At Arrived, our mission is to empower everyone to build wealth through modern real estate investing. We created two investment avenues to cater to investors who want to be hands-on with their portfolios and those who want to simplify.

Arrived’s individual property offerings allow investors to build a highly tailored portfolio of investment properties they hand-selected. The Arrived Single Family Residential Fund allows investors to instantly diversify into a group of single family residential properties chosen and managed by the experts at Arrived.

Investors can opt for individual properties, investing in the Fund, or choosing both for even greater diversification. Here’s how they compare.

How do Arrived’s individual properties work?

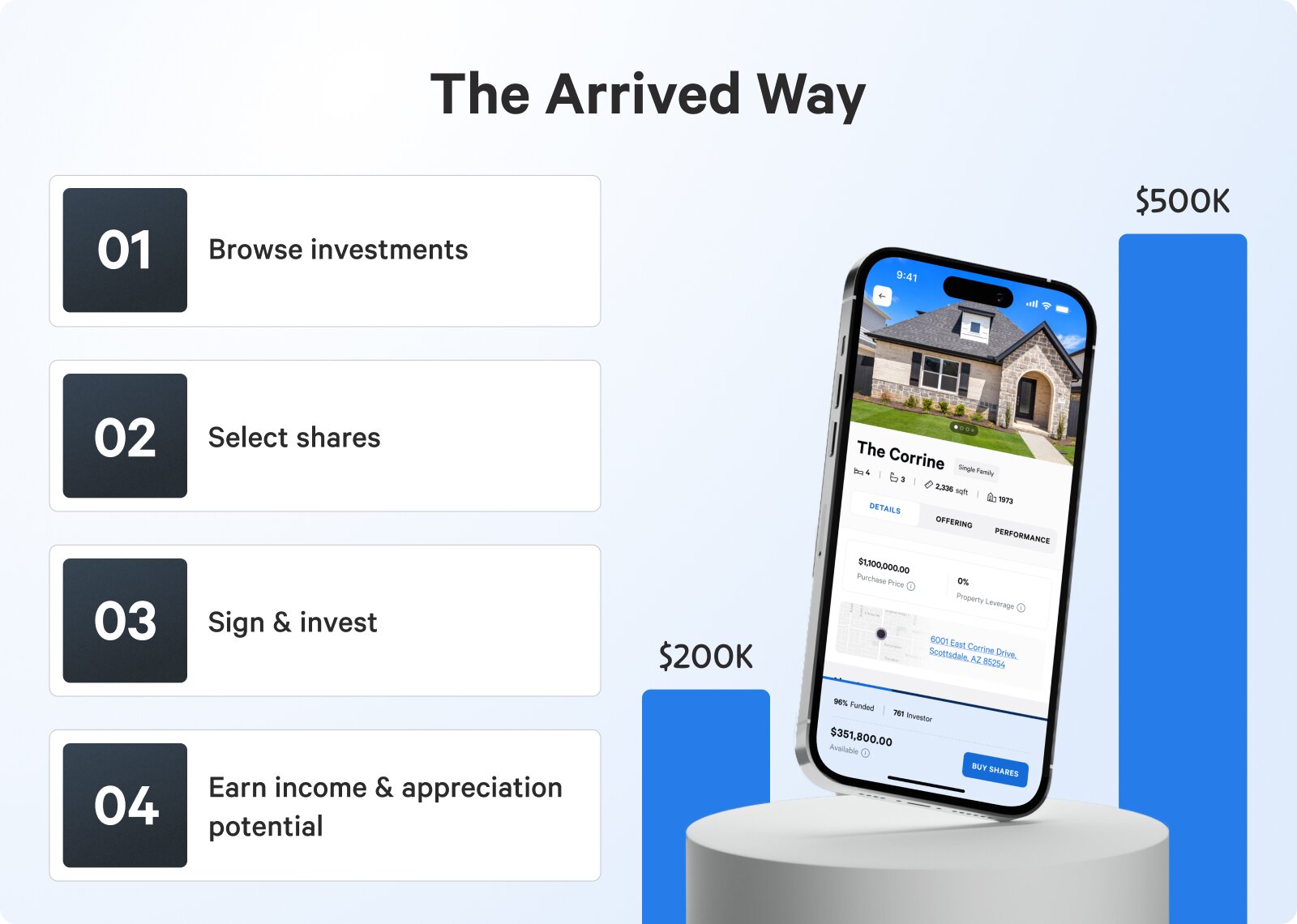

Arrived enables investors to explore a selection of rental properties pre-vetted for their appreciation and income potential. Users can decide the amount they want to invest in each property, fund their initial investment within minutes, and start building their rental investment portfolio in four easy steps:

We’ve worked hard to enhance the investment experience, focusing on speed and simplicity. Our operational model is designed to maximize returns for investors, primarily emphasizing property acquisition and management.

Here’s a brief overview of the process:

Smart property acquisition

Our team, who has previously managed a $11.3B portfolio of 57K+ rental homes, utilizes data science and decades of expertise to pinpoint the ideal homes at optimal prices. We analyze numerous markets to identify those with strong cash flow and property appreciation potential. Properties meeting our criteria undergo thorough property and financial analyses by our Investments team.

Streamlined property management

After we acquire a property at the right price, our operations team takes charge to ensure efficient management. We renovate and invest strategically with trusted partners to enhance returns and minimize future maintenance costs. Guided by data-driven criteria, local expert property managers vet potential residents to reduce issues that could impact property returns. Our team employs vetted technology platforms for ongoing property monitoring to provide residents with responsive customer service.

Transparent investing

Once investment properties are available, investors can review all the details on the property page, including:

- Photos

- Market insights

- Purchase price

- Rental income potential

Investors can opt to invest in each property starting at $100. From there, Arrived handles 100% of the property management process so investors can focus on their portfolios.

How does the Arrived Single Family Residential Fund work?

While our diverse range of individual properties enables selective investment, the Arrived Single Family Residential Fund allows investors to invest in a bundled portfolio of homes, delivering additional benefits.

An expertly crafted fund

The Arrived Single Family Residential Fund leverages Arrived’s proprietary operating model, which benefits from established relationships with third-party property managers in dozens of markets. This means the Fund can quickly diversify into the more than 55 markets Arrived currently operates in. Arrived’s operating model is also nimble, allowing Arrived to quickly move into emerging markets as well as purchase single family residential homes in secondary and tertiary markets that may not fit a larger public REIT portfolio, diversifying the Fund even further.

One-click Diversification

Individual property offerings follow a “drop” model, which requires investors to be active when new properties are released to maximize their choices. The Arrived Single Family Residential Fund will contain multiple properties and markets, with investments spread over time. Through this process, the fund has diversification built in. Investors can invest in the fund on their schedule, starting at $100.

Transparent investing

The Fund is designed to offer the same high level of transparency offered through Arrived’s individual property offerings. Each single family residential home in the Fund is showcased along with its address, photographs, and other key features so investors fully understand what properties are included in the Fund.

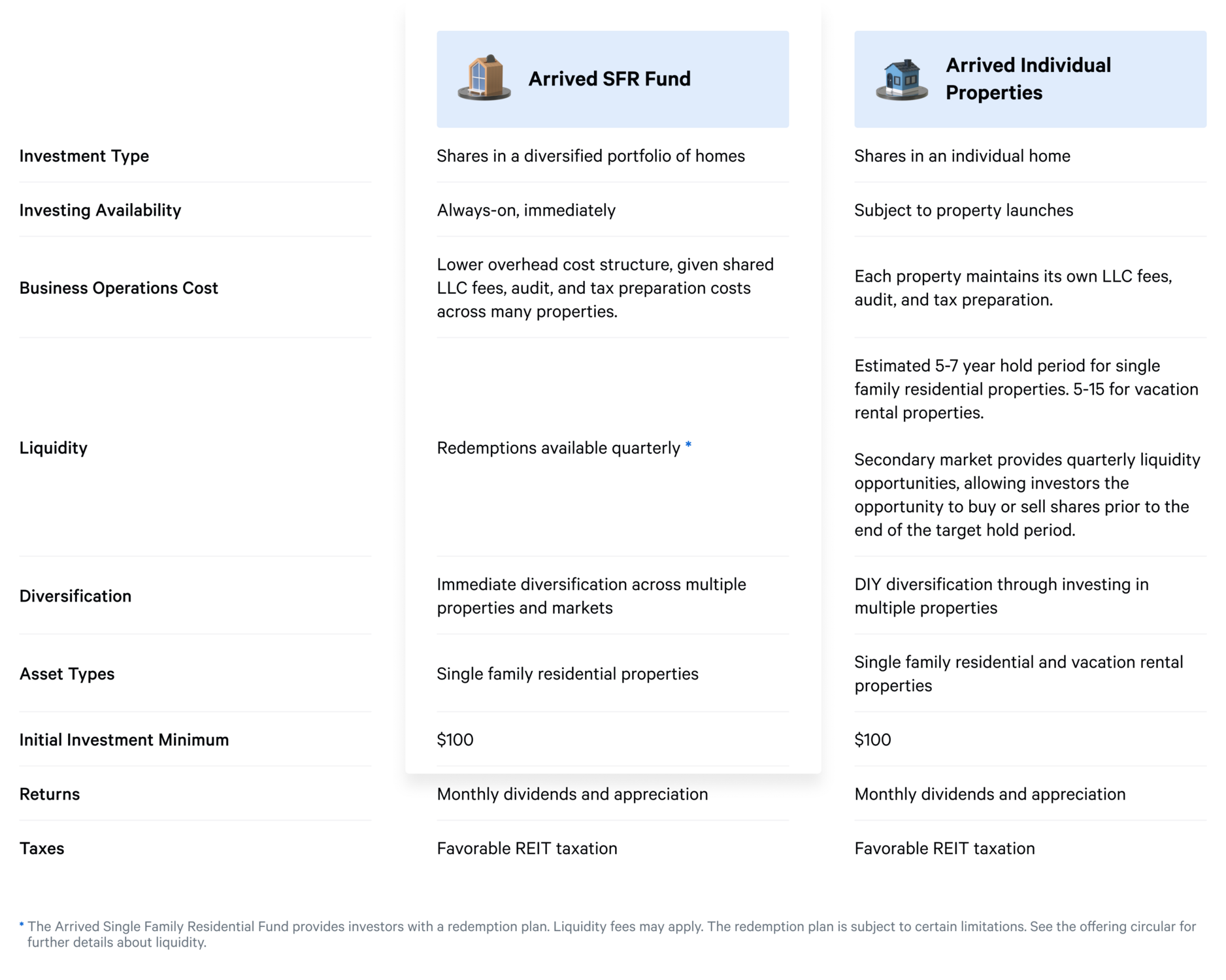

How does the Arrived Single Family Residential Fund compare with Arrived’s individual property offerings?

Arrived individual property offerings and the Arrived Single Family Residential Fund allow investors to invest in pre-vetted single family residential properties based on their appreciation and income potential with a few key differences:

Which is right for you?

Opting for individual property offerings, the Arrived Single Family Residential Fund, or both depends mainly on your financial goals and timeline. Here are a few considerations:

- Investment goals: The Arrived Single Family Residential Fund and Arrived’s individual property offerings can earn dividends through rental income and property appreciation, allowing investors to easily include real estate investments into their larger portfolio.

- Risk tolerance: Investing in real estate diversifies your total assets and may lower your risk profile. Real estate, particularly private real estate, is an excellent way to diversify a portfolio. While both investment vehicles are designed to be held for several years, the Arrived Single Family Residential Fund offers access to liquidity through the redemption plan.

- Investment horizon: The Arrived Single Family Fund and individual property offerings are designed to appreciate over several years. However, the Arrived Single Family Residential Fund has adopted a redemption plan intended to provide investors with access to liquidity. After six months following a particular investment, an investor may request a redemption of all or any portion of those shares, which, if approved, will be redeemed at the then-current Arrived Valuation at the end of the quarter. The Arrived Secondary Market is a peer-to-peer platform that allows investors to buy and sell shares of individual properties during designated quarterly trading windows.

- Minimum investment requirements: Arrived's mission is to make investing in rental homes accessible to everyone. As such, the minimum amount required to invest in both the Arrived Single Family Residential Fund and Arrived individual property offerings is just $100 USD.

- Tax efficiency: Both investment vehicles offer tax advantages. For individual property offerings, appreciation from real estate is taxed under capital gains rates, or around 15% for most people. The Arrived Single Family Residential Fund offers tax advantages through dividend distributions.

FAQ

Who can invest?

How much can I invest?

What type of products are available on Arrived?

Will I have any responsibilities for managing properties I invest in? If not, who is responsible?

What type of returns can I obtain?