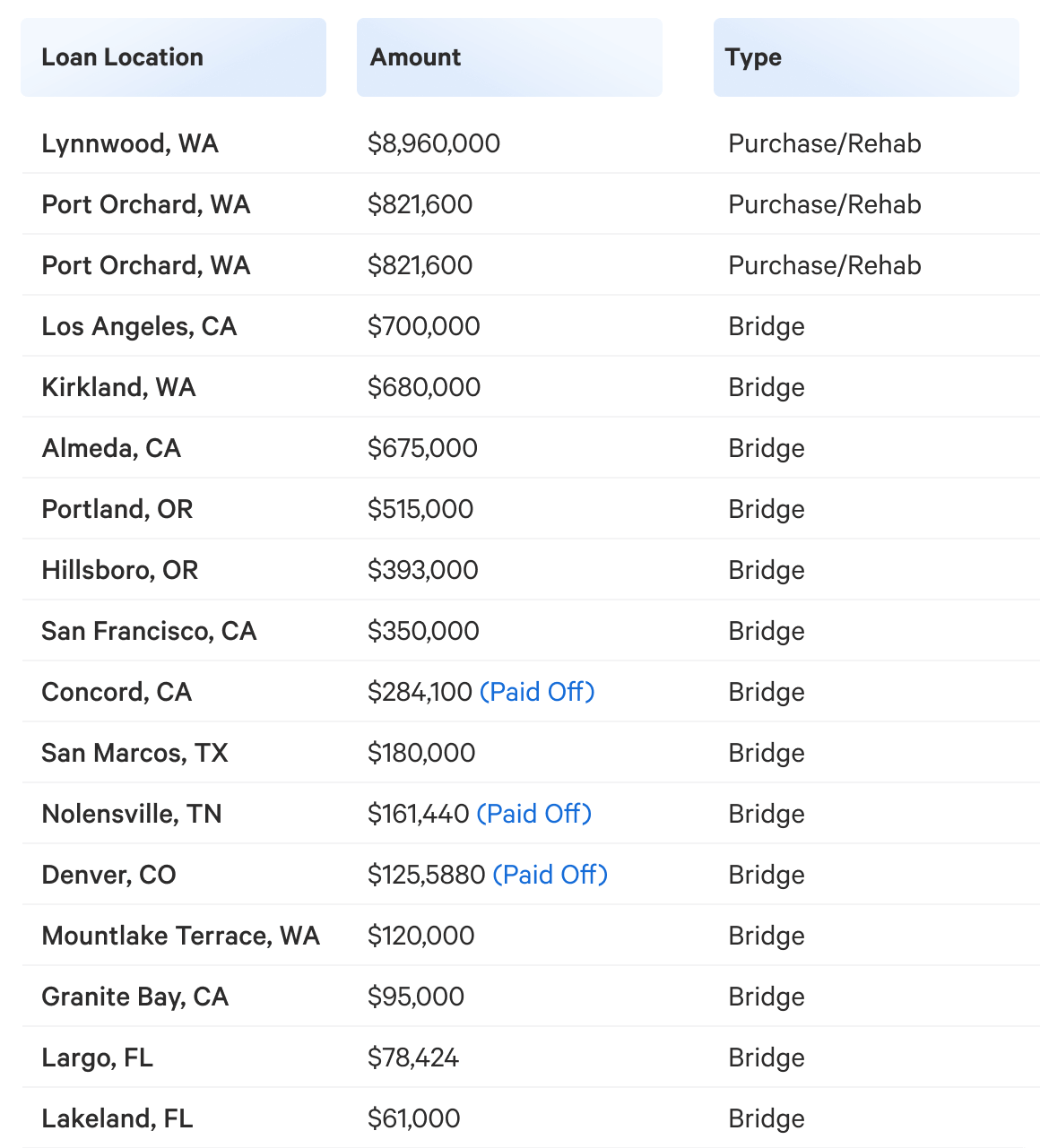

Arrived Private Credit Fund

With over 16K investors and $49M invested, the Arrived Private Credit Fund delivered an 8.1% annualized return in May and added 17 new loans. The fund currently holds 57 active loans, with repayments and new acquisitions being acquired on an ongoing basis.

The table below details the new loans added to the Arrived Private Credit Fund in May.

Single Family Residential IPOs

All rental income generated from Arrived properties benefits its investors by adding to the property’s cash reserves or by being paid out as future monthly dividends.

Overall, individual Single Family Residential properties had a stabilized occupancy rate of 94% for 409 total properties, collecting a total of $780,983 in rent revenue in May.

In May, 33 new leases were started, with an average lease term of 20 months. Of those new leases, 29 were leased above the forecasted amount.

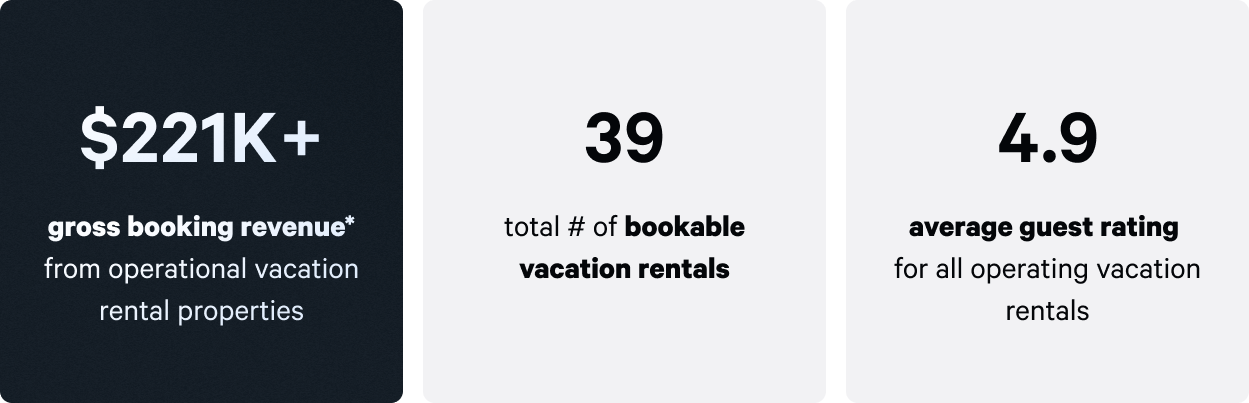

Vacation Rental IPOs

Arrived vacation rentals generated $221,953 in gross booking revenue for 39 booking-ready properties in May.

The table below presents the gross booking revenue for each property in May, along with the current guest rating score.

¹ Booking revenue was impacted due to a maintenance issue.

See the Property History Timeline for individual updates for each property.

Want to stay at an Arrived vacation rental? Add it to your Airbnb wishlist ✨

Guest review highlights

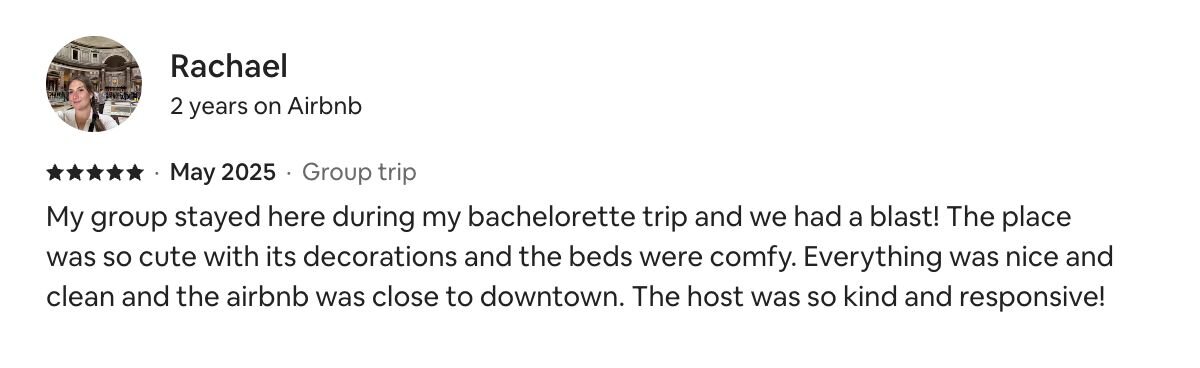

- Guest review of The Oasis

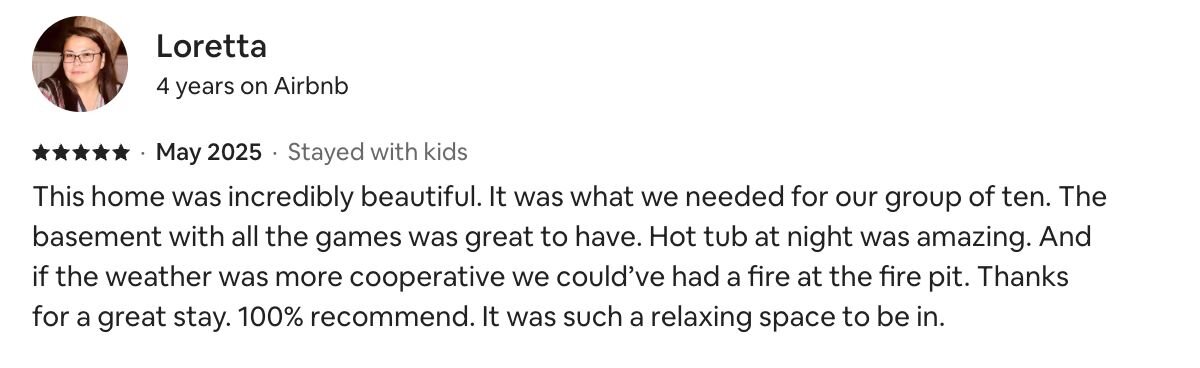

- Guest review of The Regal

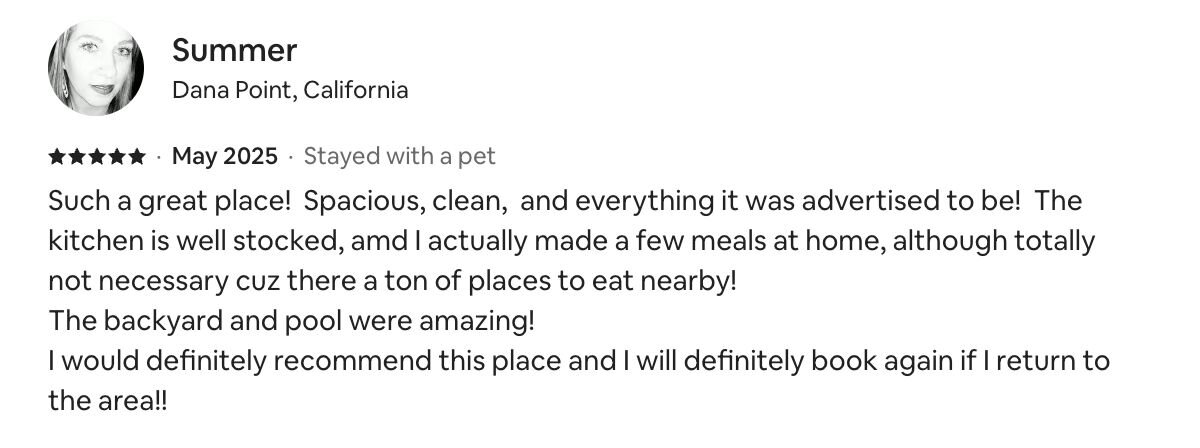

- Guest review of The Seafoam